Energy Sets Up Two New Trades – Here They Are

Before we discuss these incredible trade setups in the Energy sector, we have to discuss the continued shifting global economy and how that relates to these setups. Nearly three weeks ago, we posted a research article suggesting Crude Oil would call to levels near $50 over the next 30+ days, then stall for about 45 days before falling further and potentially attempting new lows near $40 ppb. It is important to understand certain aspects of the global economy, economic demand and how it relates to seasonal patterns for Energy.

We believe the move lower in Crude Oil is related to a supply glut that continues to plague the global markets while global economic trade, shipping, and activity continue to weaken. Too much oil supply with weakening global economic activity means Crude Oil will likely waffle lower until this dynamic changes.

Please read our recent research post to know where Crude Oil is likely to head next. Also this crude oil, prediction uses our oil price DNA algorithm to show us the future price range of oil.

Other energy-related symbols, like Natural Gas and ERY, are set up for a different type of price move.

The reality of the situation is that once Crude Oil reaches to levels near $50 ppb, it is very likely that a support level will push Crude back higher (as we suggest in our research) which will align with a seasonal pattern for Natural Gas and early Winter demand for heating oil. September, October, and November are typically a ramp-up period for winter demand and end of year holiday travel. People tend to take advantage of the last bit of Summer to seek out vacation spots, prepare for winter and push the cold back as long as possible.

Future contracts may move higher, in preparation of this seasonal trend, many months before the season actually starts. This is the reason we believe the energy sector is setting up some incredible opportunities for skilled technical traders.

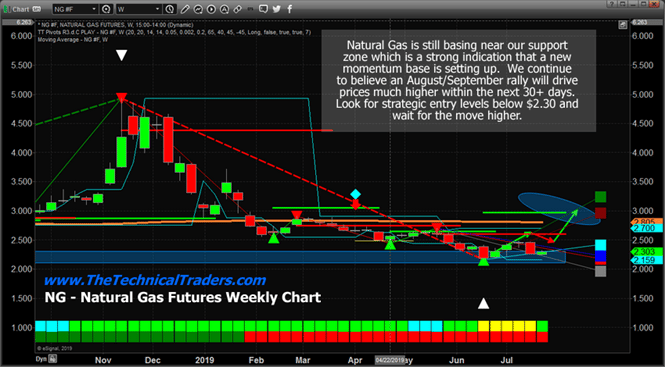

The weekly chart of Natural Gas

This first Weekly chart of Natural Gas highlights a basing pattern that we’ve been following for months. We believe any move below $2.30 is a strong bottoming/basing setup for skilled traders and our predictive modeling systems suggest we are just weeks (3 to 5+) away from a big upside move in NG.

We believe natural gas will continue to fall and base. Once a bottom has been made the upside potential for NG over the next 60+ days is quite substantial. We believe an in initial upside move after it bottoms will be to levels above $3.15 will take place before October 10 and that potential for an extreme breakout upside move above $4.00 is quite likely before the end of November 2019.

Please read this article to learn more about our research into NG and the opportunities that are setting up now. Also, this post we shared Natural Gas Moves Into Basing Zone.

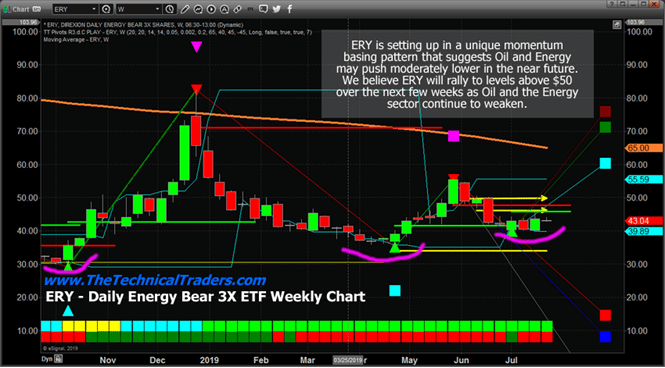

ERY – Bear Energy Sector Chart

Keeping in mind that the setup within the energy sector is two-fold. First, Oil and NG will continue to fall and base/bottom (moving slightly lower over the next few weeks). This is why ERY is such a great setup right now. Any breakdown in energy commodity prices over the next 3~5 weeks will push ERY 15% to 25% higher from current levels – which is exactly what we are expecting to happen.

Then, as Crude Oil and Natural Gas base in their support zones, ERY will peak which is when we want to pull profits from ERY and watch other bullish energy ETFs for long side setups.

From current levels, we believe ERY will target $50 to $52.50 fairly quickly as Crude Oil and NG continue to move lower and setup a momentum base within the basing zone/support range. Remember Crude Oil should move to levels near $50 (a full 10% lower than current price levels) before basing.

Concluding Thoughts:

As we’ve been suggesting for months, 2019 and 2020 are setting up to be incredible years for skilled technical traders. These moves in commodities, energy, and metals are providing us with trade after trade of 10%, 20% or more. Almost every month, the markets are setting up 10 to 15+ incredible trading opportunities and all we have to do is time our entries and run these trades as we do any other trade. Not all trade setups are the kind we like and we only enter the ones that we think have the highest opportunity and lowest risk.

Get ready because these incredible setups in Metals and Energy should keep you busy pulling the trigger to create profits over the next 5+ months or longer with my Wealth Building & Global Financial Reset Newsletter.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

Join Now and Get a 1oz Silver Round or Gold Bar Shipped To You Free. Follow our research and visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades.

Chris Vermeulen

Technical Traders Ltd.