A different investing strategy to get more from your investments:

ETF Asset Revesting Strategy

- Generate 2-3 times more annual returns than buy-and-hold investing.

- Protect and grow your portfolio in bear markets with minimal risk.

- Continue building wealth in retirement and never run out of money.

If you want to get more out of your investments and quickly fund your dream retirement, then pay close attention.

I’m going to reveal a style of investing that could help you reach your retirement goals faster.

It’s called Asset Revesting.

Asset Revesting is an investment strategy that can safely help you generate 2-3 times more annual returns than buy-and-hold investing.

Plus, it can make you money in all market conditions: a raging bull market, a market correction, a recession, or a multi-year bear market. Asset Revesting is unlike any investing strategy you’ve come across.

What I’m going to reveal is a whole new way of generating faster and higher profits than other traditional investing strategies like diversification, dividends, or active trading.

If you’ve tried different investing strategies and still not made the type of gains you want, that’s okay.

Most investing strategies deliver mediocre returns at best, and worst of all, they expose you to massive losses during downturns.

Would you risk your life savings in the stock market or with an advisor if it meant losing up to 55% of your nest egg?

How about the delayed growth during downturns? It’s not just your money that’s stagnating —it’s your future and wasted time. Instead of compounding and growing, your nest egg is just trying to catch up and recover to where it was before.

These are just some limitations you experience when you rely on traditional investing methods like buy-and-hold.

However, Asset Revesting is completely different…

Revesting, as I define it, is an investor taking back the power and control of their investments for higher growth and preservation.

It’s an investment style that empowers you by helping you grow your wealth faster and avoid long periods of portfolio decline.

It’s all about generating gains without the stress and high risk of traditional investing methods…

And knowing that your portfolio is safe no matter the market condition.

It’s why investors who use the Asset Revesting Strategy report amazing benefits, like Ron Smith, who said:

“…It’s helping me grow and protect my retirement savings, and I sleep better at night…”

How Asset Revesting Works, and How it Helps You Profit in Bull and Bear Markets.

Before I get into the details of the Asset Revesting Strategy, let me briefly tell you about myself…

My name is Chris Vermeulen, and I have been an active investor in the stock market since 1997.

Over the years, I have traded all styles, from scalping to day trading, swing trading to long-term investing, fundamentals to technical analysis, stocks, options, currencies, futures, and ETFs.

I’ve been invited to share my knowledge of the financial markets on shows and publications such as Kitco, Bloor Street Capital, Yahoo Finance, The Money Show, BNN Bloomberg TV, TD Ameritrade TV, Schwab TV, Cheddar TV, Trader TV, and many others.

You can catch me every Monday on Business First AM with my Trader Tip segment broadcasted to 115 US TV stations.

As we all know, there is no quick or easy way to success. It takes years, dedication, blood, sweat, and tears to master pretty much everything.

Even though I was fortunate to semi-retire in 2008 when I was only 27 years old, my journey to financial freedom was not easy.

I still remember the day I blew up two trading accounts and had to face my wife and kids, knowing that we were back to square one.

I spent every waking hour searching for a solution…

I didn’t want to keep feeling the anxiety of market swings or settle for mediocre returns that made my dream life feel like a distant hope.

I was tired of hearing the same slow-growth strategies preached by mainstream financial media. Tired of putting off buying nice things for my family or canceling vacations we’d planned for years.

I knew there had to be a better way to invest — a way that doesn’t depend on waiting for decades — and I was determined to find it.

That’s when I started working towards finding an investing strategy that can generate profits faster than the buy-and-hold strategy.

After lots of trial and error, I finally developed an investment strategy that allowed me to do all these:

-Consistently generate higher annual returns than the buy-and-hold strategy.

-Protect and grow my portfolio during bear markets and recessions.

-Provide a luxury life for my family and enjoy a worry-free semi-retirement life.

This strategy is what I call Asset Revesting.

I want to share this ETF strategy with those who, like me, are tired of following advice that only produces mediocre results.

It’s for investors who want to achieve their retirement goals faster, minimize risks, and protect their retirement portfolio against market crashes.

With that said, let’s see what Asset Revesting can do for you…

Asset Revesting Solves Your Biggest Investment Challenges.

Instead of holding onto declining assets during market volatility and downturns…

Asset revesting involves exiting positions that are starting to decline or stagnant and reallocating your money into assets starting a new upward trend.

By doing this, we’re always looking for the next opportunity to generate profits—rather than remaining stuck in underperforming assets.

Now, your next question might be:

How do you know which assets will perform well (or which ones to avoid)?

How can you identify when to enter and exit an asset at the right time?

How do you ensure your investment continues to grow in bear markets?

To solve these problems efficiently, I take a safer and more profitable approach than many financial advisors and institutions offer.

That means instead of wasting time chasing the next hot trade or exposing myself to the volatile and slow buy-and-hold method…

I use technical analysis to generate Asset Revesting Signals. And make no mistake, these are not your typical trading signals.

Unlike many trading signals generated based on prediction, news, and emotions, which often leads to inconsistent results, small wins erased by big losses, or a portfolio that barely grow…

Asset-revesting signals are generated based on many data points, including price, trends, cycles, money flows, and market participant sentiment.

When successfully generated, Asset Revesting signals serve three purposes:

- They tell you when to enter and exit an asset to capture maximum profits. That means you never have to worry about buying too late or selling too early.

- Asset Revesting signals also appear before a market crash so you can move your investments to safety. That means you never have to worry about losing your investments in bear markets.

- These signals also help you identify and hold assets that are rising in value. Your portfolio will ONLY hold investments that make you profit, eliminating assets that will lose money.

Asset Revesting signals are one of the most accurate and reliable signals you’ll ever come across…

They make the market “easier” for the average investor … by taking all the guesswork out of investing.

I want to show you real-life examples that demonstrates the success and effectiveness of Asset-Revesting Signals.

How Asset Revesting Signals Protect Your Investments In Bear Markets.

Let’s look at real-life examples of how asset-revesting signals helped me and other Asset-Revesting users generate more profit and protect our investments.

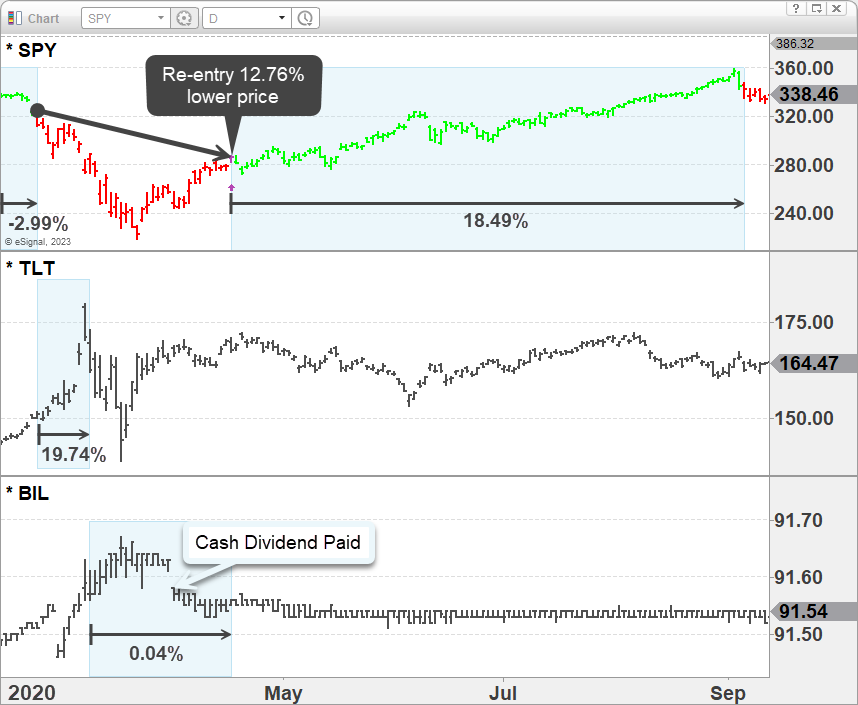

This was the start of the market crash on February 24, 2020.

Markets tumbled as COVID-19 fears spread rapidly. The Dow plunged over 1,000 points, and the Nasdaq Composite dropped more than 3%, sparking panic. In the weeks that followed, countless investors sold their assets at steep losses.

But for asset-revesting users, the story was completely different…

We received a timely asset-revesting signal that guided us to exit the equities market before the worst hit. We then shifted into long-term Treasury bonds for a nine-day position.

The result? While the stock market plunged over 30%, our position rallied 19%.

On April 20, 2020, we received a new asset-revesting signal.

This time, we moved our capital back into the index ETF—now priced 11% lower than where we sold it just six weeks earlier.

From there, our new position surged by 18% before another signal prompted us to exit stocks and move temporarily back to cash, locking in those gains

As you can see, we received three crucial asset revesting signals.

The first signal moved us into Treasury bonds for a nine-day position, delivering a 19% gain while the stock market dropped over 30%.

The second signal moved us into cash for safety, earning daily interest and a monthly dividend payment during uncertain times.

The third signal brought us back into the SPY index ETF, which rallied another 18%, locking in substantial gains.

Without these signals, we could have suffered significant losses—and missed out on these remarkable opportunities.

Can you see how transformative Asset Revesting signals can be for your portfolio?

With these signals, you’ll know exactly what moves to make before a market crash, helping you protect and grow your investments.

Here’s another real-life example of how asset revesting signals protected us from a loss.

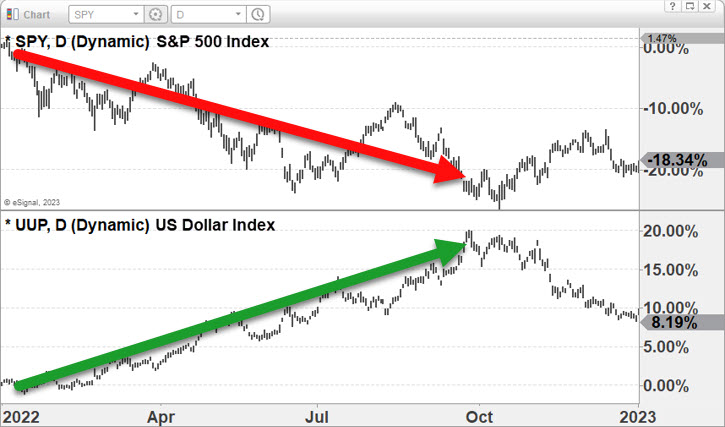

This happened during the 2022 market collapse…

The 60/40 stock and bond portfolio recorded a -18.34% loss for the average buy-and-hold investor.

Many investors lost money as they panicked out of the market and moved to cash. But for Asset Revesters, the story was completely different.

As you can expect, we received a new Asset Revesting signal before the S&P 500 loss happened…

We followed the signal and moved our capital into ETFs, such as UUP and BIL, which rallied and outperformed the S&P 500.

Without the Asset-Revesting signals, our assets would have suffered a staggering loss of -18.34%.

But because we followed the Asset-Revesting signals, we avoided the crash and moved into positions that made us money.

The bottom line? Once you start following the asset-revesting signals, alongside me and other users, you’ll never have to worry about losing your assets to market corrections or bear markets.

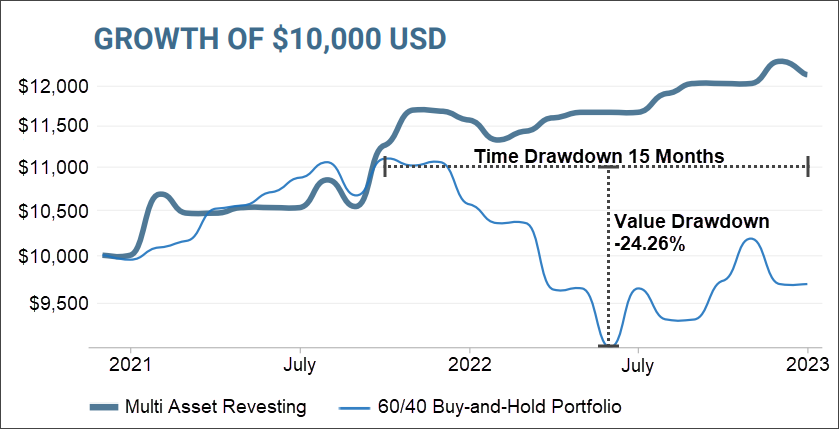

Here’s another real-life example…

Look at the chart below from the last couple of years, and you’ll notice that the average buy-and-hold investor experienced a drawdown of -24.26%.

Think about what that -24% drawdown caused—a massive chunk of investors’ hard-earned savings were gone. Investors were left scrambling to recover, cutting back on their lifestyle, and watching their retirement get pushed back by several more years.

However, Asset Revesters were completely safe. In fact, our investments continued to rise in value during that period.

With the asset revesting signals by your side, you have nothing to worry about when the market crashes.

Because even when an index like the S&P 500 crashes, you would have moved your investments to safety before the crash.

Imagine what it would mean for you and your family to never worry about market crashes again.

While others struggle to recover lost savings, you’ll have no problem funding your kids’ college, enjoying well-deserved vacations, and building a legacy for your children and grandchildren.

No sleepless nights. No second-guessing your financial decisions. Just the peace of mind from knowing your money is safer—protected from the turbulence of market downturns.

Asset Revesting VS Buy and Hold Strategy Performance Comparison.

Take a moment and look at some hard facts with me:

From 2000 to 2020, the S&P 500 delivered an annual return of just 4.8%. Adjust for inflation, and that drops to a dismal 2.5%.

Now, factor in the years lost to market crashes, the missed opportunities, and the sheer frustration, and it becomes painfully clear: buy-and-hold is a strategy that gives you too little return for the long and painfully volatile ride you experience.

Is it surprising that most people fall short of their financial goals and dream of retiring early?

But here’s the thing—I don’t blame the average investor. Wall Street and the financial media have conditioned people to believe this is the only way forward, all while charging enormous annual fees to “manage” your money for the next 20, 30, 50 years.

The financial system and the buy-and-hold strategy are designed to profit from investors while delivering the minimum amount it can get away with, just to keep charging you a fee.

It’s a system designed to keep you dependent. You might find yourself still working in your retirement years, forced to cut down your lifestyle to make ends meet, or struggling to shake the fear of running out of money.

Scary Fact: US Research Firm predicts 40% of household, and 81% of individuals will run out of money early during retirement.

On the other hand, the asset revesting strategy has proven to deliver better results and a retirement life without financial worries.

Let’s dive in and see how it stacks up against buy-and-hold.

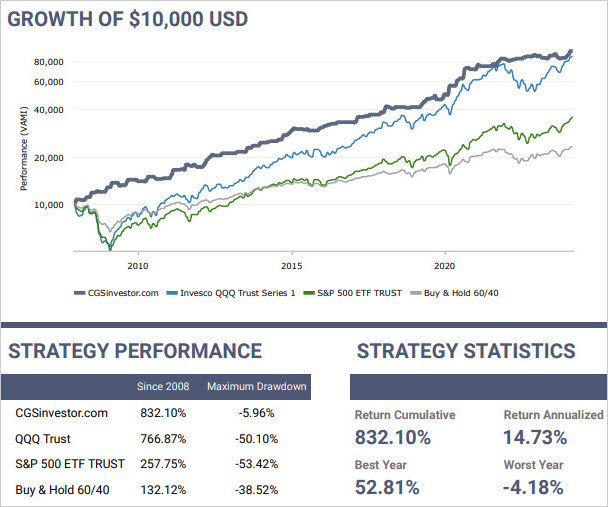

The chart below shows what happens when you invest $10,000 in a buy-and-hold strategy compared to those who use the Asset-Revesting approach.

You can see the differences in profit generated by the buy-and-hold strategy vs Asset Revesting (CGSinvestor.com).

If you had used the Asset revesting strategy, you’d have been several times richer than those who only bought and held, and you would have even outperformed the S&P 500 and Nasdaq.

That’s because instead of letting your money sit in a buy-and-hold investment, Asset Revesting uses technical analysis, cycles, volatility, money flows, and sentiment to generate signals that help you profit from market waves.

These signals help you identify what assets are about to experience an upward trend and the exact moment to enter and exit those assets for maximum profit.

Imagine how fast you can grow your retirement account if you knew exactly when to enter and exit assets for maximum profit.

Let’s look at another example.

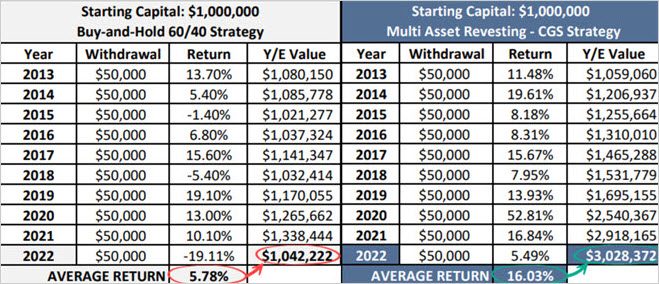

The table below shows the standard buy-and-hold portfolio over the past ten years compared to the Asset Revesting strategy.

Both start with $1,000,000 and withdraw $50,000 a year to help subsidize their retirement. (By the way, this doesn’t mean you need a starting capital of $1,000,000)

While the average buy-and-hold investor settled for a modest 5.78% return, you could have made a whopping 16.03% by following the asset revesting signals.

That’s nearly triple the growth—money that could help you take that dream vacation sooner, fund your child’s education without stress, or retire years earlier with financial peace of mind.

With Asset Revesting signals, you’re not just riding the market, you’re leveraging its movements to transform your financial future.

How Asset Revesting Signals Turn Market Volatility Into Money in Your Bank Account.

I developed asset revesting to help investors profit from market movements with minimal risk. Mind you, this has nothing to do with active trading or chasing hot stocks—it’s a tactical approach to riding market waves.

It doesn’t matter whether it’s a bullish year, a bearish year, or somewhere in between; asset revesters consistently profit from market movements.

Here are just a few of the many trades we profited from by following the asset revesing signals:

Profiting from Market Turmoil During COVID

On February 26th, 2020, we received an asset revesting signal to enter a TLT bond trade at $149.95 as the market began to tumble during the COVID crisis. Just nine days later, on March 9th, we exited at $179.10, locking in a 19.43% gain. Instead of waiting years for the market to “recover,” we leveraged its movements to secure meaningful returns.

Quick Gains with QQQ in 2023

On April 19th, 2023, we received an asset revesting signal to enter QQQ at $316.41. Less than two months later, on June 13th, we closed the position at $363.29, achieving a 14.81% gain.

Finishing Strong with SPY in 2023-2024

We received an asset revesting signal to enter SPY on November 13th, 2023, at $439.23. By February 22nd, 2024, we exited at $505.12, locking in a 15% gain.

As an asset revester, you’ll have the access to receive 5-12 asset revesting signals every year.

Many investors believe frequent trading leads to higher profits, but that’s far from the truth. Asset revesting signals give you 5-12 well-timed portfolio adjustments per year to consistently outperform the traditional buy-and-hold approach.

We focus on quality over quantity. This saves you countless hours analyzing the market. It reduces stress, minimizes trading fees, and allows your portfolio to grow without relentless micromanagement. Rememeber, when it comes to successful investing, less is more.

From the few results I’ve shown you, it is clear that Asset Revesting signals could help you outperform the buy-and-hold strategy by taking advantage of movements within the market.

These signals also alert you before a market crash so you can move your investments to safety before disaster hits.

Considering all that Asset Revesting can do for you, it makes little sense to continue settling for the little returns and high risks of the buy-and-hold strategy…

It’s time to take the leap towards an investing style that could provide the retirement you deserve…

Rethinking Your Investing Approach For A Richer Retirement.

Investors are told to buy and hold investments for decades, hoping they grow with the market.

The problem is… this approach limits your chances of achieving big and fast gains within your retirement account.

You miss out on all those gains that come with actively picking stocks with high growth potential.

This forces you to settle for little annual returns, which is never ideal when your retirement is on the horizon or if you are already retired.

That’s why I believe if you are 45 years or older and want to grow your retirement account reliably…

You can no longer depend on traditional investing methods like the buy-and-hold strategy, known to have periods of 5 to 12 years with little to no growth.

Instead, you must take advantage of market movements…

You must navigate the market and invest in only rising value assets.

By doing this, you can generate consistent profits and protect your portfolio from whatever the market throws at you.

Asset Revesting signals allow you to take advantage of movements without trying to time the market and risk losing your savings.

This strategy follows trends that have already started instead of trying to predict turning points like market tops and bottoms.

These signals help you pinpoint opportunities you would have missed as a buy-and-hold investor.

It also helps you fill your portfolio with opportunities that, in the long run, outperform the buy-and-hold investing strategy.

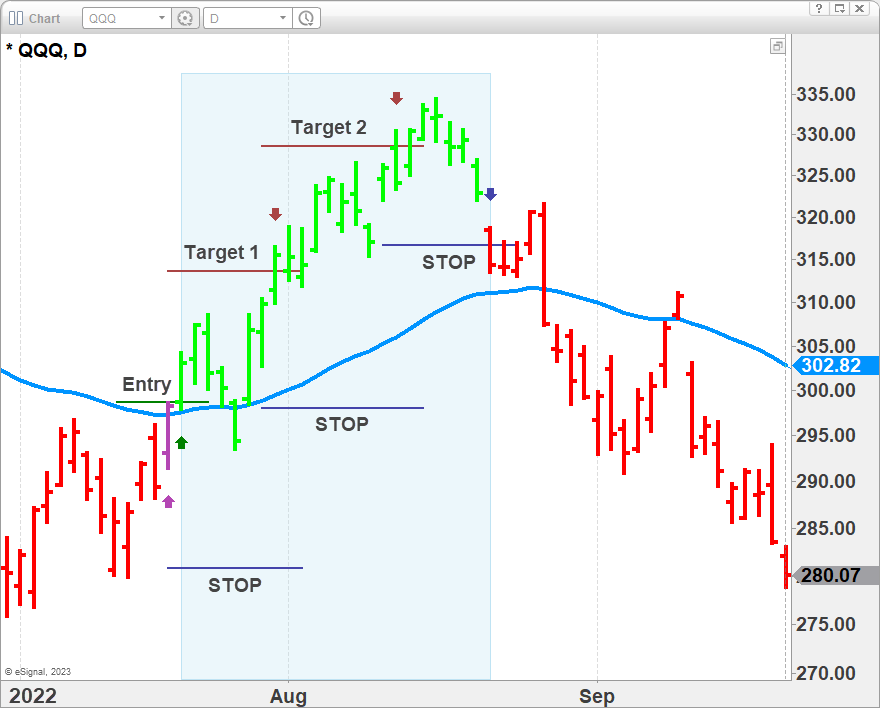

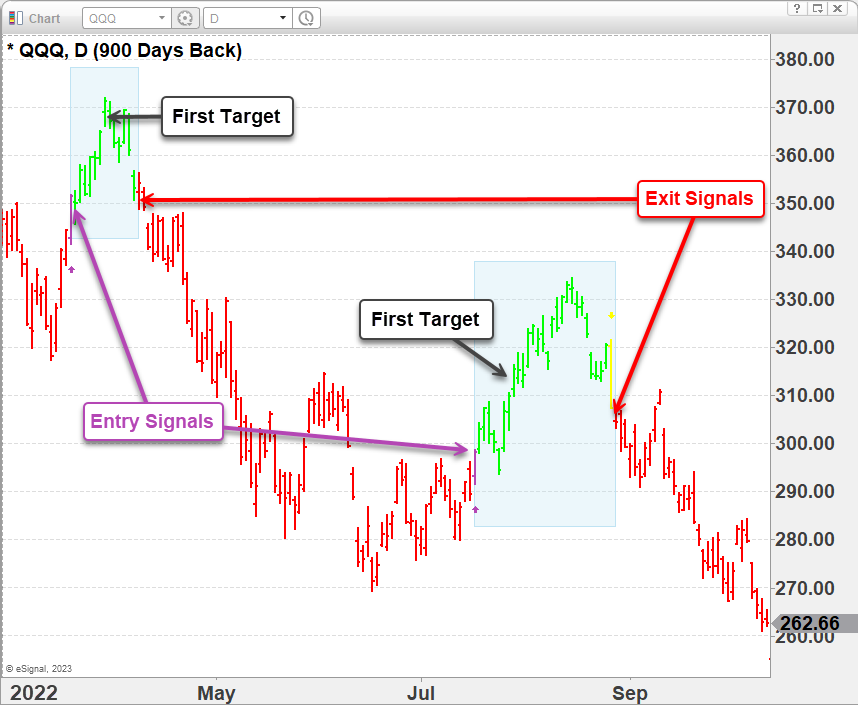

Look at the chart below, which shows how the value of QQQ rises and falls over time.

If you had followed the asset revesting signals, like I and other investors did, you would have safely moved in and out of QQQ, allowing you to take advantage of volatility instead of suffering because of it.

Look, I can’t promise your dream retirement will magically become a reality…

But by executing Asset Revesting signals, you have an excellent start at making that happen.

That’s because Asset Revesting is based on high probabilities. These signals only appear when there’s a high chance it will make us profit or protect our investments.

These signals ensure that you consistently profit from market movements instead of letting your money sit in the market’s whirl and settling for mediocre returns.

So, it’s time to decide what type of investor you want to be…

Do you want to be a passive investor whose portfolio is exposed to significant risk?

Do you want to continue struggling to make above-average returns, miss market rallies, and hold a portfolio of positions losing money?

Ask your advisor how much money you will lose if the stock market falls 35-55% in the next bear market and interest rates stay nearly the same. You’ll be shocked. I guarantee it.

However, if you want to consistently profit from market opportunities as an investor, following the Asset Revesting strategy is your safest and most profitable option.

Following these signals won’t require any drastic investment changes.

You won’t have to learn technical analysis or learn to interpret market signals.

My team and I will do all the hard work for you. You only have to receive the Asset-Revesting signals, execute them, and take your profit. It’s that simple.

Now, I want to show you how to receive the Asset Revesting signals.

The Only Way To Receive Asset Revesting Signals And Grow Your Retirement Account.

Imagine a retirement where you spend more time with your family, travel the world, pursue your hobbies, enjoy the luxuries of life…

And never have to worry about running out of money…

That’s the type of retirement the Asset-Revesting signals can provide for you.

I developed this strategy in 2001 and still use it with my own money.

The only way to access these signals is through my exclusive CGS newsletter (Consistent Growth Strategy.)

The Consistent Growth Strategy Newsletter is the only newsletter that gives you access to Asset Revesting Signals.

My mission with this newsletter is to help investors take advantage of the market’s ups and downs, and I’m inviting you to join me.

As a member, you’ll enjoy access to these benefits:

Asset Revesting Signals:

I’ll send you Asset Revesting Signals telling you when to enter or exit a position to capture maximum gains. You’ll receive these alerts via our mobile app and email. You can also find them on our members-only website.

These alerts are issued EOD (End Of Day), so you have all night and the next morning to place the order on the next opening day. It makes it easy if you have a busy schedule or don’t want to be worried about reacting quickly to enter or exit a position.

I issue 5-12 trades per year—that’s it. This is just enough to catch and profit from each year’s market rallies and declines by rotating our money into one to two ETF positions at a time.

Also, I should mention that you can have my Asset Revesting signals executed for you in your brokerage account at no additional cost if you don’t have time or want to manage positions, but more on that later.

Special Weekly Report:

You’ll receive an easy-to-understand report every Monday and Wednesday to keep you updated on everything happening in the markets. Each report is 1 to 5 pages long, and the video version with more details is 5 to 15 minutes long.

Access to Dedicated Customer Service:

Our dedicated team of specialists is always available to assist or answer your questions regarding your membership subscriptions or materials.

That’s not all I have for you, though.

I also have more exclusive services that can significantly boost your trading profit.

Join Consistent Growth Strategy right now, and you’ll enjoy unlimited access to these bonus services.

Bonus #1: “My Buy-Hold-Sell-Rebuy Strategy For Knowing When A Bear Market Starts, And More Importantly When The Bear Market Has Ended,” A Written And Video Weekly Update ($449 Value)

Free access to this passive technical investor report is only for Consistent Growth Strategy members.

This is a weekly report with written and video analysis called “The Technical Investor.”

It’s like having my team sit down with you for 10-15 minutes and having us tell you the most critical things unfolding and what we plan to do to avoid losses or make more money.

Once you become a Technical Investor, you’ll get instant access to these reports in our members area.

It’s a powerful yet passive bonus; it’s hard to explain the feeling of knowing what type of market we are in (bull/bear), what we need to do to avoid, and how to profit from chaos in a calm, laid-back way.

All I’ll say here is, if you’re an investor, this bull market/bear market strategy will be one of the most effective long-term tools you possess, provided you follow it and apply the information.

Here are a few you’ll discover…

● The big trend report. (Trading and investing with the big trend will ensure consistent above-average returns regardless of whether the market rises or falls.)

● Intermarket analysis and what all the critical assets and trends are telling us. (Almost everything in the world is connected, and the financial markets and individual assets are no different. Find out what the indexes, sectors, bonds, yields, currencies, and commodities tell us and which assets drive the big trends.)

● Stock market bull and bear market signals to know when to buy or sell our favorite stocks. (Find out when a new bull market starts, and watch your favorite stocks rocket higher and pay you dividends.)

● Know what US and Canadian ETFs to use when following The Technical Traders’ passive investing signals. (If you’re someone like me trading your OWN money, you might be stuck within a particular family/brand of ETFs your firm will let you trade. Use my list of equivalent ETFs for each brand of funds so you can copy and trade my signals.)

● Retirement accounts provide the best opportunity for account growth. (By using this strategy in your retirement account, you will retire sooner, with more money, collecting dividend income while avoiding bear markets.)

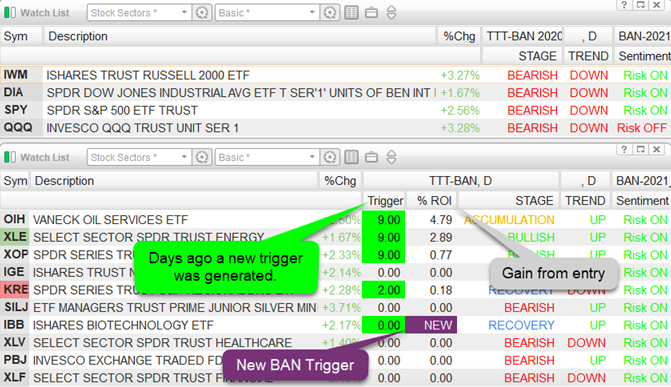

Bonus #2: “Best Asset Now” BAN Trader Pro Hottest Sector ETF Signals ($1499 Value)

This is the private and proprietary sector ETF trading strategy I share with members of the CGS strategy bundle I am offering today.

My BAN trading system revolves around technical analysis, momentum, stage analysis, and market sentiment…

Own the three hottest sector ETFs during stock market rallies. Investing using the relative strength of stocks and sectors dates back to the 1920s and consistently outperforms the S&P 500 and Nasdaq over the long run.

All successful traders manage positions as if their account depends on it, and that’s because it does. Get detailed trade signals for each position, complete with portfolio allocation, entry, targets, and stop levels.

I also share several tools I recommend individual investors use to reduce FOMO and make fewer costly emotional decisions.

This alone is almost worth the price of admission because I show you, live and on-screen every morning, exactly how to find the best sectors and what to expect. I help eliminate the frustration that comes with guessing and taking random trades.

– Get my daily pre-market 5-15 minute video analysis. (Know what is moving, what it means, and what we should expect with indexes, sectors, bonds, metals, and energies. These videos are highly educational; members use them for day trading, swing trading, and to manage their emotions better.)

– Own the best sectors during stock market rallies. (This proprietary sector selection process delivers explosive growth potential, which is generated End-Of-Day.)

– Learn how to find and trade our hotlist of 44 sectors for a never-ending stream of trade ideas. (Become a master at finding and owning the hottest stocks before they become mainstream news and how you can use options for explosive returns.)

You’ll miss all these bonuses and opportunities if you’re not subscribed to this CGS bundled newsletter.

Bonus #3: Seven-Hour Technical Analysis Course Of “What Indicators To Use And How To Use Them” Detailed 12 Video Classes ($749 Value)

These insightful classes give you a behind-the-scenes view and explanation of what we use and how we use a select group of indicators and tools.

We do things differently, so how you see something may be the opposite of what you think a particular indicator is telling you.

Take notes on what you will implement and better understand how we view the market’s movement.

Here’s a list of the classes:

- Support And Resistance

- Moving Averages

- Trend Channels

- Relative Strength And Stochastics

- Japanese Candlesticks – Part I

- Japanese Candlesticks – Part II

- Fibonacci Price Theory – Part I (My favorite tool)

- Fibonacci Price Theory – Part II

- Fibonacci Price Theory – Part III

- Three Surges To A High And Low

- Applying Technical Analysis – Part I

- Applying Technical Analysis – Part II

When subscribing to the Consistent Growth Strategy, you get immediate access to these 12 classes.

Once you get your reading or computer glasses and start watching this treasured bonus, I want you to attend lessons 9, 10, and 11 and take the classes.

They are called “Fibonacci Part I, II, and III.”

Even though it’s one of the least popular types of analysis, I consider it one of the most important.

Too many traders become victims of their success, unfortunately.

If you sign up for the Consistent Growth Strategy newsletter, I want you to be ready to handle the success that comes with it and be active with execution.

You will have access to all these bonuses as soon as you join.

NOTE: A friend of mine, Brad M, created this technical analysis video course material. So, don’t take the classes if not hearing my voice is a problem for you. Brad and I grew up trading together, and he knows how I use each type of analysis in my trading.

Please understand you DO NOT need to know or learn any technical analysis to get the full benefits of CGS. I do everything and give you the trades, but if you love to learn as I do, the tactics presented are pure gold.

Bonus #4: “How To Have My Exact Trades Executed In Your Self-Directed Trading And Retirement Accounts” Automated Trading ($2,500+ Value)

When I’m out in public talking with others, and they ask what I do, it eventually leads to them asking me this question:

“Can you trade my money for me?”

The quick answer is: “Kinda.”

I used to say no. I don’t manage anyone’s money besides mine because I am not a licensed investment advisor or broker.

So, I legally can’t give any personal trading or investment advice or manage other people’s money.

This has stayed the same. But here’s the good news. You can have my Consistent Growth Strategy signals automatically traded in your self-directed trading account.

You simply set up an account with the broker we selected to work with, fund your account, or move your retirement account over to them. The broker will help you set up your account where the CGS trades are executed instantly and automatically.

They are not an advisor and do not charge a management fee. There is, however, a $4.95 transaction fee for each trade adjustment (amounting to $9.90 – $19.80 for the total trade, depending on how many profit targets we reach because we scale out of positions as they mature).

If you want to save time and money, Auto-trading is the solution, and I don’t charge a dime for it.

The time savings alone greatly benefit you as a Consistent Growth Strategy community member.

Think about it. Suppose you have a $250,000 account and pay the average advisor fee of 1.3%, which is $3,250 annually. That’s more than the CGS newsletter.

I was on the phone with an investor with a $3,000,000 account. He is firing his advisor, who charges over $32,000 a year, because he lost nearly 25% of his retirement account from the so-called “team of experts” who know what they are doing.

Simply put, that’s a big difference without the bonuses, extra growth opportunities, or bear and bond market protection that CGS provides.

This is only one example of the many emails and phone calls I get regarding how out-of-control people feel about advisors handling their money.

You can take control back by subscribing to CGS or asking your advisor to subscribe to CGS and apply the trades to your accounts. Also, I should mention that advisors around the world use my signals to help their clients, and advisors build their advisory businesses faster because happy clients refer their friends and family.

As your account grows, the CGS fee remains the same no matter how large your investment account grows, unlike with an advisor who charges a fee based on assets under management.

Bonus #5: “Live Monthly Mentoring Sessions” Zoom ($2400 Value)

Many members (including me) in these live sessions consider these to be the greatest thing outside of our money-making trade signals.

Interestingly, 70% of members didn’t realize the power of participating in our live sessions until they attended one.

● Two monthly mentoring sessions with my team and me. (Bi-monthly sessions are a refreshing way to keep up on the markets and trends at a more granular level.)

● 60-90 minute sessions allow us to cover various topics. (From trading to investing, individual stocks, business ideas, real estate, the economy, and more.)

● Aspiring to become a successful trader or investor and take control? (Get all those trading and technical analysis questions answered that you always wished you could know the answer to.)

● Gain the traits of success by attending sessions and learning from others. (Discipline, patience, persistence, confidence, humility, positive thinking, objectivity, self-awareness, curiosity, and balance.)

However, a warning…

There are no “hot trade tips” in these sessions. Members and I can’t be bothered by low-level tactics used by people looking for quick, speculative, high-risk trades.

Instead, we focus on high-level strategies designed to elevate your trading account and emotional state for a happier and healthier lifestyle.

These bonuses alone can quickly earn you back the cost of your consistent Growth Strategy Newsletter Subscription.

In this way, if you think about how much I’m giving you, the newsletter doesn’t really “cost” you anything. If nothing else, it’s like me giving you money.

I know by providing multiple ways for struggling investors to get everything they need to reach the next level of success, they will stick around longer. As a result, they increase their knowledge base and experience growth.

Here are just a few testimonials from folks achieving their financial goals through my newsletter.

“…I paid off my membership in my first trade…”

“Chris has made us money & under current conditions and has saved us lots of money”

“…so valuable in helping traders avoid the pitfalls…”

How much does it cost to join the Consistent Growth Strategy Newsletter?

To be clear, a service like this doesn’t come cheap…

Normally, a year membership costs $5,500

But I’ve prepared something special for you that will dramatically reduce this price…

I want you to build your retirement fortune as soon as possible. And I want to make it incredibly easy for you to get started.

So, if you’re among the first 50 people to join, you’ll enjoy a huge discount.

If you subscribe today, you only have to pay $2,999 to become a member of the Consistent Growth Strategy Newsletter.

That’s a $2,501 saving for being among the first 50 people to take advantage of this opportunity.

Let’s take a quick recap of all you’ll be getting for $2,999 for a complete year.

This package with the bonuses is worth $13,097, but it’s all yours for only $2,999 if you join now.

This Newsletter Will Give You An Edge In Your Investments.

When saving for retirement, the last thing you want to do is take more risk.

That’s why safety is the number one priority of the Consistent Growth Strategy Newsletter.

While there are always risks in the financial markets, asset-revesting signals dramatically reduce them.

As I showed you from the examples earlier in this message, you’ll receive these signals before a market crash so you can move your investments to safety.

That means you will sleep better at night even when other investors lose in a bear market because your portfolio is safe.

Take a moment and think about the peace of mind you’ll experience when your portfolio is free from extreme volatility, and your investments keep their value or rise no matter the market condition…

This is the edge Asset-Revesting signals give investors.

I invite you to take advantage of these powerful signals, which could help you grow and protect your portfolio without the emotional rollercoaster and risk of traditional investing methods.

This is far better than holding on to your dear life (HODL) during a bear market and riding it out as most financial advisors tell you to.

I will note that we do not provide refunds for our newsletter service…

However, this newsletter service will keep your investments safer and generate more gains than most financial advisors offer.

If you’re wondering why there are no money-back guarantees, here are the reasons:

Reason #1: Anyone who needs a safety net to fall on to make a decision is neither psychologically nor emotionally ready to join my newsletter. And that’s okay. I created this newsletter for the small percentage of investors willing to do what it takes to win.

Reason #2: This type of trading takes time. It is not a flash in the pan. If you do not have the time or patience to wait for reliable, consistent growth, you must own up to this BEFORE you sign up.

Reason #3: You will have access to a lot of downloadable information, not to mention invitations to join our live mentoring sessions. Insider access is not free, and content is not inexpensive to create and then provide to our members.

If you opt not to execute the trades, that is your choice. You will still have received an incredible amount of learning during your subscription.

Having said all that, you can cancel anytime and for any reason without questions. We will cancel your renewal, and you will keep your member access until the end of your subscription term.

So What’s It Going To Be?

You’ve seen that with Asset Revesting signals, you have a much better chance of generating 2-3 times more profit than the buy-and-hold strategy.

You have seen how other investors use these signals to consistently profit from market waves and build their retirement nest egg.

I have also reduced the membership cost with a discount, saving you $2,501, plus you receive all the bonuses.

As you can see, I have reduced any friction that will stop you from benefiting from this life-changing newsletter service. As I see it, you have three options moving forward.

Option #1: Do nothing and let this opportunity slip away forever.

If you already have enough money to retire comfortably and never worry about money again, then maybe you don’t need the Asset-Revesting signals. But if you’d like to generate consistent profit that will fast-track your retirement or give you more fun money to spend while retired, you’re left with two other options.

Option #2: Do it yourself.

You can spend time and resources trying to beat the market or waste money on other strategies. But I am 100% sure you won’t find one that allows you to consistently grow your retirement account like Asset Revesting. Okay, onto your last option.

Option #3: Let Asset Revesting Signals do the work for you.

All you have to do is execute the signals I’ll send you. These signals will help you protect your assets during bear markets and position yourself to profit from market opportunities.

And remember, if you don’t want to learn the markets or place any trades, you can activate the CGS automated trading signals in your brokerage account at no additional cost for a complete, done-for-you solution.

You’d agree that Option #3 is the best choice right now.

If I am right, then it’s time you secure your subscription.

And remember, only the next 50 subscribers will enjoy the discount, and then this opportunity will be gone.

That means if you join now, instead of paying the regular $5,500 subscription, you’ll only have to pay $2,999 for a full-year subscription.

So don’t miss the opportunity to take advantage of the discount I’m offering today.

See this as the start of a new financial journey with many opportunities, little risk, and zero stress.

Click the button below to join the Consistent Growth Strategy Newsletter today and start building a worry-free retirement life.

Thank you for reading this letter. I hope you join me and thousands of others like you as we build wealth and improve our lifestyles one trade at a time.

Chris Vermeulen

Chief Investment Officer

TheTechnicalTraders.com

Frequently Asked Questions

“I’ve heard you kick members out of the newsletter and block people from re-subscribing. Is this true?”

Yes, it is true.

I only want to work with people who are serious about investing and have a positive mindset when accessing my newsletter. Life is too short to deal with lazy or negative people, so if my team or I see anyone being rude to anyone, we give them the boot.

“Why the Consistent Growth Strategy newsletter?”

In short, I’ve found the newsletter format creates the highest odds of success over the long term. Newsletters keep us all accountable and give you ongoing education without wasting time trying to figure things out on your own.

“How much time does it take to follow? I’m strapped for time.”

Each report is 1-5 pages long. There is a video version with more details that is 5-15 minutes long, depending on how long it takes to cover the markets. But you do not need to watch them or learn the markets if you don’t want to. Some members only copy the trade alerts and ignore all the other content and education I offer. Some just use auto trading, so they never have to do anything.

“I’m a financial advisor. Can I use this?”

Yes. I have members of all types, from individual investors, advisors, wealth managers, family offices, billionaires, and investment clubs. If you are an advisor or someone who shares this strategy with their clients or a group of investors there is a special subscription for you: Click Here.

“I’m in Canada (or the UK, Australia, etc.). Should I still join?”

I have members from over 130 countries. In fact, I’ve found that some CGS members from other countries (such as Canada, Australia, and the UK) tend to be very good at following the strategy and helpful within our members area comments to help new investors like you who join.

Concluding thoughts: if you are ready to advance to another level with your investments, you will need help.

I’d like to be that help, which is why I started helping others online in 2001 from my basement office.

That’s why I’m so excited to offer my Consistent Growth Strategy newsletter to you today.

.