Technical Trading Strategy With The Top Liquid Assets

Technical trading is a powerful investing strategy for those who want to protect their portfolio from market volatility and bear markets without sacrificing performance. The goal of technical trading is to follow a mix of assets that are not correlated with each other and to only hold assets that are increasing in value. This allows investors to achieve above-average returns and significantly reduce portfolio volatility.

2022 is now in the rearview mirror. If you didn’t fair well and you were caught holding stocks and bonds while they fell for the entire year, then you may want to give this special post a little read.

Using Technical Trading For Growth

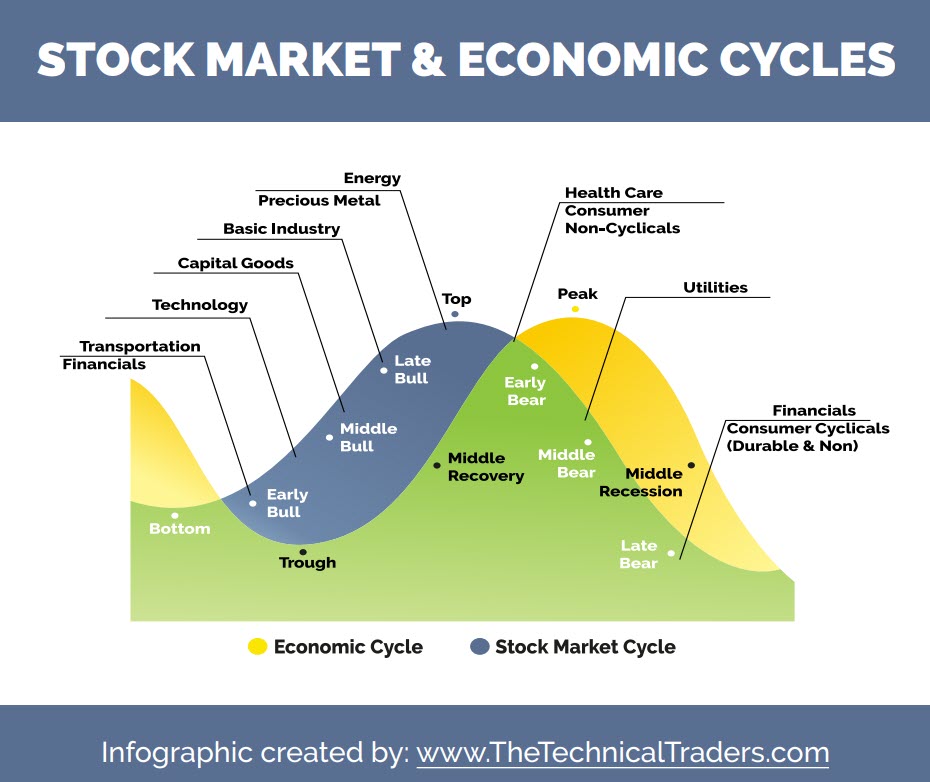

To achieve superior growth, investors must rotate capital into the best asset for the current market condition. This is done by following an asset investing hierarchy list, which ranks assets based on their expected performance and volatility. For example, if the top-ranked asset is the S&P 500 index and it generates a new investing signal, an investor may close a position in a lower-ranked asset like treasury bonds or the dollar index, then rotate the capital into the S&P 500 to maximize returns. It is important to tell when the stock market is bullish or bearish.

Benefits of investing in the top three most liquid asset ETFs

Investing in the top three most liquid assets – stock indexes, treasury bonds, and the dollar index – can be especially powerful for building wealth and are used to create a consistent growth strategy. These assets offer a combination of stability, growth potential, and diversification, which can help investors weather market downturns and achieve long-term success.

One reason to consider these assets is their liquidity, which refers to how easily they can be bought and sold without affecting the price. Stock indexes, treasury bonds, and the dollar index are some of the most liquid assets on the market, which makes them easy to trade and allows investors to respond quickly to changing market conditions.

Another advantage of these assets is their potential for growth.

- Stock indexes, such as the S&P 500 and the NASDAQ, represent a broad cross-section of companies and sectors and have historically delivered strong returns and dividends over the long term.

- Treasury bonds, while generally lower yielding than stocks, offer added opportunity when they are in favor and trending higher, making them a good choice as an alternate asset when stocks are falling.

- The dollar index, which measures the value of the US dollar against a basket of foreign currencies, can be a good way to add additional low-risk growth during extreme market volatility in stocks and bonds. The US dollar index can be traded using the long (UUP) and inverse (UDN) ETFs, so no matter if the dollar index is rising or falling, investors can squeeze more out of the market during the most difficult of times.

Following these three assets provides diversification of uncorrelated assets, meaning each asset can move in a different direction. As an example: both stocks and bonds may be falling in value, but the dollar index may be rising. By owning only the asset which is rising, investors can potentially reduce account volatility and multi-year drawdowns while generating consistent growth with their overall portfolio. I talk about why only price pays us as investors in this post.

Concluding Thoughts

In short, technical trading is a powerful, proven strategy for building wealth and preserving capital. By owning only rising assets using technical analysis, along with position and risk management rules, investors can achieve above-average returns and reduced risk.

Over the last 25 years, I have refined a proprietary ETF portfolio I use and share with investors who want to avoid bear markets and reliably grow their accounts with less stress and more enjoyment. And believe it or not, this CGS strategy can also be AutoTraded, meaning that once your Autotrading account is set up and funded, your money will be invested without you having to do anything else.

If you have any questions, my team and I are here to help you safely navigate both bull markets and bear markets with our Consistent Growth Strategy.

If you enjoyed this article, please share it with others, and be sure to join my free newsletter and have more articles like this delivered to your inbox.

Chris Vermeulen

Chief Investment Officer

www.TheTechnicalTraders.com

Disclaimer: This and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.