How To Become A World-Class Investor Without Self-Discipline

If you’ve had any education in trading at all, you’ve heard that self-discipline is a major key to success. I want to touch on this topic to reinforce this point! Understanding the psychology of trading is the distinction between those who win and those who don’t. Thankfully, there is a way for individuals who struggle to properly manage their losses to take full advantage of the stock market.

Personally, I don’t think trading needs to be complicated. Keeping things simple is the key to repeatable success, as it helps individuals with poor self-discipline stay in control and on track. I’ve studied many of the world’s top traders, and they only use a few basic strategies in combination with self-discipline when it comes to position and risk management.

This does not, however, mean trading is simple. There is a lot of room for failure when it comes to self-discipline and trade execution, and there isn’t any trading method that’s 100 percent bulletproof. All strategies have losing trades and losing years.

The most effective way to become successful as a trader is to learn directly from someone who has already made the mistakes you may just be headed straight for and not only survived but persevered and triumphed through the struggle.

Self-Disciplined Traders Look Before Leaping

One of the most common mistakes inexperienced traders make is to trade when they see an opportunity they think might be too good to miss. Jumping into a position based on a hunch or on the belief that you may be missing an opportunity is no different than gambling. Men struggle with this issue the most, and it tends to come at a high cost of wasting both time and money. In fact, I talked about why women tend to be better long-term investors on my blog. All of us, at one time or another, have felt a rush of greed for a trade based solely on the desire not to miss out on an opportunity. And, yes, that includes me.

Self-discipline means a trader applies skill and logic to their trading. They learn every day, and they use what they know to make intelligent decisions. They don’t worry about missing out; they focus on protecting their capital first, then look for quality trades second.

How I Became A World Class Investor

In 2001 I started sharing my market analysis online through an email newsletter. One of my main goals was, and remains, helping to fast-track a trader’s learning curve from a beginner to a more advanced stage within a few months. Throughout my evolution of teaching others how I trade and invest, the level of self-discipline I had further strengthened as well.

By 2008, I had lived and breathed trading, studied strategies, and implemented them with success. I decided it was time to make the learning curve of reading the markets through the use of technical analysis even easier, faster, and more automated!

After countless hours of analysis and with the help of multiple programmers to convert my knowledge, expertise, and strategies into a real-time automated technical analyst, I was on my way. I programmed the system that I had been manually trading since 2001, which I still use today, because it works exceptionally well.

The system does all the time-consuming number crunching so that I can accurately identify current market trends. It also provides trade details like position sizes, entry signals (long or short), profit-taking levels, and protective stops.

When using this strategy, most of my decisions are already accounted for, essentially making it easier to trade the markets and not rely so much on my self-discipline. I can anticipate the market’s entry and exit points ahead of others and be mentally prepared, knowing I may have to take action within a couple of days. I find this very helpful when dealing with emotions like FOMO.

With all that said, you don’t need to know and trade everything. The key is to find a few simple strategies that work for you and master them. Knowing what strategy is best for you is critical for your success, as it must fit with your personality, available time, self-discipline, and current knowledge of the financial market. I shared a post that can help with this titled What Type Of Trader or Investor Are You?

How You Can Become A World Class Investor

Only you can be accountable for your actions. All the books, audio, videos, manuals, courses, weekend seminars, or mentors cannot give you self-discipline. That must come from you. That is the reason why it’s called SELF-DISCIPLINE!

So what does this mean? It means understanding that to trade successfully requires an extraordinary amount of self-control and self-understanding. It requires the ability to quiet the mind and recognize when fear or greed (emotions) start to creep into your decision-making process. You must have the awareness and discipline to step back and review your strategy checklist and follow it when the situation goes against your feelings.

I have read a lot of trading books, and by far, the most exciting ones have been about what other successful traders have done and are doing to build their wealth. The book Market Wizards, by Jack Schwager, is a thorough account of trading because he interviews the world’s most successful traders.

“What sets these traders apart? Most people think that winning in the market has something to do with finding the secret formula. The truth is that the common denominator among the traders I interviewed had more to do with ATTITUDE than APPROACH.”

Jack Schwager

Two aspects of psychology you need to succeed:

1. You must trust your trading method.

2. You must trust yourself.

It’s obvious that to be successful in trading, you need a viable trading method with setups, rules, and a plan that works. Without one, no amount of self-discipline is going to help you. On the other hand, if you don’t have enough self-discipline to follow trading rules, then you can’t trust yourself to know you will do the right thing (like selling a position that is in decline). This is where most people fall short.

The journey ahead will present challenges and test even the best-laid plans. Expect to encounter failures along the way. To succeed, it’s crucial to not only have financial stability but to also have a strong mental fortitude that will endure the tough times that come with achieving success.

As depicted in the image below, success is a path with peaks and valleys, including both triumphs and failures.

Below is a quick litmus paper test that will help you know if you are more or less gambling your money vs. managing your money for a better lifestyle.

If You Answer YES, Then You Have Foundational Trading Processes in Place

- Do you have a detailed trading plan to work from?

- Do you have clearly set up criteria for each trade and adjustment?

- Do you use a hard protective stop for every trade?

- Do you have a routine that gets you back on track when you’re trading is off?

- Do you prepare for your trading day with pre-market notes?

- Do you keep track of all your trades and review closed trades?

If You Answer YES, Then You are Destined To Fail Unless….

- Have you had several winning trades, followed by larger crash & burn types of trades?

- Do you experience hesitation, apprehension, uncertainty, or fear when you are about to trade?

- Do you double down after a losing streak or in the midst of losses to regain profits faster?

- Have you ever gone into the “I don’t care” mode and watched your money disappear when in a trade?

- After losing a large amount of money, are you challenged emotionally by every trade after that loss?

- Were you successful in another profession and found trading is affecting your confidence and ego?

- Do you lose sleep over your trading and investment positions?

- Are you exiting a trade too quickly instead of waiting for the trade to mature to its full potential?

- Are a high percentage of your trades defensive?

- Do you logically know what to do in a trade but find you are not taking the actions you should?

The Brutal Truth

The technical aspect of defining a trading method is academic; the psychological power to focus and remain disciplined is much more a matter of learning the techniques of positive self-talk and setting proper expectations, which leads to better self-discipline.

That means that trying to beat the market by long shots (large directional-based trades) is not only difficult to do consistently, but it also leads to a level of volatility that will not sit well with you over the long term when losses stack up, or you find that your account is not any larger after a couple of years. Individuals who swing for the fences on trades like these tend to struggle more during bear markets.

Removing human biases as much as possible by sticking to a proven strategy and focusing on capital preservation and low-risk victories is the only way to safely navigate the market to avoid large market corrections and bear markets.

How To Be Successful With Poor Self-Discipline

A simple, well-thought-out trading strategy will feel slow and boring. That’s because all the possible scenarios have been figured out by the strategy rules (position size, stops, profit-taking levels, etc.), and all that is required is to follow the trade signals.

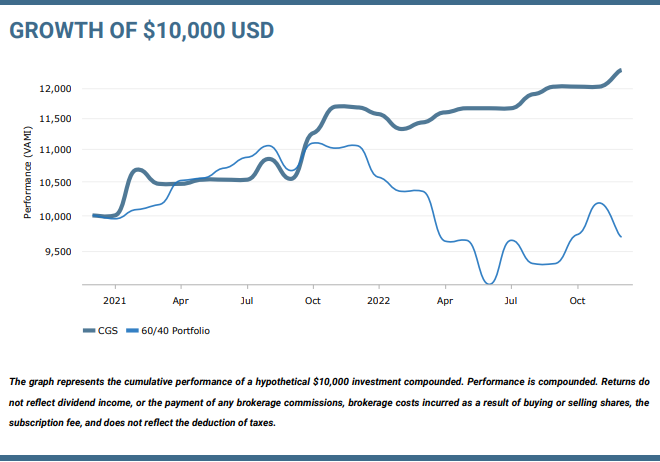

Just look at the graph below for the last couple of years. The average investor without a plan or self-discipline has lost money with the buy-and-hope strategy vs. those who use a different approach which only holds assets rising in value as I do.

I always try to remind active investors that if a strategy is SIMPLE, then it’s REPEATABLE. If it’s repeatable, then it’s BORING. If it’s boring, it means you have MASTERED it. And if you’ve mastered it, it means you will be far more likely to experience CONSISTENT PROFITS.

So, in conclusion, if you are struggling with any of the things mentioned in this article and you want to identify and profit from stock market rallies and declines using ETFs, then I can help. I am here to lighten the load and provide actionable trade and position management signals with my Best Asset Now Sector Trading Newsletter or the Consistent Growth Strategy for fast-tracking your way to retirement and boosting your retirement lifestyle. You can manually trade these signals in your self-directed account or have them autotraded for you at no additional cost.

If you enjoyed this article, please share it with others, and be sure to Join My Free Analysis and Signals Newsletter and have more articles like this delivered to your inbox.

Chris Vermeulen

Chief Investment Officer

www.TheTechnicalTraders.com

Disclaimer: This and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.