US Fed Set To Rattle Global Markets – Part II

Today is the day for the US Fed to announce their rate decision and we believe the 25 basis point rate cut is the only option they have at the moment that will attempt to settle foreign market fears and allow for a suitable “unwinding” of the credit/debt “setup” we highlighted in Part I of this research post.

We believe out August 19 expectation of a global market PEAK and the beginning of a price reversion move is related to multiple aspects of the timing of this Fed move and the current global economic outlook. The unwinding of this debt/credit bubble will likely take many more years to unravel. Yet, right now the US Fed is trapped in a scenario they never expected to find themselves in. Either continue to run policy that supports the US economy (where rates would likely stay between 1.75 to 2.75) over the next 5+ years or yield to the global market and attempt to address a proper exit capability for this debt/credit “setup”.

We believe global investors are expecting a massive collapse in the US stock market as a reaction to this move by the Fed and because of the expectation that another bubble has set up in the US. But we believe the actual bubble is set up in the foreign markets and not so much in the US. Yes, the US markets have extended to near all-time highs and the US consumer is running somewhat lean. It would be natural for the US economy to revert to lower price levels and for the US economy to rotate as “price exploration” attempts to find true market support. Yet, our fear is that the foreign markets are much more fragile than anyone understands at the moment and that a reversion in the US markets will prompt a potential collapse in certain foreign markets.

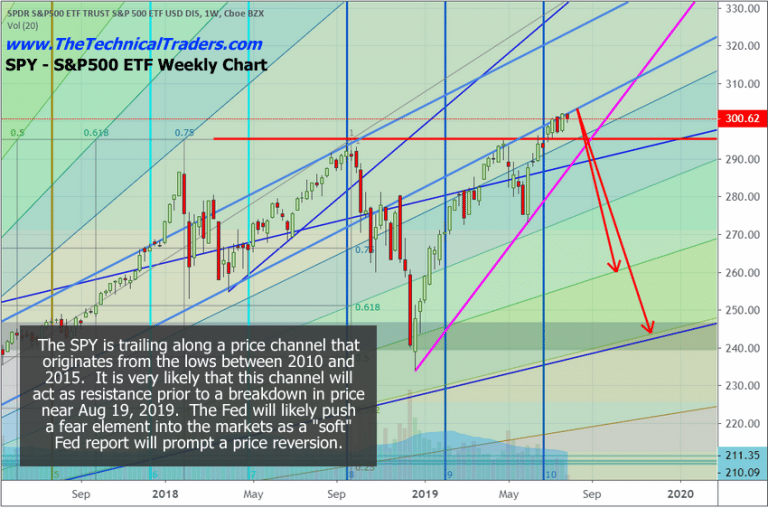

Weekly SPY chart

This Weekly SPY chart highlights what we expect to transpire over the next 6 to 8+ months. We believe the August 19 peak date that we predicted months ago will likely start a process that will be tied to the US election cycle event (2020) and the US Fed in combination with global market events. We believe a reversion price process is about to unfold that could be prompted into action over the next 2+ weeks by the US Fed, trade issues and global central banks.

If the US Fed drops the FFR by 25pb, the fragility of the foreign market debt/credit issues is not really abated or resolved. It just allows for a bit of breathing room that may allow these foreign debtors enough room to wiggle out of some of their problems. The US Fed would have to decrease rates by at least 75 basis point before any real relief will materialize for these foreign debtors.

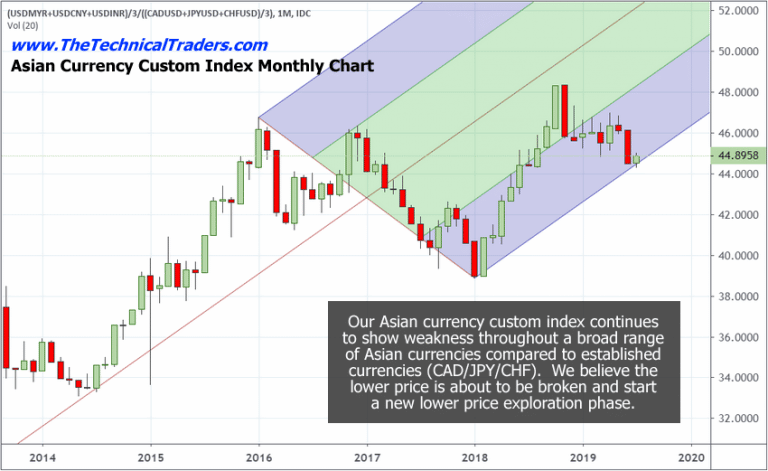

Asian Currency Custom Index

This Asian Currency Custom Index used by our research team highlights the weakness in the foreign markets. The recovery in 2018 is related to the Chinese/Asian currency market recovery that initiated in Feb/Mar 2018. The recent weakness in this custom index is related to strengthening major market currencies (USD, CAD, JPY, CHF) in relation to weakening Asian currencies. Notice how the price channels have set up to warn us that any further downside move will initiate a new “price exploration” phase that could see a -20% to -25% decrease in currency valuations – possibly much deeper.

We believe this is the real reason the US Fed is opting to decrease the FFR rate now and is not taking a more stern position related to US economic performance. We believe the US Fed is, again, donning the “Superman cape” and attempting to Save The World from their own debt/credit mess.

We are holding to our original predictions and expectations. We believe the US stock market indexes will enter a reversion price phase over the next few weeks that will prompt a downside price reversion toward recent lows (2018 levels or deeper). We believe this process will end in early 2020 and that the lows established by this move will represent incredible opportunities for skilled technical traders.

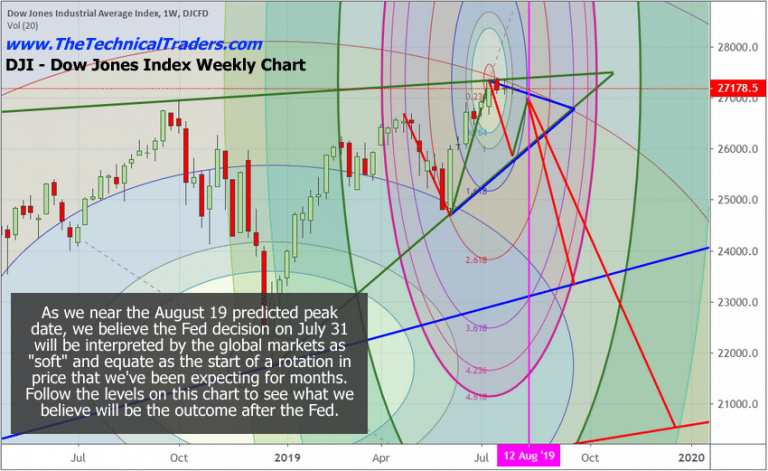

Weekly Dow Jones chart

This Weekly Dow Jones chart highlights our expectations. We believe a mild price rotation will start this move over the next 2~4 weeks before the August 19, 2019 date prompts a breakdown move. After that date, we believe an extended downside price leg will continue to reach a price bottom near the end of 2019 or in early 2020.

This Weekly Dow Jones chart highlights our expectations. We believe a mild price rotation will start this move over the next 2~4 weeks before the August 19, 2019 date prompts a breakdown move. After that date, we believe an extended downside price leg will continue to reach a price bottom near the end of 2019 or in early 2020.

Skilled traders understand how the global markets are setting up for incredible opportunities and how to identify where and when these opportunities are ripe for profits and this is where we can help you!

CRUCIAL WARNING SIGNS ABOUT GOLD, SILVER, MINERS, AND S&P 500

In early June I posted a detailed video explaining in showing the bottoming formation and gold and where to spot the breakout level, I also talked about crude oil reaching it upside target after a double bottom, and I called short term top in the SP 500 index. This was one of my premarket videos for members it gives you a good taste of what you can expect each and every morning before the Opening Bell. Watch Video Here.

I then posted a detailed report talking about where the next bull and bear markets are and how to identify them. This report focused mainly on the SP 500 index and the gold miners index. My charts compared the 2008 market top and bear market along with the 2019 market prices today. See Comparison Charts Here.

On June 26th I posted that silver was likely to pause for a week or two before it took another run up on June 26. This played out perfectly as well and silver is now head up to our first key price target of $17. See Silver Price Cycle and Analysis.

More recently on July 16th, I warned that the next financial crisis (bear market) was scary close, possibly just a couple weeks away. The charts I posted will make you really start to worry. See Scary Bear Market Setup Charts.

CONCLUDING THOUGHTS:

In short, you should be starting to get a feel of where each commodity and asset class is headed for the next 8+ months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities starting to present themselves will be life-changing if handled properly.

FREE GOLD OR SILVER WITH MEMBERSHIP!

Kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen – www.TheTechnicalTraders.com