US Dollar Has Upside Potential – Part II

- US Dollar is establishing a price low near a current Lower Price Support Channel.

- The election is 60+ days away. The focus will shift away from stock market gains and move more toward protecting assets, currency valuations, and future expectations (reflecting the perceived US election results).

- The upside trend in the US Dollar will conversely reflect a moderate price consolidation, and/or downward price trend, in the US stock market.

In Part I of this research series, my research team highlighted the Presidential Election cycle and what we believe is the most likely outcome for the US Dollar and the US stock market going forward for the next 3 to 6+ months. As we continue to explore our data and charts, we hope to more clearly illustrate how the Presidential Election cycle relates to opportunities and trends in the US Dollar and the US stock market.

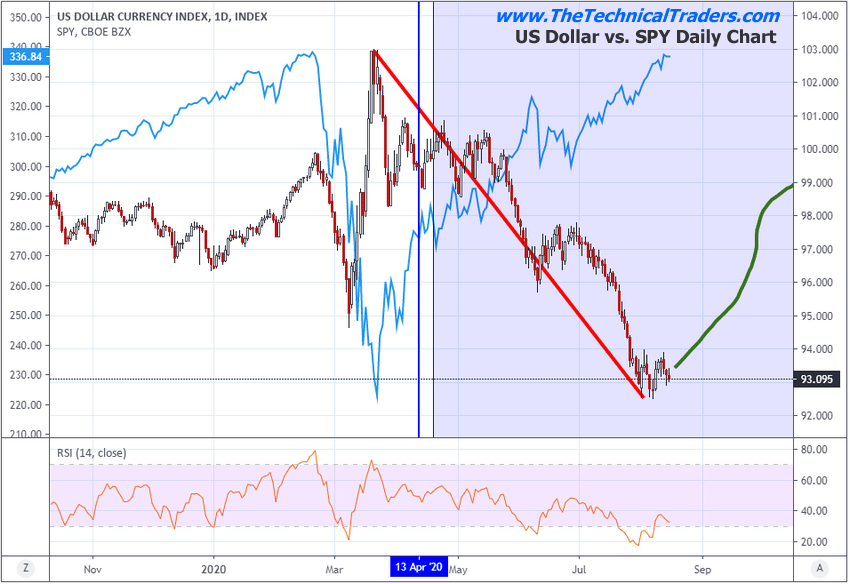

MASSIVE PRICE ROTATION IN THE US DOLLAR & SPY

We believe this downside price move in the US Dollar is related to the upside price move in the US Stock Market and support of foreign currencies after the incredible recovery in US Stock Market price levels over the past 4+ months. As investors are drawn into the US stock market within rallies, many traders ignore the trends in the US Dollar because the gains achieved within a stock rally are superior to the risks/liabilities of US Dollar price changes. Since the March 20, 2020 peak in the US Dollar, the dollar has fallen nearly 10% to levels near 93.10. Meanwhile, the SPY has rallied over 51% over that same span of time.

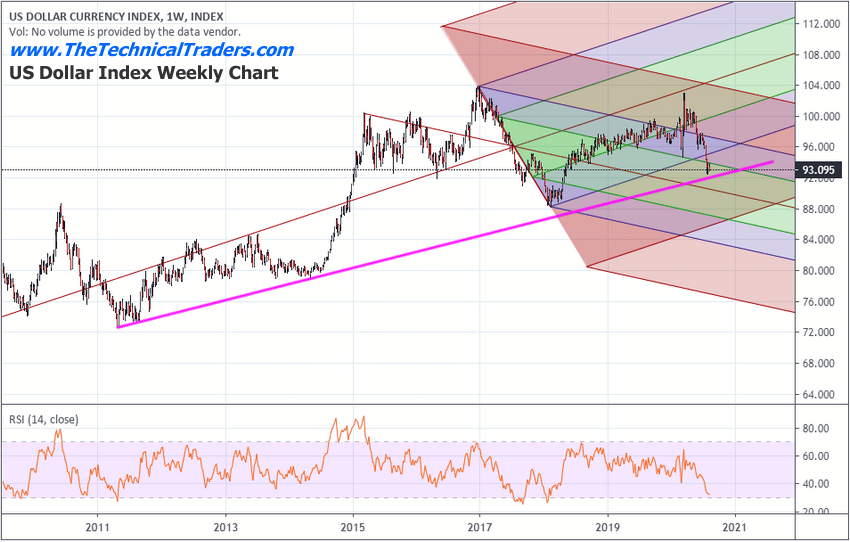

This Weekly US Dollar chart, below, highlights the competing trend channels that are currently driving the sideways price activity and recent lows. The US Dollar has broken below the upward sloping price channel/fork and is well within the middle area of the downward sloping price channel/fork. The recent lows appear to be very close to the longer-term lower price trend line which is acting as support.

What we believe is happening, right now, is that the US Dollar is establishing a price low near a current Lower Price Support Channel. We believe this is a technical price move related to the support and trend in the US stock market that initiated just before and throughout the COVID-19 virus event. Prior to the start of 2020, the US Dollar was trending moderately lower, near 97. As the COVID-19 virus event became more of a concern, the US Dollar rallied to levels just below 100. Then, when the collapse in the US stock market started near February 25, the US Dollar collapsed to levels near 94.60, before rallying to a peak near 103 (an 8% swing in price).

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The disruption in the global markets sent shock-waves throughout the currency markets as traders and investors suddenly realized “this is not just a US/China issue – this event targets everyone on the planet”. We believe the rally in the US Dollar after the March 20, 2020 bottom in the market reflected the confidence of global traders/investors believing that the US Federal Reserve was acting in a manner to help support the planet at a critical time in our history. There was no other institution on the planet that could have engaged in a more efficient and effective means of supporting the global crisis that was unfolding at that time.

Since that peak level near 103, the US Dollar has trailed lower as the US stock market recovery focused everyone on the gains in technology and various sectors. Now, with the US Dollar near a support channel and with the US Presidential Elections just 60+ days away, we believe the focus will shift away from stock market gains and move more toward protecting assets, currency valuations, and future expectations (reflecting the perceived US election results).

Please take a moment to review the charts and data we provided in Part I of this article, where we illustrate a price pattern that appears to be rather consistent in the US Dollar near Presidential Election cycles. We believe the current low in the US Dollar is the first leg of this pattern and the next leg will prompt a moderate upside price trend in the US Dollar lasting up to, and possibly through, the November 3 election day.

If our researchers are correct, this upside trend in the US Dollar will conversely reflect a moderate price consolidation, and/or downward price trend, in the US stock market. This type of pattern would suggest that precious metals could continue to climb as FEAR starts to drive traders/investors away from allocating large positions/trades prior to the contested election cycle. If we are correct, traders will pull capital away from risk, move it into safe-haven assets (precious metals, bonds, the US Dollar, and others) which will reflect the completion of the second leg of this US Dollar price pattern.

After the elections are completed and settled (which we hope happens without too much difficulty), then traders begin to reposition their assets based on what they believe will be viable opportunities given the new policies, promises, and direction of the US economy. Remember, the US economy is still the largest and most effective driver of global growth on the planet. As much as many people may not want to admit it – what the US does drives global growth and optimism. As we’ve suggested before in other articles, we believe the current “shake-out” in currencies, stock markets and debts/liabilities will result in a very strong price trend setting up for the US Dollar and major global stock markets sometime near late 2021.. are you ready for it?

Isn’t it time you learned how my research team and I can help you find and execute better trades? Do you want to learn how to profit from market moves? Our technical analysis tools have shown you what to expect months into the future, so sign up for my Active ETF Swing Trade Signals today to learn more! If you have a buy-and-hold account and are looking for long-term technical signals for when to buy and sell equities, bonds, precious metals, or cash then be sure to subscribe to my Passive Long-Term ETF Investing Signals.

Stay safe and healthy!

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation, investment or trading advice, or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. The Technical Traders research team produces these research articles to share information with you in an effort to try to keep you well informed. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.