Understanding Emotions During the Four Market Stages

The stock market, often seen as a labyrinth of numbers and charts, is deeply infused with human emotions. Beneath its seemingly sterile surface, it pulsates with collective hopes, fears, elations, and despairs. Stock prices swing based on a range of economic factors, corporate performances, and global events. However, a critical and often underestimated driver is the collective emotion of market participants. Understanding these emotions during the market’s various stages can help investors navigate its treacherous waters.

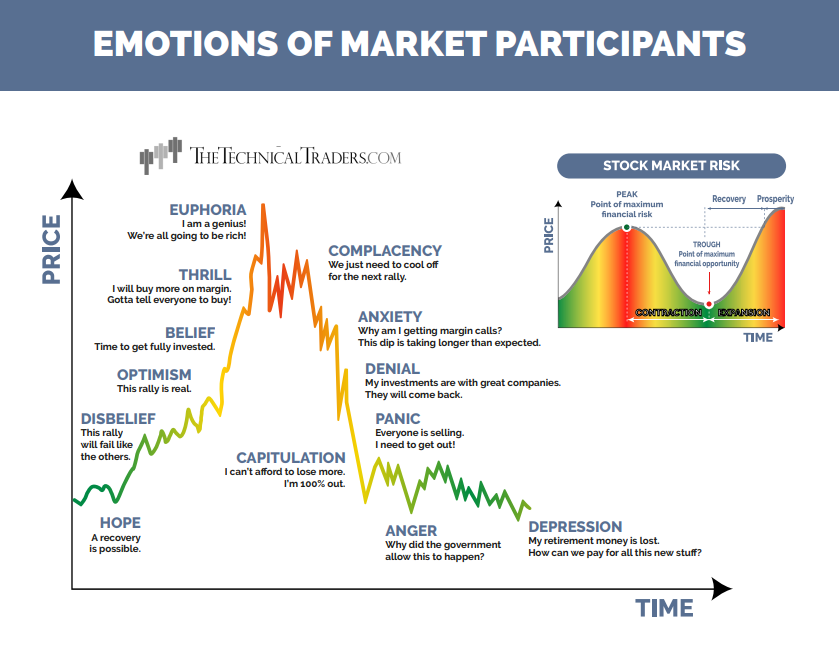

The Four Market Stages and Their Emotional Spectrum

Every market cycle is characterized by a series of stages, each of which evokes distinct emotions. The interplay between emotions and stock market dynamics is intricate. While it’s impossible (and arguably undesirable) to completely divorce emotions from investment decisions, recognizing their influence is crucial.

Bull Market Stages

- Hope: This is the dawn after a long night. Investors, having weathered a downturn, begin to see the glimmers of a potential upturn. While cautious, there’s an overarching sense of optimism.

- Disbelief: As the market slowly claws its way up, many remain skeptical. Having been burnt by past false rallies, there’s a hesitancy to embrace the upswing wholeheartedly.

- Optimism: A pivotal sentiment. As the market continues its upward trajectory, the earlier skepticism starts fading. Investors now begin to believe that the good times are here to stay.

- Belief: A surge of confidence envelopes the market. With continued positive signals, investors are more assertive in their investment choices, often increasing their market exposure.

- Thrill: A dangerous precipice. The relentless market growth leads to a sense of invulnerability. Many not only buy more but do so on borrowed money, convinced that they can’t lose.

- Euphoria: The pinnacle of overconfidence. Investors, swept up in the torrent of success, often become blind to risks. The sentiment is that the sky’s the limit.

Bear Market Stages

- Complacency: The initial declines are often dismissed as ‘minor corrections’. There’s a general sentiment that the market will soon regain its momentum.

- Anxiety: The charm starts wearing off. As the market doesn’t rebound as expected and more investors receive margin calls, a sense of unease permeates the atmosphere.

- Denial: Investors grapple with cognitive dissonance. Despite evident market downtrends, many convince themselves that their assets are still valuable and that a rebound is imminent.

- Panic: As the name suggests, a chaotic stage. Watching the consistent slide, many investors frantically try to offload their assets to prevent further losses.

- Capitulation: The lowest ebb. A point where investors, emotionally and financially drained, decide to exit the market, often vowing never to return.

- Anger & Depression: The aftermath. The emotional turmoil is profound, with many directing their ire at external entities, such as regulatory bodies or the government, while grappling with the tangible implications of their financial setbacks.

Examples of Current Asset Life Cycles

Navigating Emotions and The Market

Investment decisions deeply influenced by emotions can lead to undesired outcomes. Here’s how investors can keep their emotional compass in check.

- Evading the Herd Mentality: Throughout history, from the Dutch Tulip Mania to the Dot-com Bubble, the collective frenzy has shown its destructive power. While it’s human nature to be influenced by peers, it’s vital for investors to undertake independent research and maintain a healthy dose of skepticism.

- Staying Alert and Educated: The financial world is in perpetual motion. Continual education, combined with an acute awareness of global events and market nuances, equips investors with the tools to make informed decisions.

- Deciphering Market Dynamics: An astute investor recognizes the market’s current stage. Whether it’s the heady days of euphoria or the somber periods of denial, understanding the broader context can provide invaluable insights.

- Embrace Accountability: Every investor, irrespective of experience, will make mistakes. Rather than seeking scapegoats, embracing these missteps and learning from them is pivotal for long-term growth.

- Avoid Playing the Blame Game: While it’s comforting to lay the blame on external entities during downturns, it’s seldom productive. A proactive, self-reflective approach offers more constructive insights.

- Prudent Risk Management: Always operate within your financial comfort zone. Tempting as it might be to chase massive gains, it’s essential to recognize and respect your risk threshold.

- Understanding Leverage: Leverage, or buying on margin, can be a potent tool. However, it’s akin to playing with fire. While it can amplify returns in a bull market, during downturns, it can exacerbate losses, leading to financial and emotional distress.

- Long-term Vision and Forecasting: Every investor should have clear financial goals. Whether it’s purchasing a home, funding children’s education, or ensuring a comfortable retirement, your investment strategy should mirror these milestones.

- Aligning Risk Appetite with Life Stage: As one approaches significant life events, like retirement, capital preservation often becomes paramount. It’s crucial to reevaluate your investment strategy to ensure it aligns with your current life stage and future aspirations.

Where we could go next

Articles to Enhance Knowledge and Understanding

Stockholm Syndrome – Investors Have Stockholm Syndrom And How This Effects Their Retirement

Personality Test – A Valuable Lesson In Knowing Investors And Your Own Personality Type

Self-Discipline – How To Become A World Class Investor Without Self Discipline

Sequence of Returns Risk – Shockingly Different Investment Results And How Two Pilots Invested $1,000,000

Drawdowns – Silent Killers Of Stock And Bond Investors 50+

In Conclusion

The stock market is as much a test of emotional resilience as it is of financial acumen. The highs and lows can evoke a spectrum of feelings, from euphoria to despair. By understanding these emotional stages, being vigilant, and making informed, independent decisions, investors can better navigate the market’s complex dynamics. The stock market’s allure is undeniable, but like any powerful force, it must be approached with respect, understanding, and a touch of humility.

Challenging industry beliefs, building knowledge banks, and finding the right strategy are all key aspects to becoming a long-term successful revester. Growing wealth sustainably is not about greed, fear, or hope. It’s about safeguarding finances, preserving peace of mind, and ensuring a legacy of financial success for all generations.

If you enjoyed this article, please share it with others, and be sure to Join My Free Analysis and Signals Newsletter and have more articles like this delivered to your inbox.

Chris Vermeulen

Chief Market Analyst

TheTechnicalTraders.com

Disclaimer: This email and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.