Shockingly Different Results Of How Two Pilots Invested $1,000,000

Prepare to be amazed by the vastly different outcomes achieved by two pilots who each invested $1,000,000. You won’t believe the stark contrast in their results!

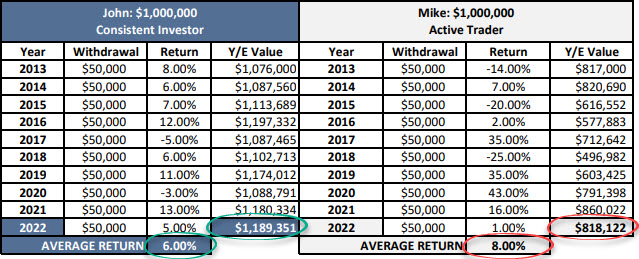

John, the consistent pilot, made $371,229 more than Mike

who earned a higher average annual return.

How is that possible??

Eons ago, in high school, I had an old-timer math teacher who would get upset every year he was forced to use a new math textbook. His main argument was that “math hasn’t changed,” which, as we know, is true. He would also talk about how much money it costs the schools to buy new textbooks, how much work it added for everyone, and that the whole thing made no logical sense from a mathematical point of view.

With that said, and pretty much ignoring all the ‘behind the scenes’ stuff, the one question we all asked as kids was, “Will I ever need to know this stuff?” We were assured that we would, and as it turns out, we do.

Using The Math We Learned As Kids

Now, meet John, the Consistent Investor, and Mike, the Aggressive Trader. Both are retired airline pilots. John has always been a careful and deliberate investor, preferring to stick with lower-risk strategies that may not yield the highest returns but are less likely to result in significant investment losses and long periods of time without any growth (also known as drawdowns). Mike, on the other hand, is a risk-taker who believes that faster-moving stocks mean a greater payoff and that the more trades he could make, the more potential he would have to grow his account. Unfortunately, Mike is not aware of the two silent killers of investment accounts.

Both John and Mike have built up substantial savings over the years and are eager to start drawing on their investments to supplement their retirement incomes. They each have one million dollars to work with and plan to withdraw $50,000 per year to support their retirement lifestyle.

Average Annual Return Is Not As Important As Consistency During Retirement

Once you cross the age of 50, how you invest is much more critical than ever before. It’s not about how much return you can generate each year. Instead, it’s all about low volatility and consistency. As you will see in the table below, it’s the evolution of how we invested in our early years.

I call this “Wealth Math,” which is all about protecting our retirement accounts from losses and long periods of no growth. The annual returns may be lower than more aggressive strategies, but investments aligned with Wealth Math are a more consistent way to generate income. At the end of the day, with wealth math, less-is-more for retirees.

Surprisingly, women naturally tend to invest this way, and have more money in retirement than men who actively trade, which I explained in the post “Why Women Make For Better Investors, Sorry Guys.”

Over the course of ten years, John’s consistent portfolio only averages 6% return, while Mike’s generates 8%. However, when it comes time to sell shares to generate cash to fund their retirement, John ends up with more money than Mike, even though John earned a lower rate of return. This is because John’s portfolio is designed to minimize potential losses, while Mike’s is more volatile and therefore requires him to sell more shares when the market dips, and his account is worth less money during some of the times when he had to withdraw money.

While no one can predict where stock and bond prices are headed, we can manage our investments to generate more consistent returns and reduce account volatility. By focusing on strategies that prioritize stability and minimize risk, John was able to come out ahead in the end. Mike, who was more focused on chasing big returns, ended up losing more money in the long run because of something called “sequence of Returns Risk.”

Most Damaging For Retirees – Sequence of Returns Risk

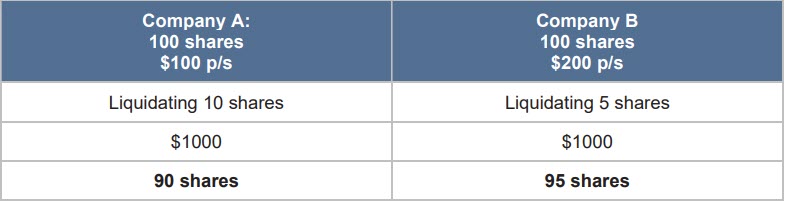

One of the most damaging things a retiree can do is liquidate stocks at the wrong time. Let’s say you have 100 shares of Company A and 100 shares of Company B. If Company A is priced at $100 per share, you have to liquidate ten shares to get $1,000. This leaves you with ninety shares participating in any rise in the stock’s value. If Company B is $200 per share, you only have to liquidate five shares to get that same $1,000, leaving you with ninety-five shares participating in rising stock prices.

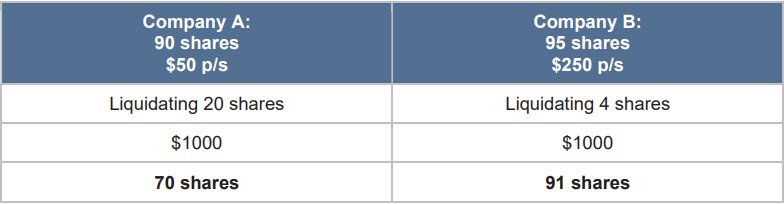

Now imagine you need to withdraw another $1,000, but the price of Company A has fallen to $50 per share. You now need to liquidate twenty shares to get your withdrawal, leaving you with just seventy shares participating in the upside potential. If at the same time, Company B’s share price has risen to $250 per share, you need only liquidate four shares, leaving you with ninety-one shares.

When depressed assets are liquidated early in retirement to meet income needs, it quickly reduces the number of remaining shares that can participate in any market recovery. Over a short period, with repetitive liquidations, especially in a bear market, a retiree can run out of money far sooner than expected. This risk increases when an investor refuses to consider cash as a position during a market downturn.

To avoid sequence-of-returns risk, it’s critical to sidestep bear markets and take advantage of falling prices to generate additional returns through the use of inverse ETFs or by owning different assets which are rising.

Thankfully, through the use of technical analysis and risk and position management, investors can identify trades and reversals to know when to enter and exit positions. The team at TheTechnicalTraders are able to read the price charts and follow major market trends, which this article details – how investors are challenging the status quo buy-and-hold strategy to create a bear-proof retirement account.

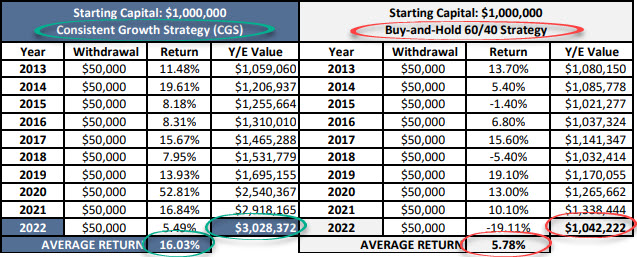

Consistent Growth Strategy VS. Buy-And-Hold Results

As mentioned before, withdrawing funds when a portfolio is in a drawdown can be very costly to your long-term financial outlook. But with a tactical investing strategy the like the Consistent Growth Strategy (CGS), an investor should not have any big losses or multi-year periods of negative returns. That means a portfolio will generally be near a high watermark (all-time high), leaving the investor free to withdraw capital as needed.

Concluding Thoughts:

While there is no guarantee that investments will always yield positive results, a well-managed portfolio will likely have more consistently positive results than negative ones. It’s important to understand that results don’t come in a linear fashion. Just like flying an airplane across the country, it’s not as simple as going in a straight line because, with the winds aloft, the shape of the earth, and its rotation, a straight-line approach will not get you to where you want to go. Knowing your portfolio allocation’s long-term average return and the maximum potential drawdowns (losses) is essential for success.

CGS investment method provides both,

consistently for larger long-term gains,

generates a higher average annual return,

which supercharges our investment accounts.

Capital Preservation – Boost Growth – Improve Lifestyle

Investors who can change course when needed with their investment plan are able to continue building their wealth and improving their retirement lifestyle through the use of position and risk management strategies like the CGS method.

Chris Vermeulen

Chief Investment Officer

www.TheTechnicalTraders.com

If you enjoyed this article, please share it with others, and be sure to Join My Free Analysis and Signals Newsletter and have more articles like this delivered to your inbox.

Disclaimer: This and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.