Surprising Consumer Activity May Suggest A Deeper Shift In The Markets, Part IV

This final portion of our research article into the shifting US/global consumer spending/economic activities will help to set up forward expectations related to how assets and the stock market may react over the next 12+ months. In our opinion, the reflation trade/rally is complete, and consumers have already run the course with regards to stimulus spending, hyper-speculation of assets (cryptos, commodities, equities/stocks, and others). What happens next is we shift into the real-world future where post-reflation valuations, consumer activities, and corporate earnings will drive expectations.

There was a time, shortly after the November 2020 elections, that was very opportunistic for traders/speculators. The US Fed was prompting very easy monetary policy while multiple stimulus programs were still taking place. Additionally, the US economy was still early into the post-COVID reflation attempts. This created a real opportunity for traders and speculators to ride a hyper-speculative rally phase in late 2020 and into early 2021 as the Month-over-Month and Year-over-Year economic output data ramped up from the extreme COVID lows.

Sign up for my free trading newsletter so you don’t miss the next opportunity to learn more!

At this time, commodities, housing, stocks, and various sectors all seemed to rally 20~30% or more over a very short 5 to a 6-month span of time. Most of these peaked out in February through April 2021. Now, nearly 5+ months after these peaks, we are starting to see very clear downward trends in China, Asia, Europe, and other commodities, equity sectors that suggest we are shifting away from the rally phase. What happens now that price levels, valuations, and expectations have been pushed toward extreme levels?

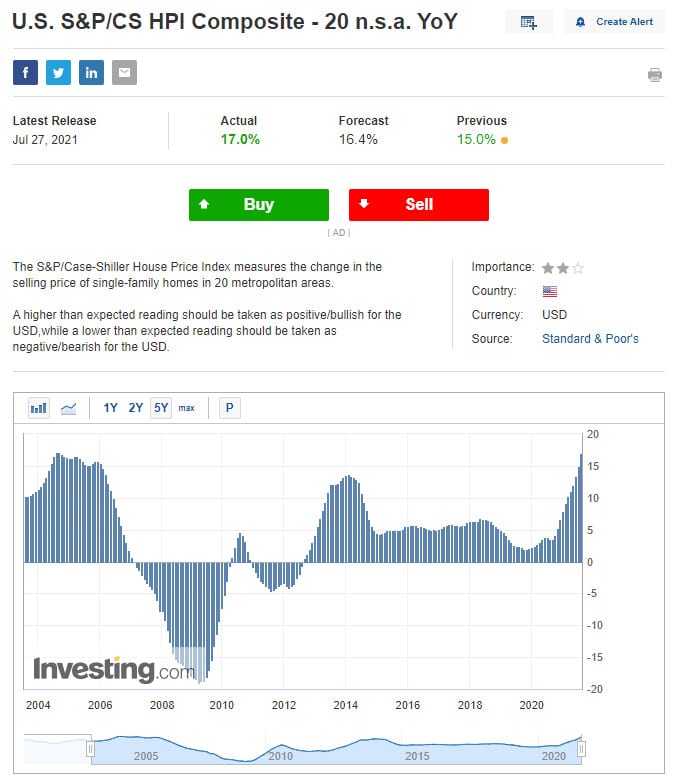

August 2021 Case/Shiller House Price Index May Break 2004 Highs – Setting New Record High

One simple measure of extreme consumer and pricing is the Case-Shiller House Price Index. Even though we’ve seen multiple waves of recovery over the past 10+ years regarding home prices, the extended and very aggressive rally in home prices over the past 12+ months is staggering. The CS HPI prior to COVID was averaging near 3% – suggesting moderate price appreciation in home values. Currently, July 27, 2021, CS HPI value came in at 17% – suggesting home prices across 20 major US cities have risen 17% on a Year-over-Year basis.

The next Case-Shiller update should happen near August 27, 2021. If this data pushes above 17.10%, that would represent the highest CS HPI rate since September 2004 – breaking to a new high and also representing a potential extreme speculative peak in home prices.

Consumers are keenly aware of these pricing dynamics – even with extremely low-interest rates. And with the US Fed talking about tightening monetary policy possibly earlier than expected, many consumers are starting to pull away from making big purchases while expecting continued price appreciation. Consumers know that rising interest rates may prompt a 15% to 25% decrease in house price values from these extreme highs. Even if the US Federal Reserve moves the FFR to 1% or 1.25%, the likelihood that mortgage rates will climb to levels near 4.50% or higher is very reasonable.

Home price values are a reflection of consumer confidence, consumer earning capabilities, and ease of purchase (entry) related to interest rates. When consumers feel the opportunity is right and interest rates are low, while they have strong earning capabilities, consumers will spend more for homes. But when any of these factors diminish substantially, particularly rising interest rates and/or lack of consumer confidence in the economy, consumers tend to pull away from making big purchases on homes.

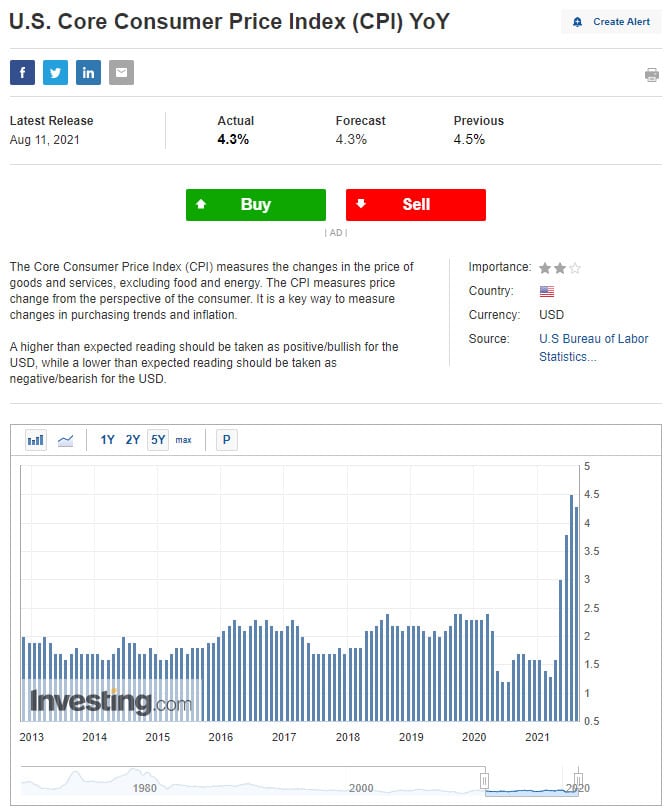

Core Consumer Costs Are Still More Than Double Average Historical Rates

Another factor in our belief that Consumers have already started to pull away from this rally peak in the stock market and economy is that Core Consumer CPI levels have skyrocketed over the past 4+ months – which suggests consumers are straining to deal with rising inflation costs at all levels.

Consumer CPI is a measure of pricing for goods and services (excluding food and energy). If you understand the rally in Core Consumer CPI does not include rising food and energy costs, yet still rallied to more than 200% average levels over the past 4+ months, then sit back and let me try to explain.

Energy prices are more than 200% higher than they were 14+ months ago. Crude Oil was trading below $30 ppb in April 2020 and recently reached a high price level above $76 ppb. For the average consumer, energy costs have more than doubled over the past 10+ months and that will present a real problem as the economy starts to open back up.

Additionally, the cost of food items has risen over the past 14+ months to near the highest levels on record going back to 2011 or 2007-08. The interesting facet about this bit of information is that rising food costs in 2007-08 also coincided with a massive housing price bubble that imploded in early 2009 (Source: https://www.usinflationcalculator.com/inflation/food-inflation-in-the-united-states/)

In an eerily similar setup to 2007, food prices started to rally higher in the first quarter of 2007 by about 30%, then peaked out at +6.1% in October 2008 – just a few months before the housing market collapse really destroyed the global markets. Currently, food prices have already gone through a similar type rally phase, starting in April 2020 with a big 40% price increase. Food price inflation peaked near the middle of 2020 near 4% to 4.5% and has continued to moderately weaken in early 2021. This same type of moderate food price inflation happened in Q2 and Q3 of 2009 – during the height of the housing/credit market collapse.

US Consumers Will Continue To Drive Future Market/Economic Trends in 2021 & Beyond

The one thing we are trying to impart to you with this research article is that the US consumer is the main driving force behind the market price and activity trends. If the consumer stays actively engaged in the economy throughout the end of 2021 (through the Christmas season and beyond), we may see a more moderate recovery in the stock market and asset value price levels over time. But if the consumers pull away from engaging in the economy because of this recent extremely high CPI and other asset/inflation data, we may see some type of price reversion event take place which many people may be unprepared for.

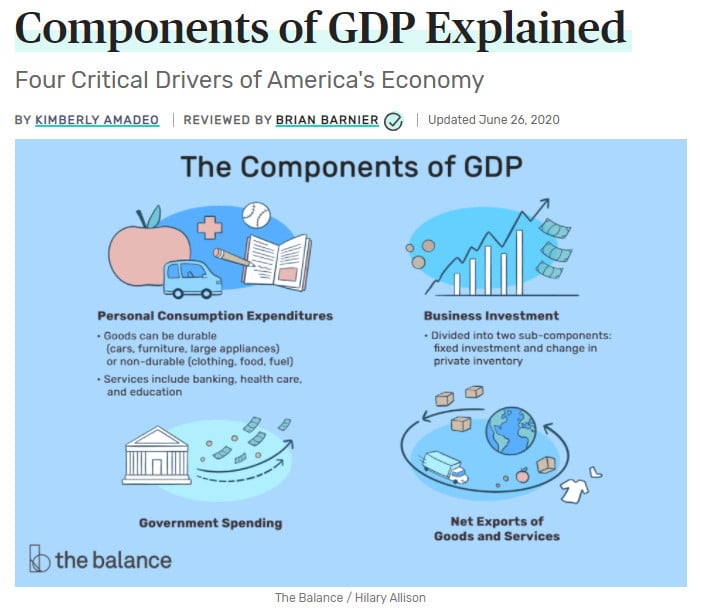

The US consumer & consumer services make up more than 70% of total US GDP. Government policy, US Federal Reserve actions, and Business spending/engagement are all components of how well the US economy operates going forward. Like a high-performance engine, everything has to work, everything needs proper lubrication, and there is a very small tolerance for error.

Consumer Sentiment Falls To The Lowest Levels Since December 2011

After this extremely high CPI, asset value, and other reflationary economic levels, while we are seeing Consumer Sentiment declined dramatically (from 81.2 to 70.2: falling -14.5% to the lowest levels since December 2011), it appears consumers have already started to head for the exits.

We need to stay cautious of what may happen over the next few months and be headed into the end of 2021 in terms of valuation levels and volatility. If the consumer side of the economy suddenly vanishes, because of inflationary, economic, or other concerns, we may see a very sudden collapse in home prices, economic activity, GDP, and other asset values. If consumers re-engage in the economy after these massive inflationary and economic rallies, then we may see continued support for stock market valuation levels near current values.

Again, consumers drive economic activity and without consumer engagement, the US and global economy may slip into a Recession. The post-COVID world has experienced a very strange and explosive economic explosion in terms of price appreciation, economic data output, inflation, and other factors. History has shown that once we reach these extreme levels, consumers typically react by pulling away from speculation and waiting for new opportunities in the markets.

The current Consumer Sentiment levels are already suggesting that consumers have started to pull away from economic optimism. We need to stay very cautious of what happens over the next few months as we see how the end of 2021 and early 2022 play out.

More than ever, right now, traders need to move away from risk functions and start using common sense. There will still be endless opportunities for profits from these extended price rotations, but the volatility and leverage factors will increase risk levels for traders that are not prepared or don’t have solid strategies. Don’t let yourself get caught in these next cycle phases unprepared.

Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

For those of you who are interested in Options Trading, our resident specialist Neil Szczepanski will be hosting a LIVE two-part Intermediate Course beginning on Wednesday, August 25, 2021. Neil will dive deep into the different strategies and outline what are the best trade setups and what to avoid – helping you to become a more knowledgable, confident, and advanced options trader. To learn more, or to register for the course, kindly click on the following link: INTERMEDIATE OPTIONS MENTORING COURSE.

As something entirely new, check out my initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire youth to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many people as possible!

Have a great day!

Chris Vermeulen

Chief Market Strategist