Silver Begins Big Upside Rally Attempt

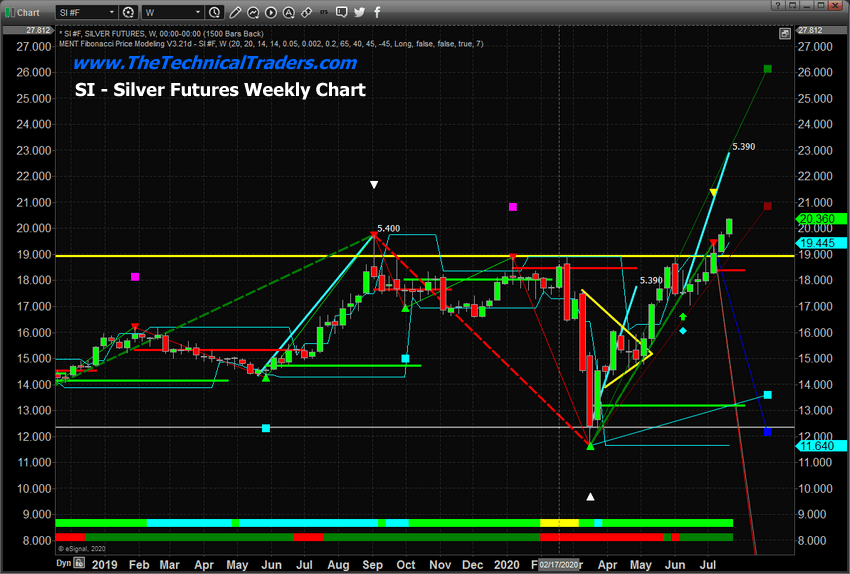

The move we saw in Silver early this week to new 6-year high price levels, above $22.60, is quite likely the biggest upside move in Silver since the bottom in March 2020 – after the US stock market collapsed because of the COVID-19 virus event. This new rally in Silver is likely the move we’ve been suggesting to our followers relating to a series of measured upside price moves totaling approximately $5.30 in each advance.

We wrote about these measured price moves in Gold and Silver in this article – Click Here

As traders, watching bonds accelerate moderately higher as the US Dollar falls and the stock market attempts new lofty levels, we are intrigued by the move in metals because it suggests a large segment of investors believe a bubble is nearing very peak valuation levels. The only reason metals, particularly Silver, would be accelerating as it has recently is that traders have suddenly adopted a stronger demand for second-stage hedging of risk.

Gold is the traditional hedge for many traders in times of risk. Silver, being the second-tier hedge, typically start to rally 4 to 6+ months after Gold begins to move substantially higher. Gold is currently trading near all-time highs – near $1820. Silver just recently bottomed in March 2020 near $11.65 and has rallied more than 70% to current levels – above $20.35. If our research is correct, Silver will rally to levels above $26 within this current upside rally.

The multiple measured moves in Gold and Silver suggest waves of price advances happen in a series of structured upside price moves. We believe this current upside move in Silver will push price levels above $26 per ounce. If Gold continues to rally as Silver rallies, then future measured moves should target $31.50 and $36.75 in Silver – possibly higher.

I recently talked about silver specifically in both of these videos. The detail of what to expect and timing of the breakout is explained in layman terms and both short term traders and long term investors will benefit. No matter if you like miner stocks or if you buy physical metals, there are two videos you should watch/listen to.

Recently, Gold has move moderately higher while Silver has really started to accelerated more dramatically. The move in Gold, compared to Silver, is like to push to levels above $1950 fairly quickly as the risks to the credit/debt and stock markets become more evident over time.

The Gold to Silver ratio is currently at 89.1. It peaked in March 2020 at 126.6. Historically, after a peak in this ratio is established at a time when the global stock market enters a period of contraction or extreme risk. From the peak in the Gold to Silver ration in late 2008, the ratio contracted over 63% to bottom in mid-2011. That bottom in the ratio was very close to the peak in Gold and Silver price levels.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

If a similar type of price decline happens in the Gold to Silver ratio, it should fall to levels near 47.5 from the current level near 90. This represents a substantial drop in the ratio level – which translates into a continued rally in both Gold and Silver until a peak syncing of price between Gold and Silver is reached. Once the Gold to Silver ratio contracts below 60, it is likely that both Gold and Silver will begin to rally in similar price ranges. That will be a very exciting time to watch for gold and silver bugs because both Gold and Silver could rally 8% to 15% each week (or more).

Once Gold reached the $1950 level, the next measured move target, subsequent target levels are $2200, then $2450. Remember, traders, move into metals to hedge against risks they perceive in the stock, credit markets, and global economy. At this point, we have to believe traders are pumping capital in Silver as Gold nears recent all-time highs. We can’t ignore the fact that traders are actively hedging unknown risks in the markets aggressively in metals.

In fact, if you consider what the US Fed, global central banks and governments have attempted to accomplish over the past 6+ months and what has happened in Gold and Silver over the past 3+ years, it suggests traders have been actively hedging against market risks for over 2+ years. They are more aggressively hedging right now – which suggests there is a very strong fear that the markets are trading on borrowed-time near these current high price levels.

Our passive investor signal newsletter which tells you when to own stocks, bonds, and metals has been long gold since it started a new bull market of July 2019. We have since added large-cap gold miners which have also started a bull market this year. Silver, well it’s just getting started, better late, than never!

We’ve continued to urge traders to stay cautious over the past 12+ months because of the risks identified by our proprietary modeling systems and our super-cycle research. Right now, we believe the risks of a major contraction in the US and global markets are still rather high. The new highs in the NASDAQ are evidence of a DOT COM-like disconnect in the markets. The US stock market is not rallying in a healthy manner – certain segments are rallying because they are still generating profits while the COVID-19 virus blows holes throughout the global economy.

Pay attention to what is happening in Gold and Silver because they are screaming “risk is excessive throughout the world” and traders that are chasing the rally in the US stock market could wake up to a very sudden surprise soon.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed.