Revisiting Our Silver and Gold Predictions – Get Ready For Higher Prices

If you have been following our research into Gold and Silver over the past years, then you were already prepared for the recent rally that has taken many investors by surprise. This year, 2020, Gold and Silver are set up to have their best year of price appreciation over the past 40+ years. It is no consequence that this is taking place right now. Our cycle research and our predictive modeling systems have helped us stay well ahead of this move. In fact, way back in early 2019, we were already warning this type of price move would take place and suggesting a target price level of $3750 for Gold was not out of the question.

OUR GOLD PREDICTIONS CAME TRUE

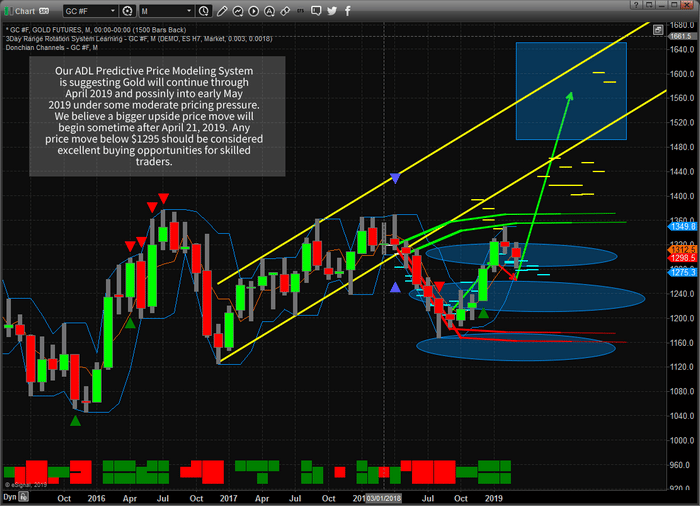

This article will review some of our past research posts to help you better understand what is really happening in precious metals right now. One of our most visited research articles in 2019 was related to our prediction that Gold would rally from $1240 to well over $1700 before the end of 2019 based on our Adaptive Dynamic Learning (ADL) predictive modeling system.

Our predictions at that time shocked many traders because the global markets were not expecting precious metals to rally in this manner reflecting a renewed “fear trade” setting up. The idea that Gold could rally nearly 40% at a time when the global markets appeared to be driving growth and gains was alien to most people. Yet, here we are with Gold attempting to break above $2000 and our $1700 price prediction being a thing of the past.

SILVER GOES INTO FULL SUPER-HERO MODE

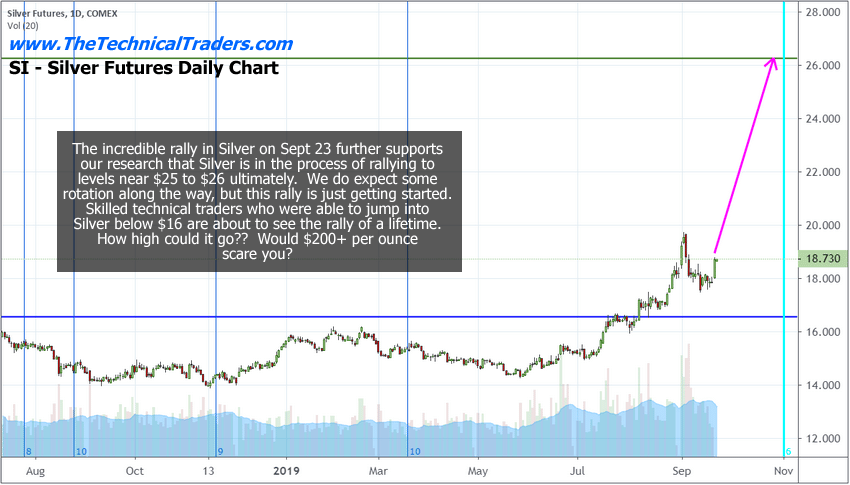

Later in 2019 our research team published the infamous “Silver Super-Hero” article. This article suggested that Silver was deeply undervalued at a $15 price level, especially at a time when we believed Gold would begin to skyrocket higher. We pushed this article out in September 2019 attempting to alert our followers to the incredible opportunity setting up in Silver.

One highlight of this article was that Eric Sprott, of www.SprottMoney.com (https://www.sprottmoney.com/eric-sprott ) picked up on our research and highlighted it in many of his podcasts over the past 12+ months. Eric is a renowned gold bug and recently mentioned in one of his podcasts that the Technical Traders is one of his “favorite” researchers of precious metals due to the accuracy of our predictions.

Be sure to opt-in to our free market trend analysis and signals now so you don’t miss our next special report!

Whenever someone like Eric Sprott picks up on our research and confirms our efforts, it is like winning an award from another seasoned and experienced trader/researcher. With Eric’s help, many other metals traders learned of our research and predictions – which further added to our accolades and credibility related to our precious metals research.

The recent breakout move in Silver also added to the ‘win’ column of our incredible research and predictions. When Gold moved above $1800 per ounce Silver suddenly sparked to life and rallied to levels near $24 in an instant. This huge upside move in silver sent a shock-wave out to metals traders – you better start paying attention to what is happening in precious metals (and particularly Silver) because this is just getting started.

CYCLES, SETUPS & THE EVENTUAL PEAK IN METALS

Part of our research delves into cycles and broader price patterns. When we discuss patterns and cycles that are setting up, we want you to consider how these powerful events can turn into incredible opportunities for skilled technical traders and how you should be preparing for these events.

Near the end of 2019, we published a research article about the 7-year cycle that was just starting in Gold and how traders needed to prepare for this pattern. Remember, by this time, we had been warning and suggesting that Gold and Silver would begin to skyrocket higher for well over 12+ months. It was just a matter of time before the fuel was ignited and prices started to climb.

The COVID-19 virus event was the event that suddenly questioned longer-term sustainability and global market capabilities. We were aware of this new virus and the potential for global problems in early January 2020, yet the metals markets ignored the real risk. It was not until February/March that traders started paying attention to the true risk factors related to this global event. Yet in December 2019 we were warning of the risks:

Be prepared for a surprising spike in volatility in early 2020 with a moderately strong potential for an early 2020 downside price rotation which prompts a new price trend and possibly an early test of support (near 280 on the SPY chart). 2020 is going to be a fantastic year for skilled traders – get ready for some incredible price action.

Currently both Gold and Silver are moving moderately higher after the explosive upside breakout move recently. Our researchers believe another wave of higher price levels will engage both Gold and Silver over the next 30+ days where Gold will target the $2300 level and Silver will target the $33~$35 level. It won’t end there either. Both Gold and Silver are moving in measured price waves it appears. As risks continue to become evident, we believe that Gold will eventually target the $3350+ level and Silver will eventually target the $75 to $85+ level. These targets are very likely to happen before the end of 2020.

Where is the peak in Gold and Silver? Based on our research we believe Gold will peak somewhere above $3750 per ounce and Silver will peak somewhere above $120 per ounce. It is not too late to get positioned for this incredible rally in precious metals if you have not already done so.

We actively trade Gold and Silver in our Technical Trader portfolio – find out more about our Swing Trade Signals and how to get our alerts with the best entry and exit points for a gold or silver trade. We also trade Gold and/or Silver in our Technical Investor portfolio, designed for buy-and-hold or retirement accounts. Become a member of the Technical Investor to receive my Investing Signals.

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for informational and educational purposes only. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.