Platinum And Palladium Set To Surge As Gold Breaks Higher

RESEARCH HIGHLIGHTS:

- Gold will target the $2,250 level before stalling and attempting another upside price rally targeting $2,500 or higher.

- Silver will target the $33 price level when the current upside move builds enough momentum, then target $38 or higher.

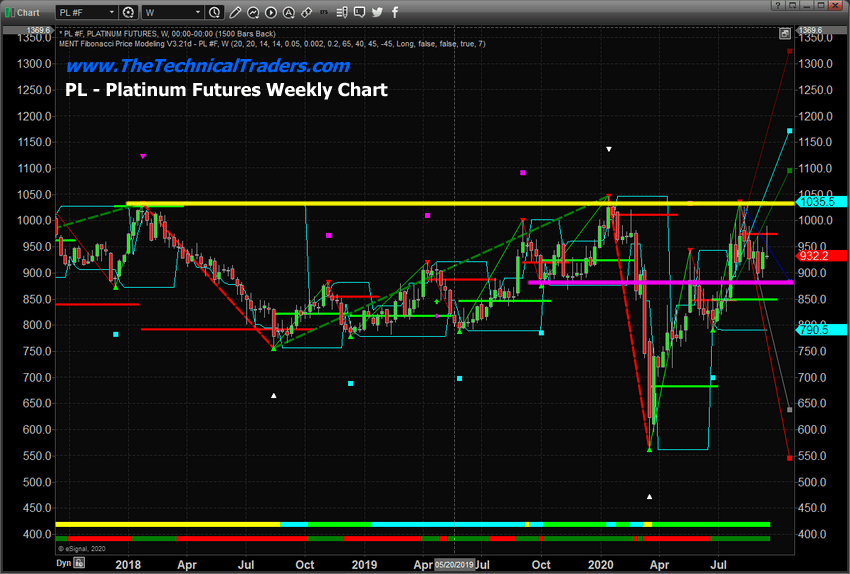

- Our next upside price target for platinum is $1,410, representing a +52.4% upside price target.

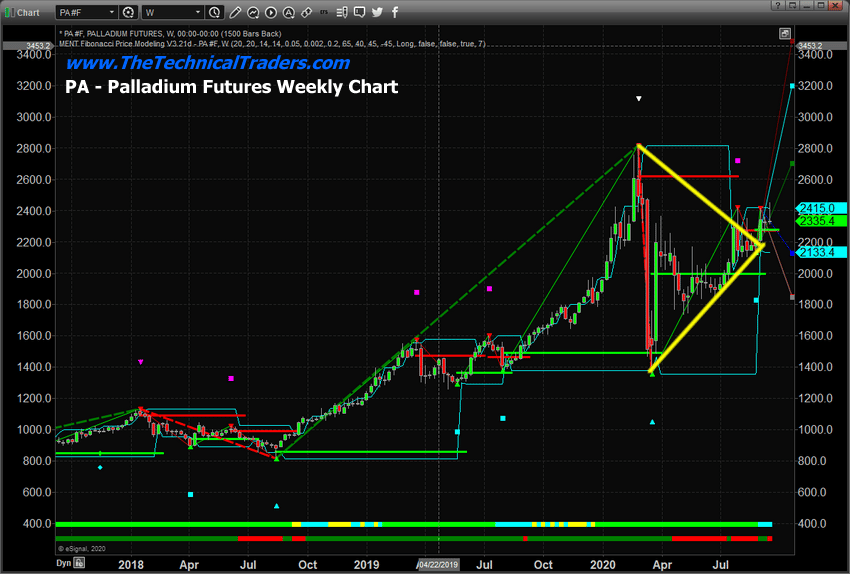

- Palladium bottom in March 2020 was near $1,357. We expect a new upside price target for Palladium near $3,663 once it has broken out past current resistance levels.

If you have been following my research for a while, you are already aware of past research posts suggesting Gold and Silver will advance in multiple upside price legs over the next 90+ days. Gold will target the $2,250 level before stalling and attempting another upside price rally targeting $2,500 or higher. Silver will target the $33 price level when the current upside move builds enough momentum, then target $38 or higher.

What you may not be aware of is the incredible opportunities setting up in Platinum and Palladium. Platinum has set up a very deep COVID-19 low near $550 and rallied back to briefly touch resistance near $1,035 as we can see in the Palladium Weekly chart below. Since that move, Platinum has stalled below $1,000 waiting for momentum to start another upside price leg. Using a simple 100% Fibonacci Measured move technique, we can easily identify the $485 price swing from the $1,035 highs to the $550 lows. All we need to do is find a support level near what we believe will be the Momentum Base level, then add that $485 to the Momentum Base level to find the next upside target in Platinum.

Let us assume the Momentum Base will happen near $925. This would result in the next upside price target for Platinum will be $1,410. Of course, Platinum would have to rally above the $1,035 level to confirm this upside breakout trend and for the $1,410 target level to become valid. That $1,410 target level represents a +52.4% upside price target.

Palladium presents an even broader price rotation. The peak just before the COVID-19 collapse was near $2,820. The bottom in March 2020 was near $1,357. This creates a range of $1,463. We can clearly see the Flag/Pennant formation on the Palladium Weekly chart (below) highlighted in YELLOW. We want you to pay close attention to what already appears to be a moderate upside price move after the apex of the Flag/Pennant formation.

If we add the $1,463 range to the Flag/Pennant Apex level, near $2,200, then we end up with a new upside price target for Palladium near $3,663. This represents a +66.5% upside price target for Palladium.

Something else we want to point out is the relationship of Platinum and Palladium to Gold and Silver. If Platinum and Palladium rally towards the targets we have suggested (+52% and/or +65%) from the Momentum Base levels, could Gold and Silver rally a similar amount? A 55% rally in Gold from current levels would target the $3,038 level. A 55% rally in Silver would target the $42 level. These new upside target levels are well beyond our “Measured Move” suggested targets – these higher target levels may be broader upside Fibonacci expansion levels? Still, they suggest a much bigger move in precious metals is pending.

Watch how Platinum, Palladium, Gold and Silver react over the next 6+ weeks. We believe there is a very strong possibility that a bigger upside price move is just waiting to breakout as the markets deal with incredible levels of uncertainty over the next 60 to 90+ days.

Isn’t it time you learned how I can help you better understand technical analysis as well as find and execute better trades? If you look back at past research, you will see that my incredible team and our proprietary technical analysis tools have shown you what to expect from the markets in the future. Do you want to learn how to profit from these expected moves? If so, sign up for my Active ETF Swing Trade Signals today!

If you have a buy-and-hold or retirement account and are looking for long-term technical signals for when to buy and sell equities, bonds, precious metals, or sit in cash then be sure to subscribe to my Passive Long-Term ETF Investing Signals to stay ahead of the market and protect your wealth!

Chris Vermeulen

Chief Market Strategist

Technical Traders Ltd.

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only – read our FULL DISCLAIMER here. Visit www.thetechnicaltraders.com to learn how to take advantage of our members-only research and trading signals.