Gold Starting Stage 4 Decline: A Repeat Of 2008?

Passive buy and hold Investors, in general, are starting to panic: XLU, dividends, bonds.

It has been an interesting year, with stocks down nearly 25% and the bond ETF TLT down over 40% since the 2020 highs. The passive buy-and-hold investor is becoming panicked, and we can see this in the stock market through the mass selling of utility stocks, dividend stocks, and bonds.

When the masses become fearful, they liquidate nearly all assets in their portfolios which is why we see the Big Blue chip stocks selling off along with precious metals. As investors liquidate around the world, they focus on where their money can still be preserved. With most currencies falling in value, there is a flood toward the U.S. dollar index as the safety play.

Gold Video Analysis

Here you can watch my detailed analysis along with both my short-term expectations and long-term supercycle outlook.

Global Currency Trends – Monthly Charts

As the US dollar index rises, we tend to see precious metals fall. As you can see from the charts below, almost all currencies are falling in value, helping to sharply increase the US dollar index. This is a headwind for precious metals until it finds resistance at the top.

Gold Monthly Chart Comparing 2008 Bear Market and 2022

Let’s take a look at the monthly chart of gold. I believe gold entered a new bullish supercycle in 2019, which is very similar to the Supercycle that started in 2001.

I believe the recent bear market in equities can be compared to the 2008 bear market. Technical analysis shows that gold could correct another 16% lower and match the same 34% correction we saw in 2008.

The price of gold is threatening the 1674 support level. If the price is broken on the monthly chart, it will signal a large sell-off to roughly the $1300 to $1400 level for gold.

While the circumstances and economy are very different from 2008, the price charts paint a very similar picture. I believe there’s still a long way to go for gold to find support, and it may take another 8 to 12 months to unfold. I also believe that the precious metal sector will be one of the first assets to bottom and then start a multiyear rally, similar to the 2009 to 2011 rally.

While the 34% correction starting to take place may look very large, it is in line with what we’ve seen in the past. Though price charts don’t repeat, they do tend to rhyme, so I’m expecting a similar type of scenario. I’m sure it will unfold a little differently and take a different length of time to mature.

Price Stage Analysis – Gold Starting Stage 4 Decline

The price of gold is on the verge of breaking down from a stage three topping phase. Once the breakdown is confirmed, it will be in a stage four decline, also known as a bear market. It’s important to note that we can have bear markets within supercycles.

Just like when gold started at the new super cycle in 2001, which lasted until 2013, there can be large corrections and smaller bear markets within the bullish Supercycle.

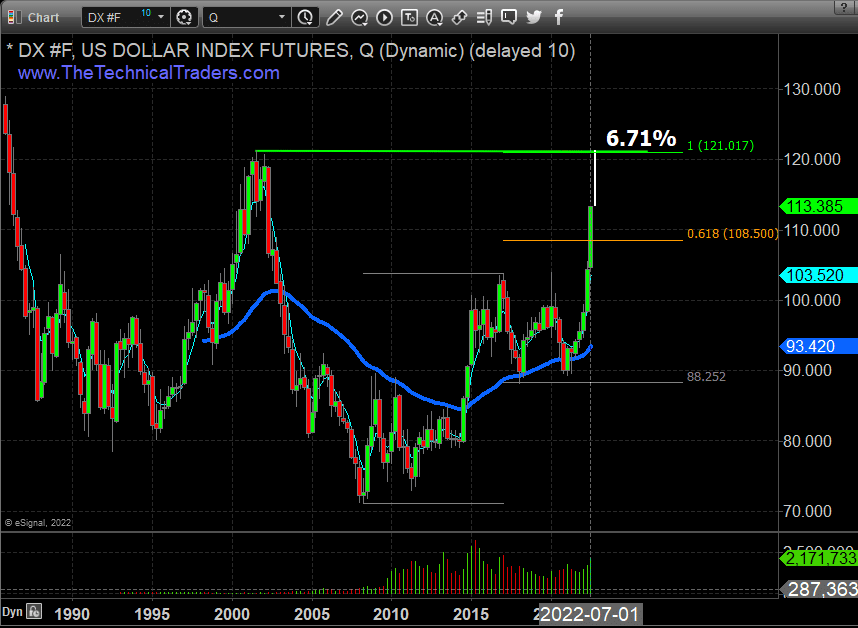

Dollar Index Rockets Higher and Has More Room to Run

The US dollar Index has been one of the hottest assets to own this year. I believe the rising value of the dollar index has been putting downward pressure on the metals sector all year. As you can see from the quarterly chart below, The US dollar index still has more room to run to match the high set in 2001.

Keep in mind; I still think there are another three to five more bars before the dollar forms a top and reverses direction. Each bar on the chart is three months because this is the quarterly chart. Thus we potentially still have a year of sideways or lower gold pricing ahead of us.

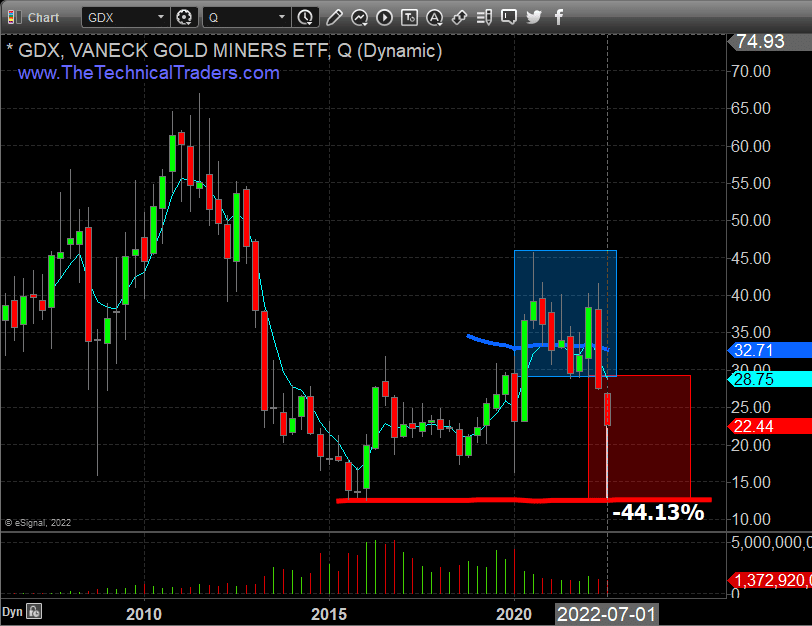

Gold Miners Will Be Under Pressure If Gold Falls

If gold breaks down and the bear market in equities continues, we will see gold mining stocks continue to sell off. The large-cap gold stocks ETF GDX shows a potential 44% decline in price over the next year. While this may sound bad, it will become an extraordinary opportunity in due time.

I believe silver and silver mining stocks will follow gold stocks as well.

In short, I’m very excited about what is unfolding in the precious metals sector. And while it may still be early, I’m keeping my eye on the sector for the start of a new super cycle rally in 2023, which could be life-changing for investors.

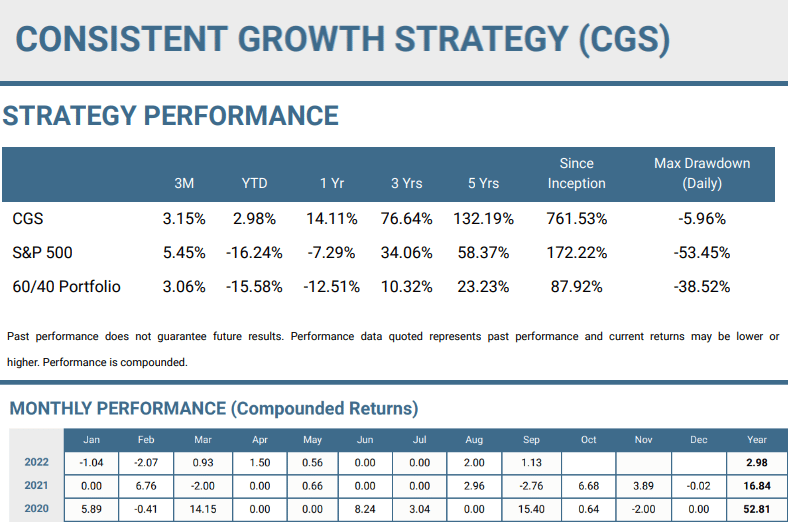

TheTechnicalTraders created the Consistent Growth Strategy that can be manually followed or auto-traded in a self-directed retirement account for people who do not want to spend their valuable time in front of a computer. Save time to do what you love and lower stress to enjoy every moment of today.

Consider what tactical investing can do when you only own assets rising in value. I challenge the status quo and do things differently. It may be slower and not as exciting as the precious metals sector, but it preserves capital, makes money when assets are trending higher, and sidesteps corrections and bear markets.

Concluding Thoughts:

In short, the world and even more so, the financial markets and assets have a habit of applying the maximum pain to investors before reversing direction. In fact, there is a “Max Pain” calculation in the options market to know where the maximum pain/losses will be for the stock market, and it’s crazy scary how the market will reach this price level during options expiry days on many cases.

The bottom line here is that the worst thing that could happen to most investors and capital in the markets now would be a multi-year bear market and drawdown in the markets. This would cripple anyone nearing retirement and everyone already retired. Having your nest egg cut in half will send shockwaves worldwide to the largest group of investors, being baby boomers and retirees. In addition, it will likely create a flood of people looking for jobs to subsidize their retirement, crushing dreams and plans along the way. And unfortunately, I think that’s just the beginning of potentially a big unraveling of the economy, and gold will do well eventually, but it is a little early yet, in my opinion.

The average investor is positioned for higher prices with the buy-and-hold strategy and feels stuck with their substantial drawdown. Things could be much worse for stocks, like 40% lower, if the charts play out like they are indicating. The big question is, will you be comfortable with your situation if that happens?

Im a huge fan of cutting losses simply because I do not believe in holding assets falling in value. It goes against the reason we invest. It can be very difficult biting the bullet and taking a loss, but I learned a long time ago its better to exit losing positions that could keep falling and move into new ones that are rising.

Sign up for my free trading newsletter, so you don’t miss the next opportunity!

Every week I remind investors I work with that now is not the time to expect to make huge money. Instead, it is about capital preservation. Focus on not losing; growth will naturally come in due time.

My team and I created a proprietary ETF portfolio for investors who want to avoid substantial market swings and instead slowly and reliably grow their accounts with less stress and more enjoyment.

If you have any questions, my team and I are here to help you safely navigate both bull markets and bear markets with our Consistent Growth Strategy.

Chris Vermeulen

Chief Investment Officer

www.TheTechnicalTraders.com

Disclaimer: This and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.