Are Metals & Miners Starting A New Longer-Term Bullish Trend?

Almost in stealth mode, precious metals have begun to bottom and start a new upside price trend while the US stock market focused on the FOMC meeting a few weeks back and current economic data. Gold, Silver, and many of the Miner ETFs recently started a moderately strong push higher – almost completely behind the scenes of the hype in the markets regarding IPOs and Bitcoin’s new recent highs.

All the Gold traders know that when Gold starts a new leg higher, it could mean inflation fears are being amplified in the global markets and/or fear is starting to creep back into the markets. After the recent rally in the US major indexes and as we plow through Q1:2021 earnings, it makes sense that some fear and inflation concerns are starting to take precedence over other concerns. Will the markets just continue to push higher and higher? Or are the market nearing some type of intermediate-term peak after rallying from November 2020? Only time will tell…

The recent move in Gold and Silver prices suggests traders and investors are starting to act more aggressively to hedge against downside market risks. My research team and I believe these upside trends may confirm an upside breakout trend in Precious Metals and Miners within 2 to 4+ weeks. You may find some of our earlier research articles related to metals, including our April 15th price targets for Gold, Silver, and Platinum, and our research from March 26th where we explore an impending miners breakout rally.

Custom Metals Index Shows Breakout Starting – 433 Level Is Confirmation

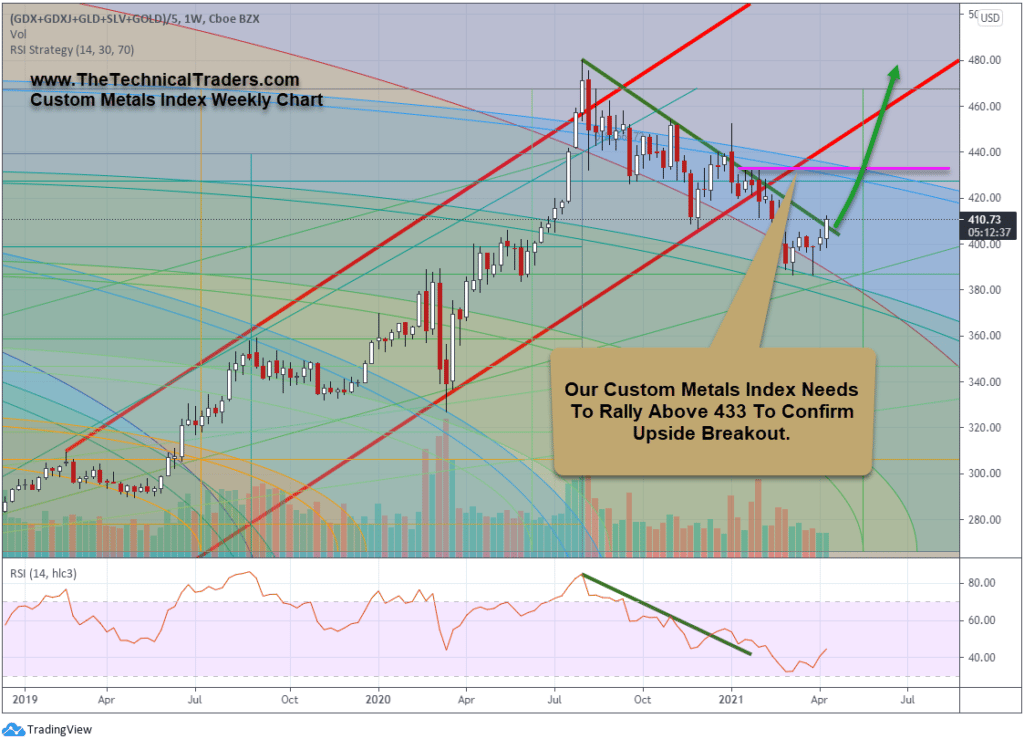

Let’s start by reviewing our Custom Metals Index Weekly chart, below. The continued downward price slide from the early August 2020 peak has extended more than 8 months. Recent lows also align with the peak levels just before the COVID-19 market collapse (February 2020). Our research suggests this level will act as a strong support level and may prompt a new bullish price leg in Precious Metals and Miners if we continue to see confirmation of this uptrend in the future. Confirmation for our research team would be a strong close above 433 on our Custom Metals Index chart – closing above the 2021 Yearly highs.

We urge readers to pay close attention to the RED price channels on this Custom Metals Index chart. These historic price channels may become very relevant in the near future. A strong upside price breakout in precious metals may prompt a rally that extends aggressively higher – attempting to reenter this current price channel. If this were to happen, Gold would have to rally above $2165 by July 2021. This would certainly put Precious Metals into a new longer-term bullish price trend.

Junior Gold Miners Need To Continue Higher To Confirm Breakout/Rally Trend

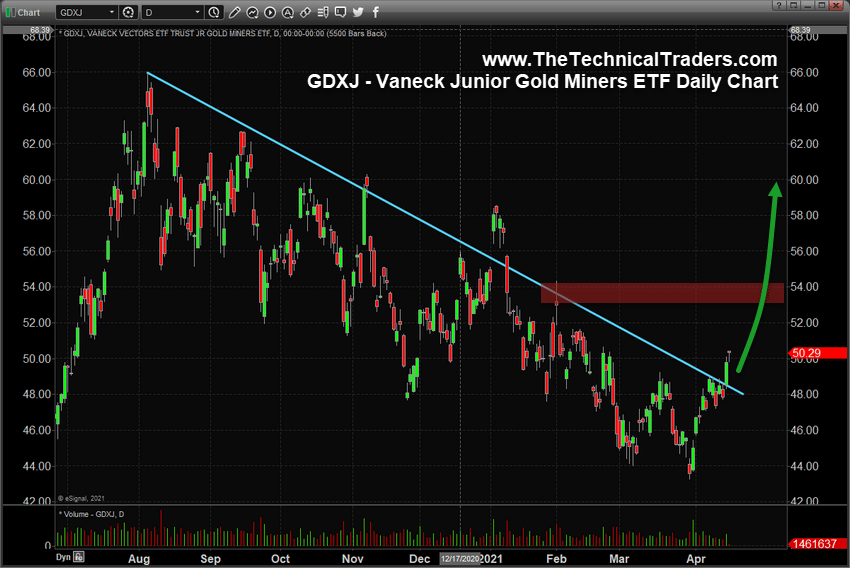

The following GDXJ chart highlights the base/bottom that has setup in Junior Gold Miners and also highlights the past failed breakout attempts following the CYAN downward sloping trend line. If this current breakout attempt is valid, we will see a continued upward price trend that confirms the breach of this downward sloping trend line over the next 5 to 15+ days. We expect this move to happen fairly quickly given how traders have shifted focus recently into hedging against downside price concerns.

Miners and Junior Miners tend to lead Precious Metals prices in volatile price trends. Junior Miners act as a leader for the Precious Metals sector as investors expect stronger Precious Metals prices to translate into stronger earnings for Junior Miners. Therefore, when traders perceive Precious Metals prices are bottoming or starting a new uptrend, Junior Miners will likely lead the rally in metals because Junior Miners will directly benefit (bottom-line profits) if metals prices move higher. Ideally, we would like to see a strong close above $53~54 to confirm this upside breakout trend. This past standout high/resistance level seems key for any continuation of any bullish breakout trends.

14+ Months Into A New Depreciation Cycle – What Next?

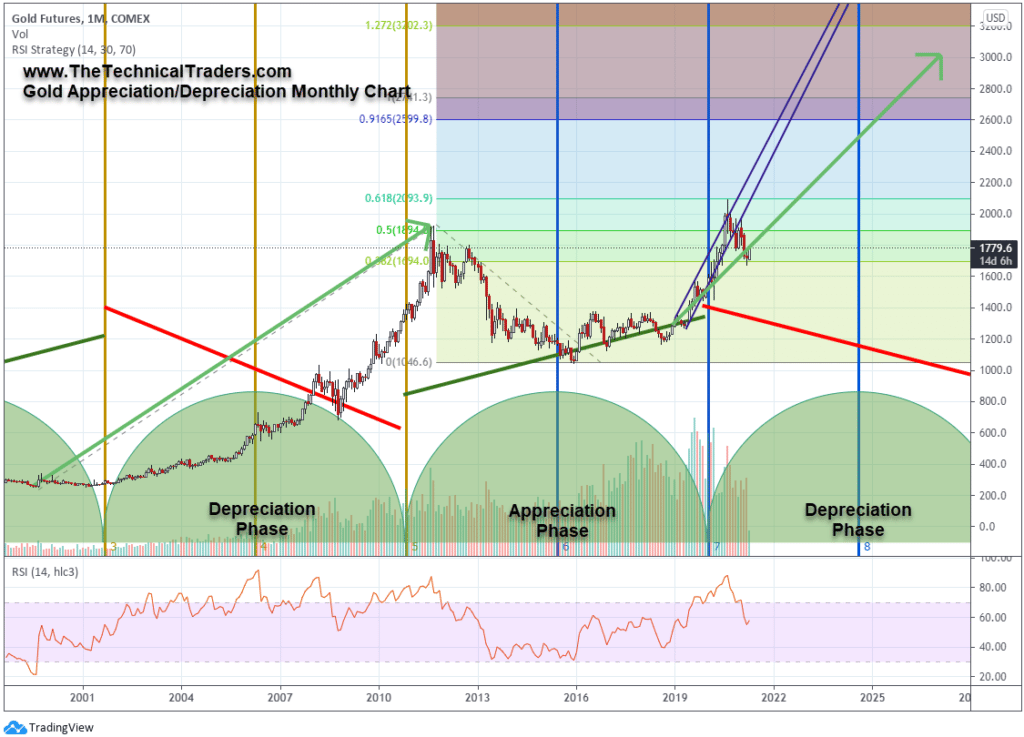

As the US stock market continues to push into new all-time highs almost every week and inflation concerns are starting to rise, while global central banks are still acting to support the global market recovery, it seems oddly similar to the 2001~2009 Depreciation Phase which prompted a rally in Gold from $262 to over $1900 (over 700%). We wrote about this change in global cycle trends in our December 18, 2020 research entitled Metals & Miners Shifting Gears.

The Monthly Gold chart below highlights our research into the broader Appreciation/Depreciation phases of the global markets. Notice how Gold rallied during the last Depreciation phase (from 2001 to 2011) – even starting to rally higher just before the Depreciation phase started and continuing for nearly a year after it ended. This happens because global traders/investors start shifting their focus into hedging against risk before the Depreciation Phase actually kicks into gear – just like what is happening right now; on the right edge of this chart.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The price Appreciation Phase ended near the end of 2019 (just before the COVID-19 market collapse). Yet, the US stock market has continued to rally higher and higher over the past 24 months, well into the start of the Depreciation Phase cycle. This is what we call an “Excess Phase Rally” – where prices continue to trend because of momentum and herd mentality from traders. As we are seeing right now, certain sectors, technology, and the US major indexes are still pushing to new all-time highs. This is partially because traders continue to pile into the momentum trades/trends – chasing those profits.

Gold has started to react to the Depreciation cycle in a way that suggests the global markets may eventually transition into a bit of a sideways price trend or come under some type of renewed valuation concerns over the next 3 to 5+ years. This type of general market concern, as well as the desire to hedge against risk, may prompt a continued rally in Gold to levels above $3000 – as shown on this chart.

Staying ahead of these types of sector trends is going to be key to developing continued success in these markets. As some sectors fail, others will begin to trend higher. Learn how BAN strategy can help you spot the best trade setups. You can learn how to find and trade the hottest sectors right now in my FREE course. For those who believe in the power of relative strength, cycles and momentum then the BAN Trader Pro newsletter service does all the work for you in determining what to buy, when to buy it, and how to take profits while minimizing downside risk.

In Part II of this article, we’ll highlight continued opportunities in various metals/mining stocks/ETF as well as continue to highlight our believe that Precious Metals and Miners are starting a broad market transition into the Depreciation Phase cycle. Are you ready for it? Are you ready for increased global stock market volatility and trends while Precious Metals may start a new 140% to 250% potential price rally?

Have a great weekend!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com