Why Gold And Oil Falling In Value Are A Bad Sign For 2023

In the past two weeks, stocks have struggled to break through resistance and extend the holiday rally. I wrote about it in the post Stock Indexes Rejected At Resistance Signal Another Correction. But what is a more bearish sign is seeing commodity prices starting to fall. There are a couple of reasons this is a warning signal for traders and investors, and I will show you exactly what they are.

Reason #1: Equity and Economic Cycles Signal Market Top and Recession

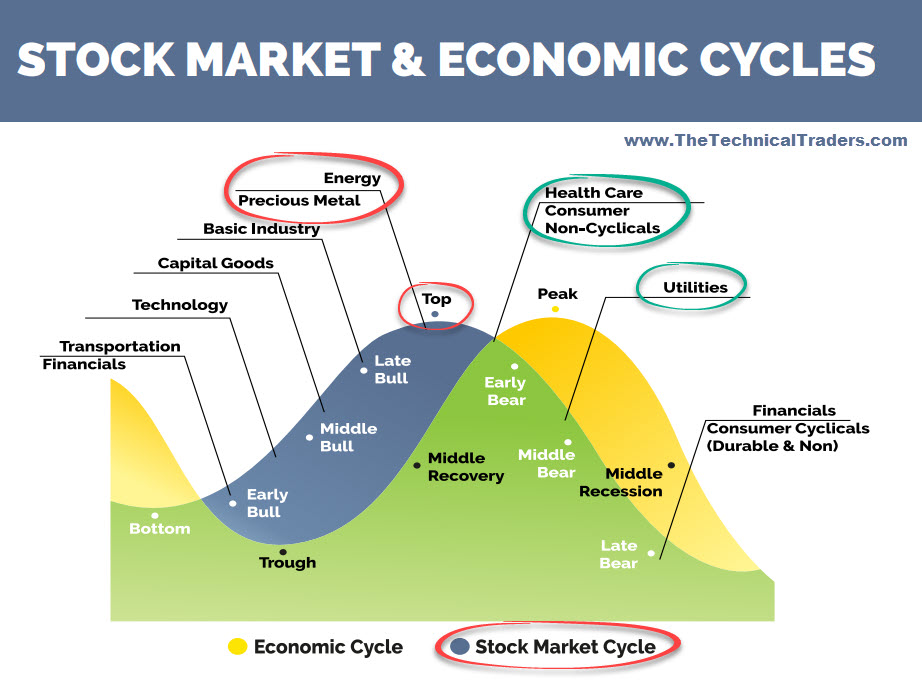

In the diagram below, you will see two cycles. The blue/green cycle is the stock market. Stocks typically lead the economy as savvy investors can see when businesses, in general, are expanding or contracting, thus telling them when they should buy more shares or start selling.

As you can see, energy and precious metals are the last assets to do well before the stock market tops. Both topped many months ago. Having said that, precious metals have had a decent rally in the past couple of months, but that rally should not to be trusted.

In this post, I will talk about energy and precious metals. In a future post, I will cover the next two sectors, which have been doing exceptionally well this year and are holding up the best – Health Care and Utilities.

Assets Peak In A Predictable Order

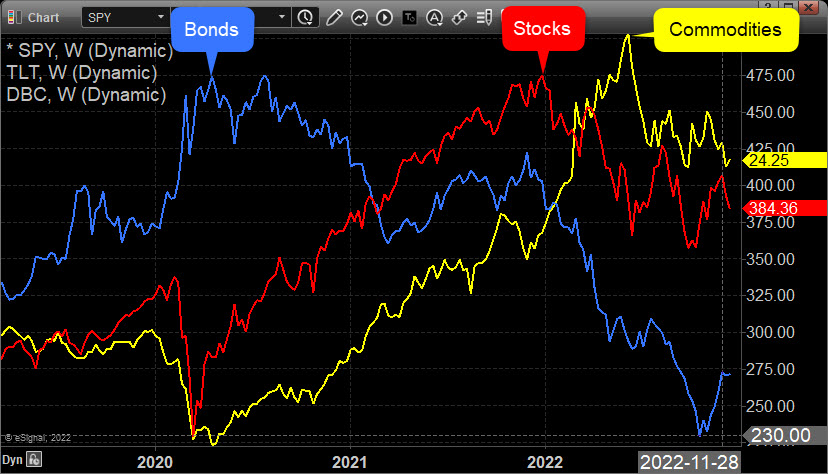

While falling commodity prices signal potential easing in inflation, it’s not necessarily a good sign. That’s because assets peak in a predictable order: bonds, stocks, and then commodities.

Without turning this post into a rant, I should mention that what I share here is investing 101. It’s been my mission with my trading and investing newsletters since 2001 to help as many individual investors as possible avoid market corrections and bear markets and also profit from volatile times when most others are losing money.

So, when I speak to an investor on the phone who is 40+, suffering from the old buy-and-hope investing strategy with big drawdowns, it makes me worry. If you have money with an advisor who has just plopped your money into stocks and bonds using the buy-and-hold strategy, please know that 2022 – 2025 could be VERY difficult times. I believe that what is about to happen next will delay or destroy your retirement if you don’t have a plan to preserve capital.

While almost everyone suffers from the passive, no-brainer buy-and-hold strategy, which a 10-year-old could do for you, it is not the way you should have your money managed. You are being tortured but don’t realize it because you think it’s the norm, and that’s because you likely have Investment Stockholm Syndrome.

Crude Oil Prices Continue To Plunge

Crude Oil has fallen to the lowest level in over a year, suffering a weekly loss of -10%. Oil has given back all of its gains for the year and is taking a toll on energy sector stocks.

As investors see businesses slowing and a recession in the near future, the price of oil begins to fall. A recession often means less traveling, slower sales, a decline in shipping, and less product demand. Oil falling means savvy investors see tough times ahead.

Gold Miners Weekly Chart

Gold stocks have been out of favor for a long time despite the recent rally, which has sparked a lot of interest recently. Subscribers and I owned GDX with our Best Asset Now Strategy and sold it for a quick 7% gain this week. We sold just before the price topped, as the technical analysis charts and indicators told us to get out.

The most important thing to understand about investing is that the only way we make money is when the price of an asset moves in our favor. No news or fundamental data will protect you from falling prices. Moving to cash and revesting capital into assets that are rising in value is the best way to secure consistent growth. I talk about this in more detail in the post Only Price Pays.

Reason #2: Commodity Index ETF – Weekly Chart

Commodities tend to rally in the late stages of a stock bull market. This is because stock evaluations become high and are no longer a fair value. Thus, investors turn to alternative assets, and physical commodities happen to be the asset of choice.

As you can see in the chart below, commodities topped in June 2022, five months after the stock market topped in January 2022. The DBC commodity index is clearly in a Stage 3 market phase and on the verge of breaking down into a Stage 4 decline (bear market).

Concluding Thoughts:

In short, investors no longer want to own stocks, and they don’t want commodities. Going forward, investors will start liquidating positions, possibly for many months, in all asset classes until a new level of equilibrium has been found. This is a perilous time to own stocks and commodities if your capital is being invested with the buy-and-hope strategy. Should this be the case, I feel for you because if you are 50+, your retirement is about to be threatened at the worst possible time in your life.

2022 has been an excellent year for those investing with the Consistent Growth Strategy alongside me as we actively use my ETF asset hierarchy allocation. This super-conservative strategy, with a max drawdown of 5.96% since 2007, packs a powerful punch with an average compounded return of 15.62% yearly. This year we keep hitting new high-water marks consistently: May, Aug, Sept, and again this week.

If you are concerned about your investment account and your retirement, then you should know there is a DIFFERENT way to invest. It goes against everything you likely have been taught/brainwashed to think when it comes to how your money should be invested and protected. My ETF strategy is simple to follow with 4-12 trades per year, and if that’s still too much for you, then you can have it autotraded in your brokerage account at no additional cost, as it’s part of my investment newsletter service.

As always, I believe in baby steps, so if you have your money invested with an advisor, you can simply have some of your capital autotraded outside of your advisor account. What you will save in advisor fees will cover the cost of the newsletter, making it a NO-COST investment upgrade. Imagine – you can actually test the waters before wanting to have more of your money actively protected for you.

Chris Vermeulen

www.TheTechnicalTraders.com