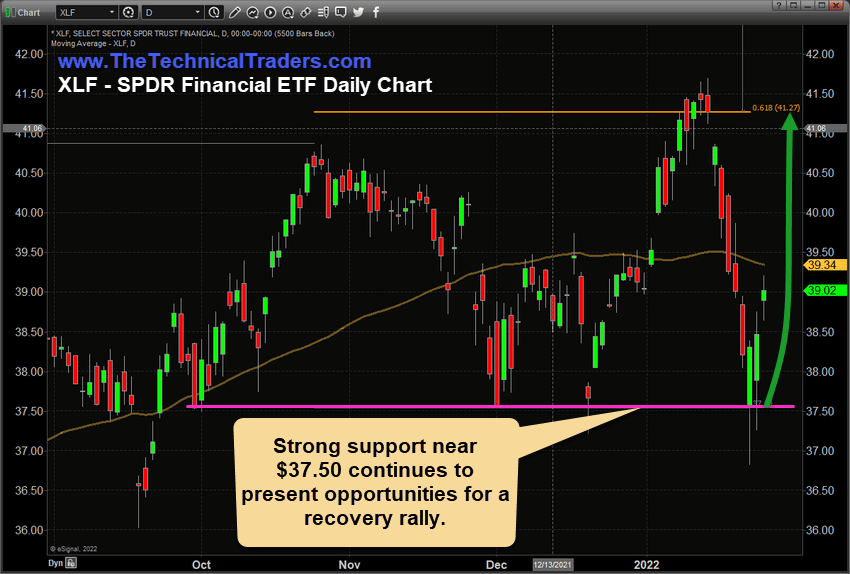

Financial Sector ETF XLF $37.50 Continues To Present Opportunities

Recent volatility in the US markets ahead of the Fed comments/actions have prompted a relatively big pullback in almost every sector. Many traders are concerned the Fed may take immediate action to raise rates. Yet, a small portion of traders believes the Fed may be trapped in a position to act more conservatively in addressing inflation going forward. I think the Fed will continue to talk firmly about potentially raising rates. The Fed is more interested in decreasing the assets on their balance sheet before they risk doing anything to disrupt support for the global markets.

Suppose my analysis of the Fed predicament is correct. In that case, the recent collapse of the US markets represents a fear-based emotional selloff of many sectors that may still represent a strong opportunity for a recovery rally in 2022. One of those sectors is the Financial sector – particularly XLF.

I wrote about this on January 7, 2022, in this article: FINANCIAL SECTOR STARTS TO RALLY TOWARDS THE $43.60 UPSIDE TARGET

I also wrote how the US Fed might be playing with fire regarding their stern positioning and statements recently in this article on January 14, 2022: US FEDERAL RESERVE – PLAYING WITH FIRE PART 2

Critical Components Of Recent Inflationary Trends

If you attempt to follow my logic as I read into the Fed’s intentions. There are three critical components to navigating the rise of inflationary trends recently.

- The COVID-19 virus event created several disparities in the global markets. First, the disruption to the labor and supply-side markets began an almost immediate inflationary aspect for the global economy. Secondly, the US’s stimulus and easy money policies have stimulated demand for products, technology, houses, autos, and other real assets. These two factors combined have increased inflationary pressures on the global markets.

- Rising consumer demand for real and virtual assets such as Cryptos, NFTs, and others has pushed the speculative investing cycle into a hyper-active rally phase. This was clearly witnessed in early 2021, with the Reddit/Meme rallies became the hottest trades, then quickly dissipated after July 2021. This speculative rally has pushed the post-COVID rally well beyond reasonable expectations over the past 16+ months.

- Excessive debt levels push a deflationary process to the forefront. Consumers are now starting to pull away from the excesses of the past 16+ months. The Fed’s tough talk and recent deeper declines in various sectors over the past 12+ months show that inflationary trends are subsiding. Despite the supply-side issues being resolved, consumers continue to pull away from hyper-speculative activities. The markets will naturally revalue to support more realistic price levels, deflating excessive P/E ratios and recent extreme price peaks in assets.

Possible Next Steps for the US Fed

My interpretation of the global markets is that excess speculative trending and rising commodity prices, combined with excess debt levels and consumers who have suddenly become very aware of global market risks, are already acting as a deflationary process. Because of these underlying factors, which I believe are currently in play throughout the globe, the US Federal Reserve may be forced to wait things out a bit. The Fed may have to navigate these natural deflationary processes while attempting to provide monetary support for what I believe will be a downside/deflationary trend over the next 3+ years.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

The US Federal Reserve may not have to take any aggressive action right now. Instead, it may decide to watch how the global markets contract as consumers pull away from inflated price levels and higher risks and attempt to navigate these natural deflationary price trends. If the Fed were to act aggressively right now and raise rates, they could push the global markets into a steeper collapse. This process would likely burst numerous asset bubbles very quickly and push many foreign nations into some type of debt default.

This presents a new problem for the US Fed – going from inflationary concerns to global economic collapse concerns very quickly. So when I suggested the Fed is playing with fire – maybe I should have said “playing with the nuclear economic football”?

Financial Sector Resilience

Still, I believe the US Financial sector is showing tremendous resilience near $37.50. I think it has a powerful opportunity to rally back above $42 to $44 if the Fed takes a more measured approach to let the global markets deflate a bit before taking any aggressive actions.

The US Financial sector will likely continue to benefit from price volatility and consumer demand as these deflationary trends prompt consumers to engage in more normal economic activities. The Financial sector also has continued to stay under moderate pricing pressure since the 2008 highs. XLF is only 25.46% higher than the 2008 highs, whereas the NASDAQ is more than 575% above the 2008 market highs.

The Financial Sector may be one of the strongest market sectors over the next few years. Deflationary trends push consumers and global markets away from excess debt levels and towards more traditional economic activities/trends.

Want To Learn More About Financial Sector ETFs?

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

I invite you to learn more about how my three Technical Trading Strategies can help you protect and grow your wealth in any type of market condition by clicking the following link: www.TheTechnicalTraders.com

Chris Vermeulen

Chief Market Strategist

Founder of TheTechnicalTraders.com