G20 News Drive Big Moves In The Markets

This past weekend was full of exciting news and information. Combine this with the strong US economic activity, the potential for some type of reprieve in the US/China trade issues and the historic meeting in North Korea between President Trump and Kim Jun Un, and the markets were set up for a big move at the open of trading in Tokyo.

The other big news originated from the Bank of International Settlements (BIS). This Swiss-based central banking committee for “central banks” released an annual report on the progress of global central banks and the global economy last weekend. They urged central banks not to chase easy money policies any longer and to focus on core policy changes, practical economic practices, and real leadership to help drive future growth. They urged nations that easy money policies may help to show some types of immediate economic improvements – but that the risks of continuing such policies and lack of true economic reforms do nothing but pack risk into the back end of these efforts.

Recently we have been talking about the unit and very different opportunities in other assets like real estate and precious metals. Each metal is unique for market timing has its own personality. Our gold predictions are an eye-opener, why silver is awesome, and our most recent analysis on platinum is timely.

Our opinion is the US stock market is poised for a big move based on this news and continued economic activity. If the US is able to settle trade issues in a manner that supports a strong future economic output and restore some balance to foreign trade, as well as continue to produce strong economic activity and output levels throughout the last 6+ months of this year, we could see a very strong price rally setting up into the end of 2019. This could prompt a big move to the upside IF all things line up properly as we have suggested.

If things take an ugly turn over the next 2 to 4+ months, then we believe current support levels will likely act as a floor in the US stock market as the global economies struggle to find their “launch button” to jump-start their economies. As the news stated, the economic factors of the globe are in a transitional state at the moment. The US is the leading global economic engine and many other foreign economies must transition away from easy money policies and make hard choices to drive future growth. Volatility will be KING over the next few months/years and the US Dollar will likely continue to strengthen as this transition plays out.

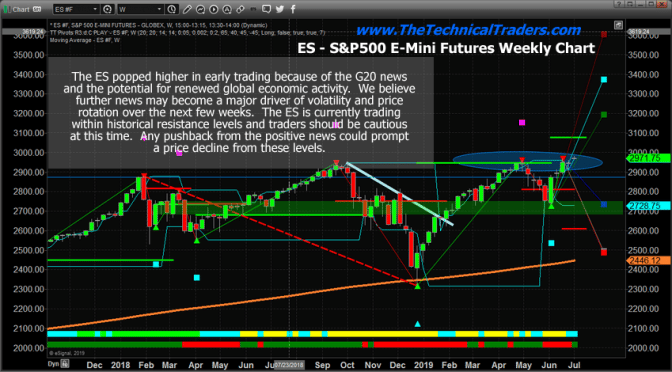

This ES chart highlights the resistance levels just below $3000 that we are watching as a critical ceiling in the ES. As we have suggested, the news last weekend is driving upward price activity into this resistance area. Traders should be cautiously bullish right now and should be keenly aware of risks that could prompt a breakdown in price. Current support is near $2700.

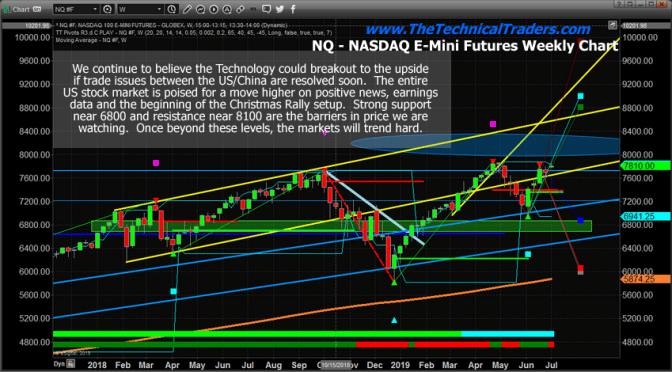

Technology could be a huge winner if the US/China restore proper trade relations and establish a stronger future economic tie going forward. In fact, the relief of a US/China trade deal could easily spill over into the DOW and Mid-Cap stocks as general trade and infrastructure deals will likely ramp-up quickly. Our researchers believe the technology sector is the “canary in the coal mine” for the future of price related to trade and global economic activities. We believe the technology sector is unfairly weighted in either direction based on the uncertainty of the global economy right now.

Resistance near $8000 is key. Support near $6800 is also very important. This leaves a $1400 range for price rotation within critical levels. Our Fibonacci price modeling system is suggesting even bigger price volatility ranges totaling over $3000 between target levels. This suggests that volatility is still increasing and that traders should understand the risks of this volatility. Currently, we are cautiously bullish as the NQ attempt to breach into new all-time high territory again.

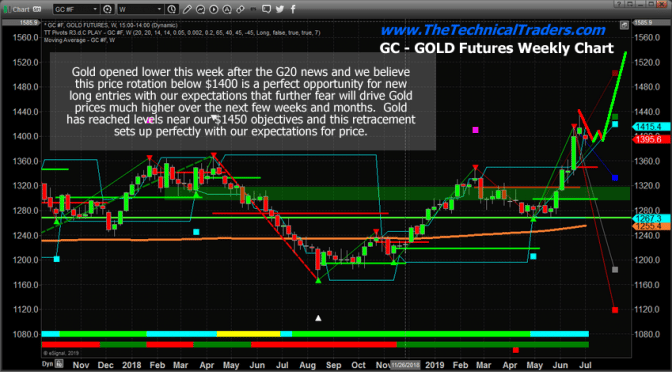

Gold paused in the rally early in trading today, breaking back below $1400. We have confidence in out research that Gold will continue to react to the Fear & Greed that is rampant throughout the globe at the moment and begin another upside move over the next 10+ days. This move below $1400 is an excellent opportunity for traders to identify new Long entry positions for the future upside move.

Remember, the transition that is required over the next 2+ years will require many difficult decisions and a means of transitioning away from easy money policies towards more practical economic policies. This will not be an easy task for many. The fear/greed cycle will show up in precious metals early and quickly. The next upside move should be towards levels above $1550 to $1650.

As we’ve been saying for many months, this is the time to be a skilled trader. These volatility spikes, huge moves in the markets and incredible trade setups are fantastic opportunities for traders. Join us in picking apart these moves, setups, and opportunities.

CONCLUDING THOUGHTS:

I can tell you that huge moves are about to start unfolding not only in real estate, but metals, stocks, and currencies. Some of these super cycles are going to last years. Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you to visit my Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible, get a FREE BAR OF GOLD and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next set of crisis’.

Chris Vermeulen

www.TheTechnicalTraders.com