Warning: Credit Delinquencies To Skyrocket In Q4

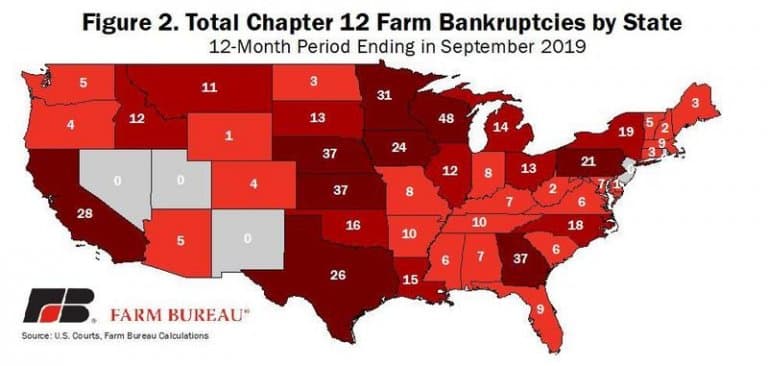

Farm delinquencies skyrocket +24% year over year as global trade issues and the ability to service credit continues to be a problem. This is a tell-tale sign that the US Fed decreased the Prime Rate recently as a result of broader credit issues related to higher interest rates for corporate and other borrowers. The last thing the Fed wants is another collapse on the lending markets similar to 2008-09.

(source: zerohedge.com)

Low growth continues to plague the global economy as this extended run in the US stock market continues to mature. There are many questions all traders are asking – will it continue higher or have we reached a new peak in price activity? Many economists believe we are ending an expansion period related to the revaluation of the global markets after the 2008-09 credit market collapse. The typical price cycle of approximately 6~7 years has extended beyond traditional bounds and many analysts are wondering how it may end?

If an economic cycle has truly come to an end, we should expect to see some change in economic activity levels, consumer confidence and mortgage/housing activities. The end of an economic cycle is usually aligned with some moderate level of economic contraction and a slowing of economic activity. The one thing that may continue throughout this end of the mature economic cycle is the “capital shift” where capital rushes away from risk and into the US stock market as long as the reversion event stays at bay. (source: zerohedge.com)

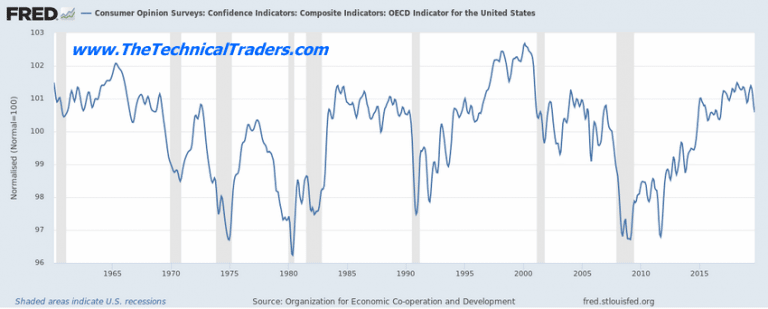

Consumer Confidence levels have fallen recently to new lows. This is a very clear sign that consumers expect the economy to contract a bit based on continued trade-related issues and the overall maturity of the economic cycle.

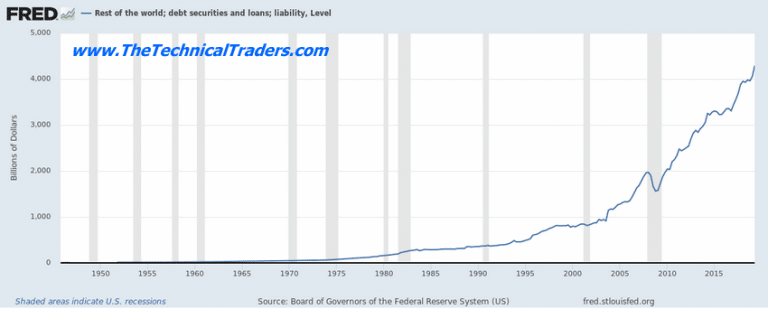

Most of the “rest of the world” has continued to binge on credit/debt since the 2008-09 credit crisis. This is a very clear sign that the US Fed and global central banks have pumped trillions of dollars out into the consumer, corporate and global markets over the past 8+ years. The question for all of us is when and if this debt becomes a liability – when does this credit become un-serviceable?

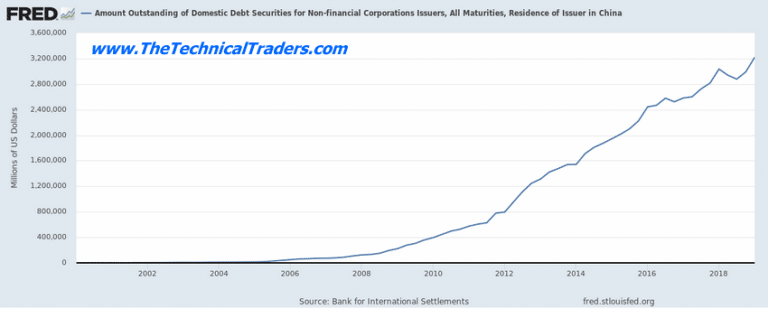

China and Asia were some of the biggest consumers of US credit/debt since 2008-09. This graph highlights the incredible 10,667% increase in debt in China since the 2008-09 levels – from approx 300 million to 3.2 billion in 8-9 short years. It appears the global economic rally was really the “binge on credit” rally.

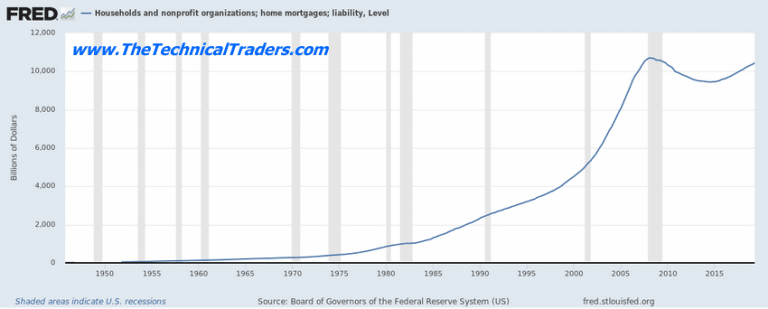

US Mortgage debt has climbed to near all-time highs recently as well. This is a sign that the US housing market has rallied to levels that are very close to the peak levels in 2007-08 – just before the crash. It may also be a sign that cracks may soon start to appear in the housing markets across the US as delinquencies and foreclosures may continue to skyrocket. People need to be able to service this debt/liability effectively in order to maintain their assets.

We believe the path of least resistance in the US stock market is higher – at least until price breaks below the current price trend channel. The continued capital shift where foreign investors continue to pour capital into the US stock market will likely continue until some event shakes the confidence of these foreign investors.

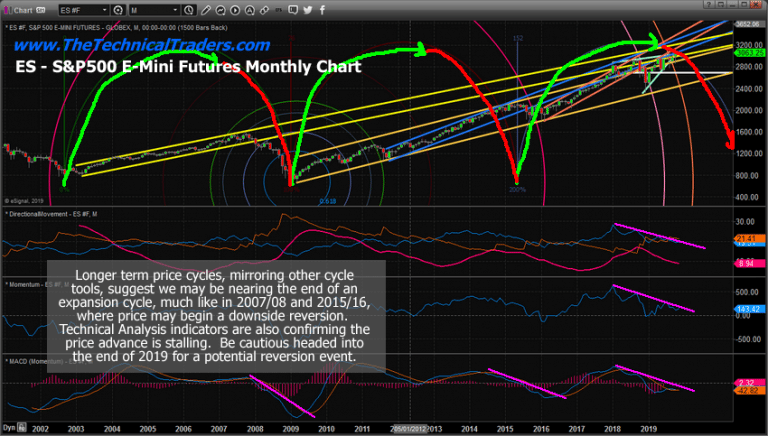

You can see from our Monthly chart of the ES, below, we have highlighted the longer-term economic maturity trend which typically lasts about 6~7 years. The rotation in 2015-16 was very mild as the US Fed continued a type of quantitative easing process by buying bonds and keeping interest rates historically low. Because the US stock market actually failed to experience any real price rotation near this 2015~2016 cycle date – we believe the current cycle highs are extremely extended and related to the credit binge that has taken place over the past 8+ years.

Our cycle research suggests we may have already past a cycle peak event and may be operating on borrowed time right now. This suggests that any further upside price activity in the US stock market may be a function of the overall strength of the US stock market compared to the weakening economic activity throughout the world. In other words, the capital shift process is still feeding large amounts of capital into the US stock market as foreign investors flee risk and uncertainty. If and when this ends, the US stock market will likely begin a price reversion process that may result in a very deep price correction.

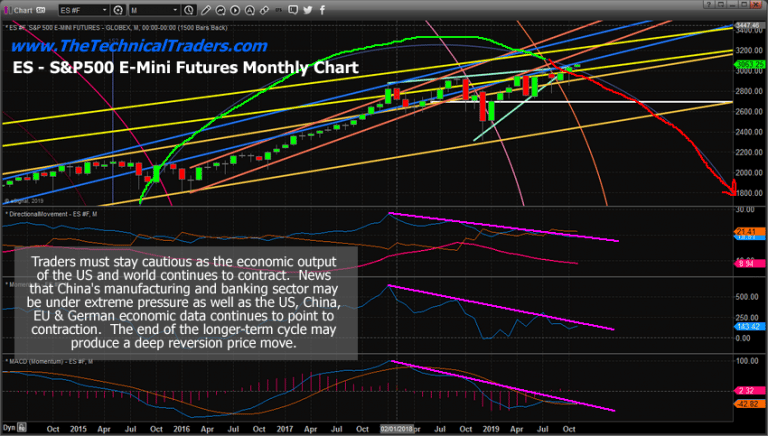

This last Monthly ES chart provides a closer look at the technical indicator data that we believe highlights the overall weakness that is building up in the US stock market. Even though we’ve recently pushed to new all-time highs, our technical indicators are suggesting that price is actually weakening in the upside price trend and could break lower at any moment.

The Direction Movement index, Momentum, and MACD of Momentum are all highlighting a weakening price trend that appears to be setting up for a broader downside price move eventually. Traders need to be very aware of the risks in this extended upside price trend and to prepare for the potential of a new credit crisis event related to the current credit levels that are far more extended than in 2008-09. If something breaks in the credit markets now, there appears to be nearly 5x to 10x the amount of credit extended throughout the global than there was 8 short years ago.

November will be the month of breakouts and breakdowns and should spark some trades. I feel the safe havens like bonds and metals will be turning a corner and starting to firm up and head higher but they may not start a big rally for several weeks or months.

October was a boring month for most major asset classes completing their consolidation phase. Natural gas was the big mover in October and subscribers and I took full advantage of the bottom and breakout for a 15-22% gain and its till on fire and trading higher by another 3% this week already.

If you like to catch assets starting new trends and trade 1x, 2x and 3x ETF’s the be sure to join my premium trade alert service called the Wealth Building Newsletter.

Happy Trading

Chris Vermeulen

www.TheTechnicalTraders.com