US vs. Global Sector Rotation – What Next? Part 1

Our research team, at www.TheTechnicalTraders.com, have been pouring over the charts and data to identify what is likely to happen over the next 60+ days in terms of global stock market volatility vs. the US stock market expectations. Recently, we posted a research article highlighting our Adaptive Dynamic Learning (ADL) predictive modeling system on the Transportation Index (https://thetechnicaltraders.com/markets-rally-hard-is-the-volatility-move-over/). This research suggests we are still going to experience increased price volatility over the next 30 to 60+ days and that price rotation may become somewhat of a normal expectation throughout the rest of 2019.

We believe the key to understanding price volatility over the next 30+ days lies in understanding the potential causes of uncertainty and capital shifts that are taking place around the globe.

Next week, On May 23~26, 2019, the European Elections take place (https://www.telegraph.co.uk/politics/0/european-elections-2019-uk-vote-date-results/). This voting encompasses all 26 EU nations where all 753 European Parliament seats may come into question. The biggest issues are BREXIT and continue EU leadership and economic opportunities for members. The contentious pre and post-election rancor could drive wild price swings in the global markets over the next 10+ days.

A tough stance between both nations, the United States and China, have left trade talks completely unresolved (https://www.reuters.com/article/us-usa-trade-china/chinas-tough-trade-rhetoric-leaves-talks-with-u-s-in-limbo-idUSKCN1SN207). At this point, the currency market is attempting to absorb much of the future expectations while the US/China stock markets react to immediate news events and perceived future economic outcomes. Overall, until this issue is resolved for both nations, the news cycles will likely drive increased price volatility across the global markets.

The US 2020 Presidential Elections are ramping up with over 24 Democratic potentials attempting to unseat President Trump. The current new from DC regarding the continued DOJ investigations and political posturing regarding Barr, Nadler and a host of other DC actors is setting up for a “cliff hanger” outcome over the next 12+ months. This will likely become one of the most hotly contested US Presidential election events in decades. The news of investigations, political corruption, and a potential US political “coup” attempt is certain to keep everyone guessing over the next 2+ years.

The markets are reacting to this volatility by attempting to adjust valuations expectations and future economic outcomes in multiple forms; currency price valuations (attempting to adjust to a shifting future economic landscape as well as to attempt to mitigate risk/capital/credit issues), Stock Market price valuations (attempting to further mitigate risk/capital and credit issues, and debt rates (attempting to effectively price risk and output expectations for the future).

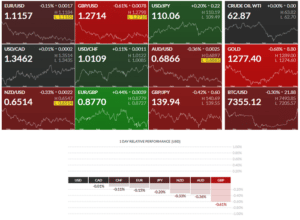

Here is a map of the Currency Market over the past 12 months. We can see the dramatic shift that has taken place since the price peak in February 2018.

Overall, the US Dollar has continued to strengthen over the past 12+ months and is regaining the “King Dollar” status as the global uncertainty continue to plague foreign and EU markets. We don’t expect this to change in the near future.

Our continued research into the current price rotation in the US and global markets suggest that we are going to continue to experience moderately high price volatility across all markets over the next 30 to 60+ days – possibly well into the end of 2019. As we suggested, above, the uncertainty relating to the multiple election events and global trade/geopolitical events do not present a foundation of calm and collected future guidance. The only thing we can suggest regarding these future expectations is that the US and more mature global markets should be able to navigate these uncertain times much more effectively than emerging or “at risk” foreign markets.

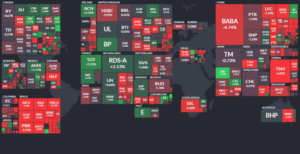

Below, you will see a global Heat-Map spanning one week. Traders should take special notice that certain EU countries are surviving the recent global price rotation quite well (France, Netherlands, Switzerland, Ireland, Germany, and others). We believe this is the result of the fact that these economies are rather mature and consistent in their output and expectations. Pay attention to the South American, Asian and Caribbean nations. It would appear that a fairly strong price contraction is taking place throughout much of these nations as the focus shifts towards the more mature markets.

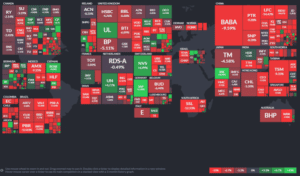

The following One Month global Heat-Map highlights a slightly different economic picture for some nations, yet confirms the shorter-term (weekly) trends for many others. Bermuda, Cayman, Germany, and Switzerland appear to be the Bullish Leaders over the past 30 days while the rest of the globe appears to be slipping into Bearish price trends. Canada and the UK appear moderately mixed with some green showing on the heat-map – which would be expected as both of these nations are considered mature global economies with strong economic ties to the US.

We believe the next 10~30+ days are going to be filled with moderate price volatility and we expect a setup in the global markets, near the end of June 2019, where a massive price volatility explosion may take place. This could be correlated with some trade issue, some fallout of the EU elections or some breakdown in credit/debt risks taking place between now and September 2019. We’ll go into more detail in Part II of this research post.

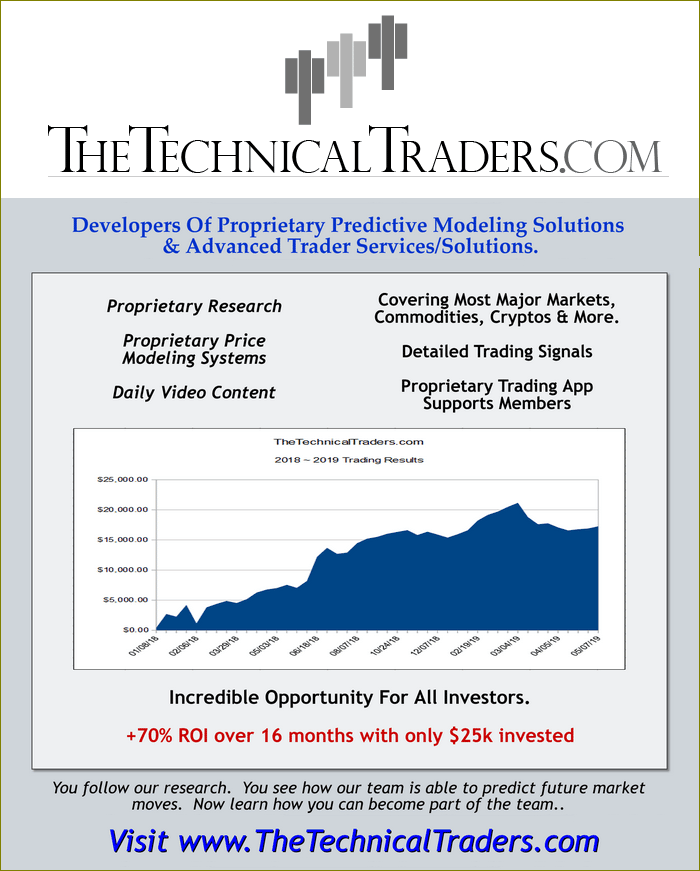

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have a few more left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have a few more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen