Two Leading Indicators for Crude Oil Point To Higher Prices

On Friday morning I created these charts on the price of crude oil, the energy sector stocks (XLU), and also the Canadian Dollar, which I think paint a clear picture of what to expect for the price of crude this coming week.

I always like to look at the leading indicators of the asset which I am interested in trading. For those trading the price of crude oil you should be watching what the energy stocks are doing or the sector as a whole. I use XLE ETF for this. I also will show you the Canadian dollar and what it is going later in this post.

Energy stocks are a way for traders to leverage the move in oil so the smart/big money tends to move into these stocks before the underlying commodity (oil) will start to change direction.

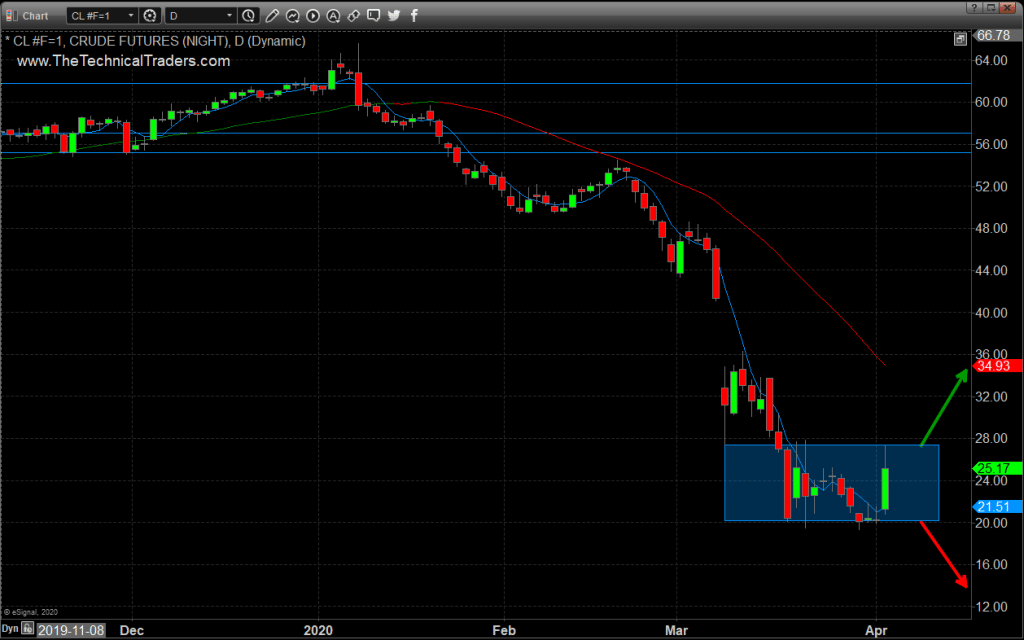

Price of Crude Oil – Daily Chart

Oil has been trading sideways for a couple of weeks. The range may not look big but just note that it’s a roughly 25% range from the bottom to the top of the blue box. The key take-aways here is simple. Oil is still trading at the bottom of the chart and trading sideways. What we will be looking for is a breakout of this zone in either direction which should induce a strong rally or selloff to the expected price levels of $34, or $14. These moves are likely to happen quickly over a 2-3 day period to expect an explosive move.

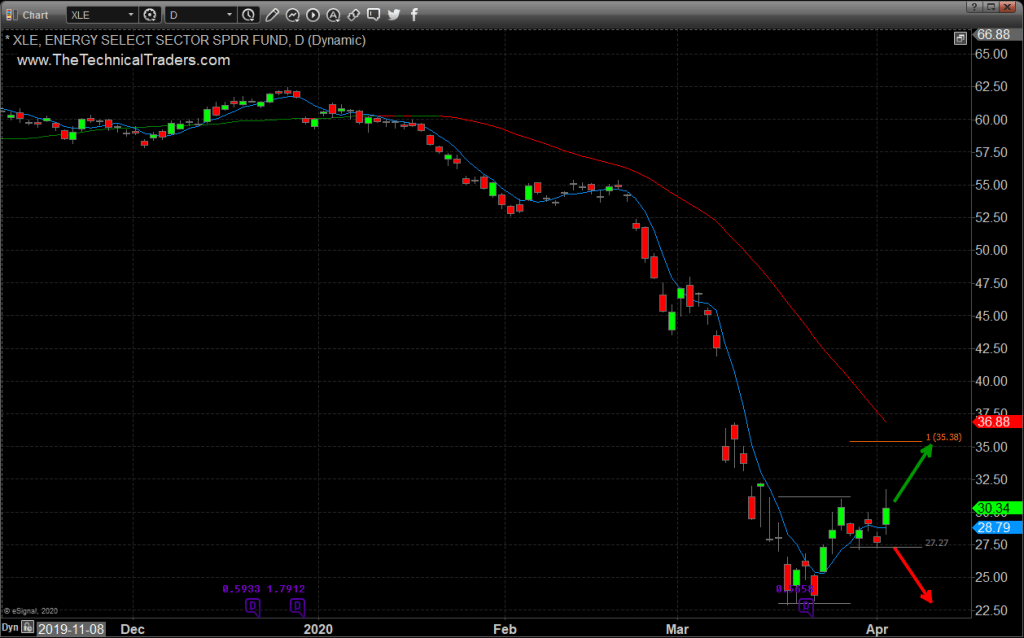

Price of Energy Sector Stocks ETF (XLE) – Daily Chart

Energy stock generally leads to the price of oil by a few days. The important points on this chart are that price has rallied off the lows, and is forming a bull flag pattern which means higher prices are expected.

Much like crude, a break in either direction in XLE can be traded, but the pattern which has formed puts the odds in favor of an upside breakout and rally of roughly 12%.

Before we continue, be sure to opt-in to our free

market trend signals

before closing this page, so you don’t miss our next special

report!

Price of Canadian Dollar – Daily Chart

The Canadian dollar is very tied to the energy sector, both the price of oil and energy stock because we are a resource-rich country, with oil being once of our top resources.

As you can see in the chart below the Canadian dollar it too has formed a bull flag pattern and looked primed and ready for another rally higher. The currency market, in general, is massive and when a large asset class is showing signs of reversing you better pay attention.

When I see a currency forming strong pattern to give us an expected price breakout direction, I like to look at what that is telling me. What companies or commodities will this move affect? In this case, money is moving into the Canadian dollar expecting oil to bottom and rally which should help increase the value even more.

I Talk Live On TV about These Trade Setups

If you want more details on this trade setup just watch this clip from TraderTV where I talked with Brendan Wickens in detail. Click Here To Watch Video

Concluding Thoughts:

In short, this coming week is most likely going to be much wilder than last week. While I didn’t cover on the other asset classes just know that precious metals, the major stock indexes, bonds, and oil have al built powerful patterns. Breakouts of these patterns will trigger big moves 10-25% in some cases, so get ready for fireworks this week!

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.