The August Stock market Breakdown Prediction and Analysis

Our August 19th breakdown prediction aligns with our other analysis tools and predictive modeling systems. The key to understanding price action lies in two modes of operational aspects for analysts. Either the analysis is going to be correct and the markets will break down as we have predicted or the analysis will be incorrect and the markets will break higher to rally to new highs. We call this the “failure to fail” mode or the “failure to succeed” mode of compliance for price. Either it will do what we expect or it won’t.

There are a few things that we, as analysts, must take into consideration with regards to future predictions of price action and direction. First, sometimes we fail to make perfect predictions. It is not easy or 100% guaranteed that our predictions will become valid or accurate on the day we suggest price should move in a certain direction.

We are going to show you the ADL charts that support our predictions and we are going to discuss why we believe the setup is still valid, but we are going to have to let price confirm our prediction and wait for it to move in a direction that either confirms our research or invalidates it.

As many of you know, we use advanced tools to help us understand and predictions regarding future price moves. Many of our tools align with price cycles, predictive modeling, and other price modeling tools that we use to try to understand where and when the price may turn or continue to trend in a specific direction.

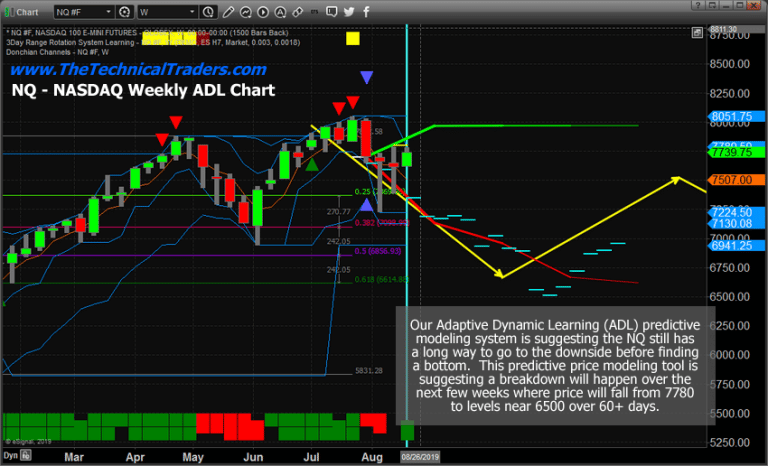

One of our most advanced tools is the Adaptive Dynamic Learning (ADL) predictive modeling tool. With it, we can ask the ADL tool to show us what price will attempt to do in the future based on a type of DNA candlestick mapping that attempts to isolate the highest probability outcomes.

Weekly NQ Futures Index Chart

Below, we’ve included a Weekly NQ ADL chart that shows you what our ADL predictive modeling system it expecting the NQ price to do over the next 10+ weeks. You can see from this chart that price is expected to trail lower from current levels and to potentially reach a low point of 6500 by early October 2019.

One other aspect that we must consider is that price can sometimes react 2-5 weeks later than the ADL predictive price levels show. We call these Price Anomalies. This is where price sets up an unusual price formation that is actually moving against the ADL predictive price level (in this case, staying higher while the ADL predictive price level moves lower).

We determine these to be price anomalies because, in most cases, the price will eventually break toward the ADL predictive price level in a reversion move. Therefore, these anomalies can sometimes be very good trading signals as price moves against the ADL predicted trend.

Be sure to opt-in to my free market research newsletter

VIX Weekly Chart

The ADL of the VIX Weekly chart shows a spike in the VIX levels over the next 3 to 7+ weeks. This spike will likely coincide with a downward price move in the US markets that could begin as early as early September 2019.

The purpose of this ADL VIX Chart is to show you how our ADL modeling system is able to warn us of future price moves and how we can align certain analysis results with other charts to form a larger perspective of the markets in general.

Concluding Thoughts:

As of right now, the August 19th breakdown prediction we shared more than a month ago still stands as the price has yet to rally above 8050 on the NQ to present a new upside price trend. Our ADL predictive modeling system is still suggesting that the price wants to move lower from current levels and attempt to target the 6500 price level.

Even though the exact August 19th date did not result in a price breakdown event, you must understand we were calling for a breakdown to happen “on or near August 19”. That means sometime this week or next week most likely – possibly a bit later if the price anomaly of the stock indexes holding up at the upper end of our ADL price range.

If you’ve followed our research long enough you’ll understand that we can make these predictions about the future based on our advanced predictive modeling tools and research – yet we can’t be 100% accurate on the date/time of the event because we don’t have the ability to see that much detail or control what the global markets do in terms of price, trends, global central banks, and other factors. We can only relate what we see in the markets using our modeling tools and attempt to help you understand what our predictive modeling systems are suggesting.

Right now, a price anomaly where the price is trading above our expected price prediction level appears to be set up which will likely result in a price breakdown in the near future (3 to 10+ days). Time will tell. If price rallies because of some external factor and breaks the 8050 highs on the NQ, then we would consider the ADL predictive analysis result to potentially be invalidated because of this new high. Currently, that is not the case and we are waiting for the breakdown event to begin and will position our money accordingly when price confirms the move.

If you like this big-picture analysis and forecasts be sure to opt-in to my free market research newsletter or let me send you my low-risk index ETF trade signals plus my analysis with my Wealth Building Trading Newsletter.

Chris Vermeulen

www.TheTechnicalTraders.com