Shifting Undercurrents In The US Stock Market

Even as we write this post, the US Stock Market continues to push higher as global traders and investors pour capital into the continued US rally. The strong US Dollar continued to attract capital from around the globe and with fresh earning about to hit from Q4 2019, investors are expecting another round of solid income and earnings growth.

Yet, underlying all of this is the undercurrent of shifting capital into safe-havens like precious metals, Cryptos, and under-valued foreign markets. This shift started to happen late in Q4 2019 and accelerated early in 2019.

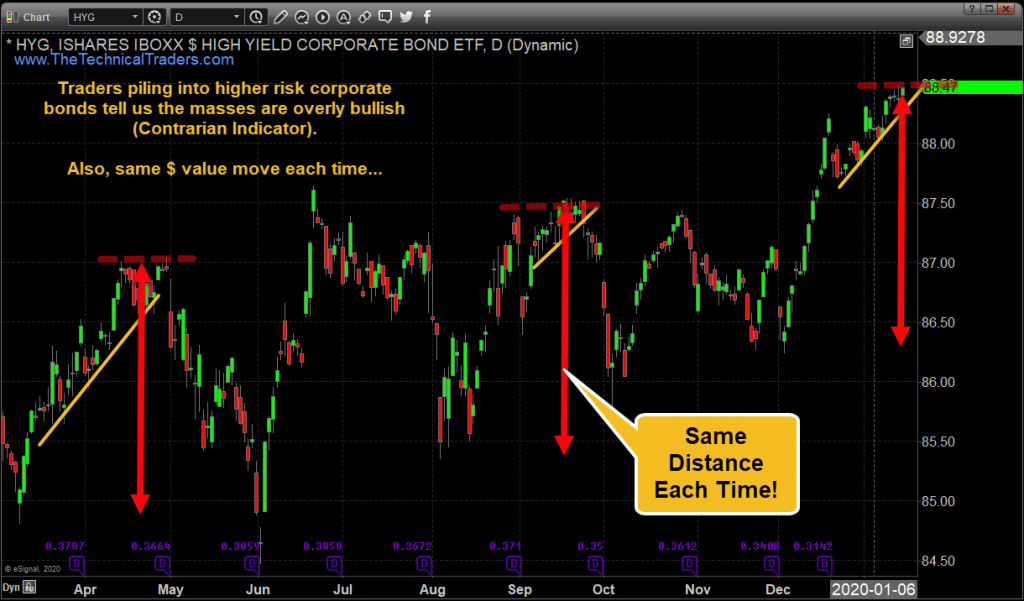

HYG – High Yield Corporate Bonds Daily Chart

One of our favorite measures of extreme bullishness is the scope of capital/trend pouring into High Yield Corporate Bonds. This chart below highlights the scale of the rallies that take place before a price reversion event. You’ll notice that each rally in HYG is nearly identical in size – and that each rally is followed by a fairly deep price reversion event.

The likelihood of some surprise earnings collapse from Q4 2019 is somewhat muted. Other than the retail sector reporting some missed earnings expectations related to Christmas 2019, generally most market sectors should report earnings and growth near an average 2% to 3% growth expectation annually.

Still, with Rhodium, Platinum and Palladium rallying extensively and Gold and Silver recently setting up an upside breakout pattern (see our recent Gold and Silver research), we believe undercurrents are already at play in the markets where skilled traders are preparing for a price reversion event – attempting to mitigate risk.

Over the past 20 years, the DOW JONES INDUSTRIAL has been positive in January by a ratio of 1.2:1. In other words, the odds of a positive January for the DOW is near 60%. The average upside price advance in January for the DOW is a little over 600 points. As of right now, the DOW has advanced a bit over 525 points since the end of 2019. We believe the undercurrent trends may result in a moderate price reversion event if our analysis is correct.

We’ll wait to see what happens with earnings data and other news, yet our proprietary technical price modeling systems are suggesting a reversion/rotation event should happen fairly early in 2020.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.