Reality Check on Trading Equities & Precious Metals

As you may or may not know, the markets have a way of making it extremely difficult to trade in general almost all of the time if you do not have a trading plan.

One of the ways the market likes to pull money from traders is through morning opening gaps. For example, yesterday, the inflow of emails about gold, silver, and gold miners was insane. I keep trying to keep everyone in check with how to handle high-risk, high uncertainty, and volatile times, which, for our case right now, is a cash position for a few more days.

Unfortunately, big moves in price trigger emotions with some of you. It causes you to start trading just because you think you need to trade, which can be for many different reasons I won’t get into here. You should know my stance by now, which is cash is a position, and retaining our capital is more important than trading some times.

I know for a fact that all successful traders have a detailed trading plan, they can control their emotions, are logical, and they wait for opportunities vs. jumping at anything that moves more than normal.

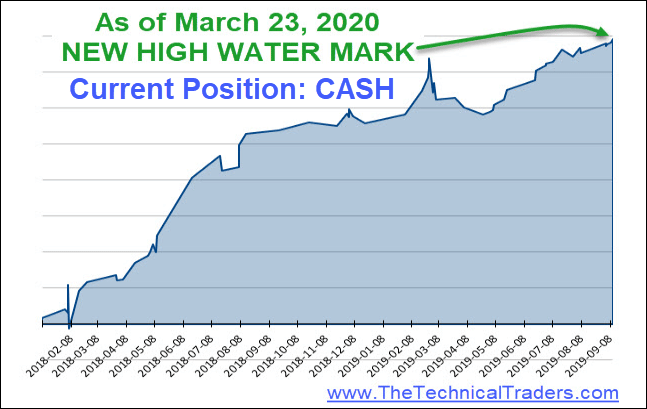

Below is our portfolio equity curve, which we hit an all-time new high just days after the stock market started its crash. Maybe if you see what your portfolio growth curve would look like if you followed my trades, you will finally see the value in CASH.

I don’t trade a lot, and we are in cash when we don’t have any positions. Other times we will have 2 or 4 positions open, but it all depends on the market and volatility. You want trading to be simple, boring, and profitable, trust me on this.

PORTFOLIO GROWTH CHART

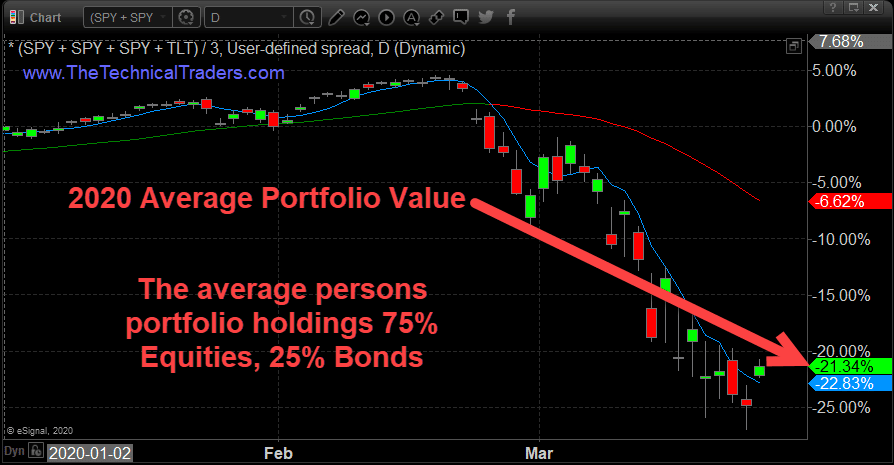

AVERAGE PORTFOLIO RESULTS THIS YEAR

Ok, enough of that rant, BACK TO MORING PRICE GAPS!

The stock market loves to do most of the day’s price range and profit potential in a way the average trader is not able to catch the move. Even more so, it is trying to get traders the worst entry or exit price.

New members over time will see and understand this when I talk about these gaps getting faded in my morning videos, which I will explain in a minute. For now, let’s take a look at the price of gold and the market sentiment from yesterday.

Yesterday gold traders were acting like a school of piranha’s. A big one day pop in price is like a drop of blood in the water, and it created a feeding frenzy. There was so much momentum going into the closing bell that the market makers will take advantage of this and walk the price up in pre-market trading the next day and try to reach the next resistance level before the opening bell.

This is what happened to gold, and miners this morning. Market makers know there are still a ton of gold and miner stock buyers out there who are going to BUY as soon as the market opens, so what happens?

The general public pays the high price, way up at resistance, and the market makers get to sell any access shares they have for a huge profit. After that, the price generally fades (falls) back down, and the majority of buyers that day just bought at the high because of pure emotions and a lack of understanding. This happens for gaps to the downside as well in a similar manner.

Now, keep in mind, this is a very short term price action. The gap may fade down over the rest of the session or a few days, but it does not mean the uptrend is the price is finished longer term.

My point is, the market has a way to get you a bad fill MOST of the time if you do not understand how and why the price moves the way it does. Even if you know all this, sometimes we have no choice to pay the price depending on the trade setup if we want to get into a position. I just wanted to share this small tidbit on how the market moves with price gaps because almost all price gaps fill, fade back down to the previous days high for the stock indexes. Commodities gaps don’t always fill, because they are a very different asset class than equities.

My current outlook and thinking for gold, silver, and miners?

In short, gold is the only one in a bull market, and it’s been the definite leader time and time again for the past year almost. It remains in a bull market, and all the money printing/QE, and zero interest rate things are very bullish on metals long term. I like gold a lot, have for a while. I think it’s going higher still as I pointed out in yesterday’s afternoon video, $2600 is my primary target long term. If you didn’t watch yesterdays afternoon video be sure to do so here:

Members video: https://thetechnicaltraders.com/memberships/wbn/monday-afternoon-video-update/

As for gold miners and silver, well today is the same story as yesterday, everyone wants to own them and thinks they are missing the train. How you should see these charts and how to best trade them I tell you in yesterday’s afternoon video.

Trading now, in my opinion, is pure speculation and emotionally driven. Sure, you could be right, and this could be the bottom, but as technical traders using rules, logic, and a proven strategy, we are not cowboys trying to pick a bottom to be early. A broken clock is right two times a day. You may get lucky, but because bottom picking without any technical confirmation is a sucker’s (gamblers) game in the long run.

As our portfolio graph above speaks for its self, in that we do not need to catch every move, in fact, we just need to catch a couple of low-risk trades and slowly build our capital. I was told by one of my mentor traders years ago, once trading becomes slow and boring to you, that’s when you finally understand the market and have a proven trading strategy.

I hope you find this helpful, and if you want this type of info every day, plus my videos, and winning trading strategy, become a member right now!

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTrader.com