Real Estate Crash Is The Next Shoe To Drop

The past few weeks and months have been very interesting to see how the global central banks and governments have attempted to position themselves ahead of this COVID-19 virus event. We continue to suggest that we are just starting the process of navigating through this potentially destructive virus event. We believe the sudden onset of the virus pandemic has sent a shock-wave throughout the globe in terms of expectations and valuations that are, just now, starting to become “real”. Let us try to explain our thinking and how this relates to Real Estate…

Before we continue much further, we suggest taking a moment to review our previous research articles related to the Real Estate market which we predicted the selloff and falling values. Both of these articles were at the top of the Yahoo finance and Google with hundreds of thousands the week we posted them:

Real Estate Crash Predicted Part I – Click Here

Real Estate Crash Predicted Part II – Click Here

The COVID-19 virus event is a global crisis event that is currently in the very early stages of consumer psychological processing. All types of crisis events prompt some forms of typical human reaction. We believe the Real Estate market may be the next big asset revaluation event as consumers continue to process the COVID-19 virus crisis and the consequences of this event.

Real Estate Cycles

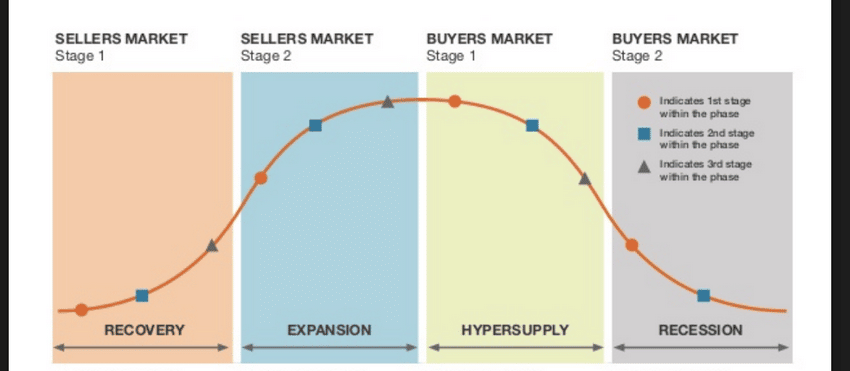

Real Estate cycles typically transition through the following phases as supply and demand functions work through the markets. Pay attention to the middle of this cycle chart. In the Expansion and HyperSupply stages, once supply peaks and prices somewhat peak/stabilize, a transition takes place in the market where buyers chase premium properties and push price levels moderately higher. The Recession Cycle is typically a disruptive cycle that is the result of an economic/income disruption. When people can’t earn enough to satisfy their debt obligations and or provide for their families, then the Real Estate cycle begins to contract.

An event like this, the COVID-19 virus event, would typically start out as a regional/local event. This did happen as it roiled certain areas of China in late 2019. Watching how China attempted to manage and hide the extent of the virus explosion within their country was painful to watch.

The Chinese state media was pushing out information and numbers which didn’t match anything seen on the streets and being reported by others within China/Hong Kong. This “disconnect” and the misinformation presented within this early virus pandemic event is critical to understanding how the world will now deal with this mess. So, keep in mind, everything was somewhat “clicking right along” in late 2019 and early 2020 as China was fooling the world.

Before we continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

As it unfolded…

The Chinese New Year celebration fell on January 25, 2020 (Year of the Rat). Near this time in China, hundreds of millions of people travel “back home” to celebrate the New Year with their families and friends. As this travel starts typically 4 to 5 weeks ahead of the date of the New Year, China allowed potentially infected people to travel throughout the world before shutting down travel within China on January 23, 2020. This locked infected and uninfected people into areas within China while the Chinese government began extended efforts to control the virus outbreak.

By early February 2020, the virus had been confirmed in India, Philippines, Russia, Spain, Sweden, the United Kingdom, Australia, Canada, Germany, Japan, Singapore, the US, the UAE, and Vietnam. In essence, the Chinese lock-down presented a very real opportunity for those that had visited China and left to be “locked into location” outside the quarantined areas within China. If they were infected or asymptomatic carriers, these people now became source-spreaders. On February 3, 2020, Chinese President Xi Jinping indicated the Chinese government knew about the virus well before the public alarm was raised – as reported by the Chinese state media.

By Mid February 2020, China had over 40,000 infections and over 900 confirmed deaths related to the COVID-19 virus. Nearly a week later, near February 19, China reported more than 74,000 total cases and 2,100+ deaths. By this time, general global panic had already been set up and this is the point of this article – how consumers respond to a crisis event like a virus pandemic. (Sources: www.aljazeera.com, www.businessinsider.com)

The reason we went through all of this detail is to illustrate how the virus event started as a localized event in China, near the end of 2019. Yet, by early February 2020, less than 35 days later, the virus event suddenly became a global event – panicking the world. The COVID-19 virus event has now turned into a global economic disruption event that has dramatically reduced most people’s ability to earn an income. Businesses and individuals will feel the consequences of this event and we believe the economic contraction is just starting. How do consumers respond to an event like this?

In PART II of this series, we’ll continue to delve into the reasoning behind our research and why we believe the Real Estate market will become very risky for investors over the next 24+ months.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I have to toot my own horn here a little because subscribers and I had our trading accounts close at a new high watermark for our accounts. We not only exited the equities market as it started to roll over, but we profited from the sell-off in a very controlled way, and yesterday we locked in more profits with our SPY ETF trade on this bounce.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.