Real Estate: Prepare For Massive Wealth Creation In 2023

Entrepreneurs and investors should prepare for one of the most significant wealth-creation opportunities of their lifetime in 2023. It will be similar to the COVID housing bubble in terms of watching your home value rise quarter after quarter, but this time it will be sustainable and carry you into retirement with more than enough cash flow to live your retirement like a billionaire.

Real estate is one of the most significant investments we make as individuals. A home is one of the best assets anyone can have, but there will be times when real estate will lose value, which we’ve recently started to see happen. Conversely, there will also be tough times when real estate can increase in value by leaps and bounds, which we experienced in 2021 through to February 2022 when housing prices topped out.

I recently had a basement apartment built in one of my rental properties. And boy, was that a mistake. I was quoted $35K, and it ended up costing $100+K, and it is still not completed. The labor rates and quality of labor these days are piss poor. Everyone is gouging and overcharging, and no one completes their jobs. They all seem to leave the last 10% of the job, the final finishing portions (the most important part and where quality skills come into play), and vanish to move on to the next easy job for quick money.

I’m bitter about my build, I got taken to the cleaners, and it is going to take years to recoup that extra expense. If you are an investor or entrepreneur, then you understand the pain of a $65+K hit because money does not grow on trees, and we know the hours, stress, creativity, and grit required to make that money.

Silver Lining of Low-Quality Tradesman and Reno Companies Gouging Home Builders

Karma has a way of coming back to those who do wrong. The pending housing and building collapse, I expect in the near future, will be a breath of fresh air for savvy investors and entrepreneurs who can preserve their capital during the stock, bond, and real estate correction over the next 12-36 months.

You see, in my small town, there is only a small group of truly skilled home builders and reno/repair people. Everyone I know has had terrible building experiences since COVID. It seems everyone stopped working for free money, or they picked up a hammer, called themselves a builder, and started charging $45-75 per hour without knowing what they were doing and inflating material costs.

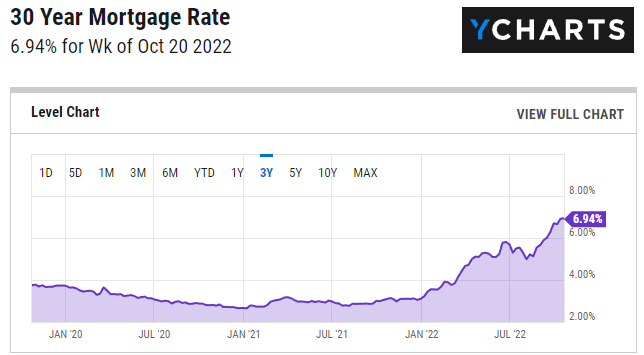

You can’t have good times without tough times, and with mortgage rates more than doubling in a year and leading expert Christopher Whalen saying we should brace for 10% mortgage rates, the housing market and builders are going to be in for a rude awakening.

When mortgage rates rise, home prices fall, similar to the bond market. As the Fed raises rates, bond prices come tumbling down.

Since the Fed started to raise rates, the price of bonds has fallen over 47%, wiping out over a decade of investor growth. I feel the same is about to happen to the housing market, but the only difference is that the real estate cycle moves much slower and lags behind the stock market and recession by 1-3 years.

While most homeowners in the USA are lucky as they locked in a 30-year rate to keep costs low, the real issue and driver of falling home prices is the fact that most Americans live paycheck to paycheck and are overleveraged. With layoffs already starting to show up by large companies every week, and labor rates topping out, it is just a matter of time before tens of millions get pay cuts and laid off, and then they cannot afford their homes and be forced to sell and rent. This will drive house prices lower, but it’s going to make time to mature.

In addition, new homeowners trying to pick up these houses will be forced to pay 10+% mortgage rates and thus demand a lower home price to make it feasible to own or rent as an investment property.

Home building will come to a screeching halt, and the faux tradesmen who have burned every bridge with all their one-time customers will be left scrambling and jobless.

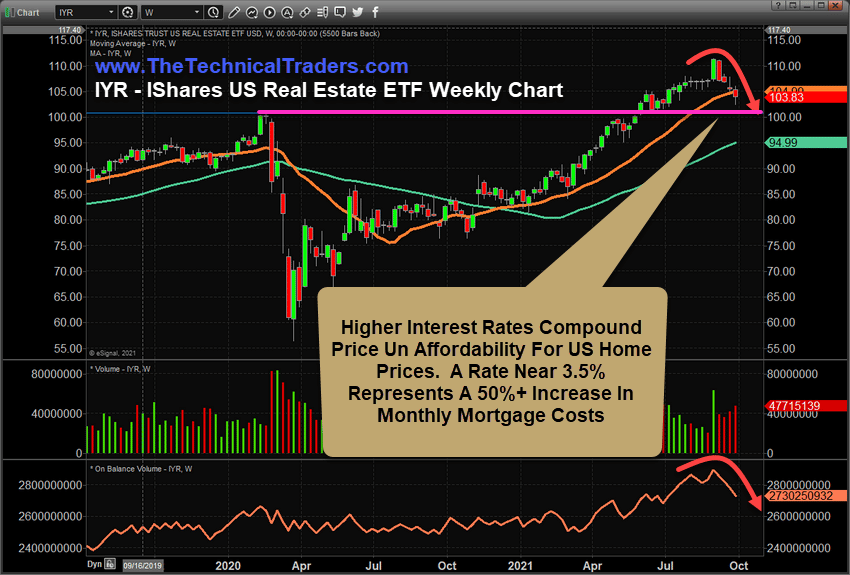

Real Estate Investors Stopped Buying in September 2021

Savvy real estate investors stopped buying a long time ago, which we can see from this chart I posted in my last real estate article.

Real Estate Investors Dumping Ownership October 2022

This updated chart shows how the price broke down from our 2021 support level and continues to fall. This ETF allows us to see what the most active real estate investors are doing with their money.

It seems they are raising cash, just as we have been doing at TheTechnicalTraders, to avoid the “bear market blues” of falling stocks, bonds, and real estate.

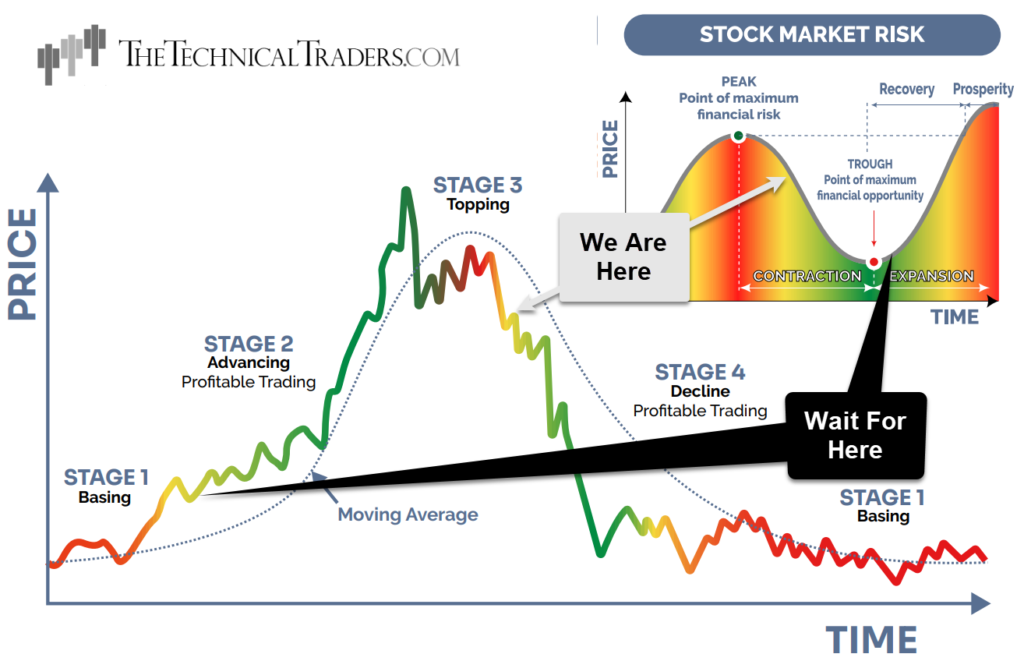

Technical Analysis Tells Us When To Buy And Sell Real Estate

If you have followed me, then you know technical analysis is my thing. I don’t care about economic data, politics, news, or fundamentals. All that matters for us as investors is that we own assets rising in value, which is exactly what I specialize in doing with my CGS ETF Portfolio.

Not many investors survived the 2008 bear market using an advisor, which is why individuals have started to focus on advisorless asset revesting.

Imagine if you see the trends of assets and know immediately if you should own it or ditch it. Do you think you could avoid market corrections and bear markets? Do you think you could profit from rising and falling prices?

See my Nasdaq 100 (QQQ) daily chart below for a visual.

Concluding Thoughts:

In short, I don’t want us to go through this pending recession and financial reset. It is not going to be fun, but it will create an opportunity to buy assets at or below their fair value, which is a massive opportunity for anyone cash-rich waiting like a lion to pounce when the timing is right.

For example, I bought and built my dream home on the water during tough times, and I remember our builder and architect telling us how lucky we were to be building then and how cheap everything was.

I also bought other properties and built high-end rental homes. I now have over 75 tenants for great monthly cash flow. I plan to double my real estate investments in due time because it’s cash for life if you do it correctly and don’t overpay or get over-leveraged.

I could start buying in the next 12 months or in three years. Not sure. We just need to wait and let the market dictate when to take action. I use technical analysis and follow price trends which makes it simple to know when something is rising or falling in value, and if you know me at all, then you know I only buy investments rising and ditch stocks and bonds falling in value.

Another story, in 2009, I bought a Canadian utility ETF that paid me a 16% dividend, and the price of the fund rallied over 100% within a couple of years. I no longer own it, but these types of opportunities are everywhere when the masses are suffering and forced to sell everything they own. The good news is you can also own the best stocks during the next market rally.

Follow me to success and ride my coattails over the next few years as we embark on this wild, thrilling, and lucrative investment adventure!

If you enjoyed this article, please share it with others, and be sure to join my free newsletter and have more articles like this delivered to your inbox.

Chris Vermeulen

Chief Investment Strategist

www.TheTechnicalTraders.com

Disclaimer: This email and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.