PART III – Debt Crisis To Be Reborn In 2020

This final portion of our multiple part research post regarding the future of a crisis-like price revaluation event will focus on two components that we want to highlight for every trader, investor, and reader. It does not matter if you are invested in anything at this point – you need to read this last portion of our research because you need to plan for and prepare for this next event.

On March 31, 2019, we published this research post regarding our cycle analysis predictions and the belief that a major price cycle top would likely form in July 2019.

On June 11, 2019, we updated our research and published this post regarding our belief that current cycle forecasting suggested the top in the market would now be set up for some time in late August or early September 2019.

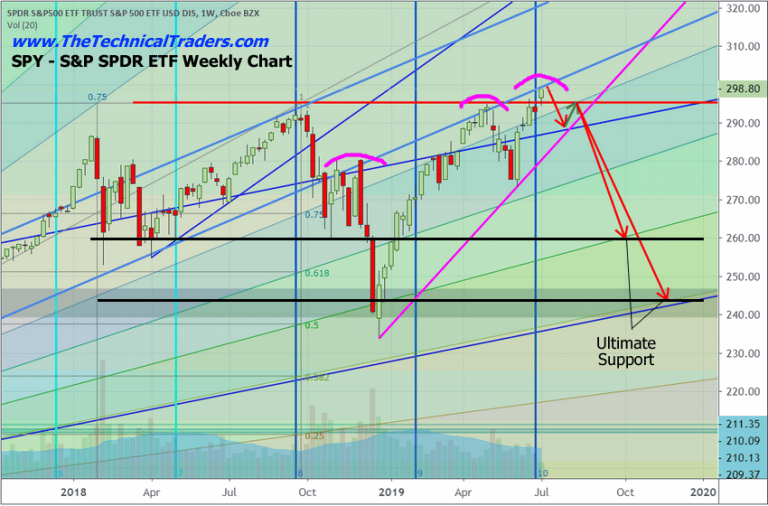

This SPY chart highlights what our research team believes to be the current outcome of the US stock market given our predictive modeling systems, price rotation modeling and other proprietary utilities we use to conduct our research. We believe the current upside price rally is a push to establish price levels above $300 on this SPY chart, just as we suggested in the June 11 article, and that this attempt a major psychological price level ($300) will likely become an exhaustion rally point where price immediately rotates lower – attempting to find support. We believe temporary price support will be found near $287 to $298 where the price will briefly stall and move slightly higher into August 2019.

It is at this point that our cycle research becomes critical for technical traders. This price rotation will set up a final leg to a larger Pennant/Flag formation with the potential for that last upside price leg, in August, to become a “washout high” price move. This happens when price fakes a price move/trend, causing investors to believe a breakout or breakdown more is taking place and JUMP IN, then price immediately reverses direction.

It is extremely important for all technical traders to understand our original price predictions, from March 31, 2019, and our current price predictions, from June 11, 2019, align with this current article in certain aspects. Price is going to target the psychological $300 level in the SPY. Price is going to continue forming into a Pennant/Flag formation. And the price will likely peak in late August or early September – just as we have predicted.

We expect this price rotation, or price revaluation event, to attempt to find support as we have highlighted on this chart. If these levels fail to hold as price support, then we could be in for a much deeper price revaluation event. We don’t believe that will be the case as the US elections and other factors should prevent the price from falling too far below the $245 level.

Expect some increased price volatility over the next 30+ days. Expect Gold and Silver to properly reflect the FEAR and GREED that is prevalent within the global markets. Expect many traders will be caught off guard when this $300 level on the SPY is breached as many will be thinking “we are off to the races – time to pile into the LONG SIDE”. We believe this is the wrong action to take.

We’ll keep you informed as this plays out with Wealth Building & Global Financial Reset Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Round or Gold Bar!

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these super cycles are going to last years. A gentleman by the name of Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com