Natural Gas and Crude Oil – Diverging Setups For Technical Traders

Over the past few weeks and months, we’ve been alerting our followers to the incredible setups in Natural Gas and Crude Oil. If you’ve been following our research, you already know on May 21st we called for Oil to break down from $62 level with a target of $55 then $49 price levels.

We’ve been alerting that Natural Gas was setting up an incredible seasonal trade with a move that was likely to push lower into the $2.00 to $2.20 level – suggesting any move into this range would be a solid buying opportunity for the seasonal upside move. Well, here we are about 35 days later and look at what happened.

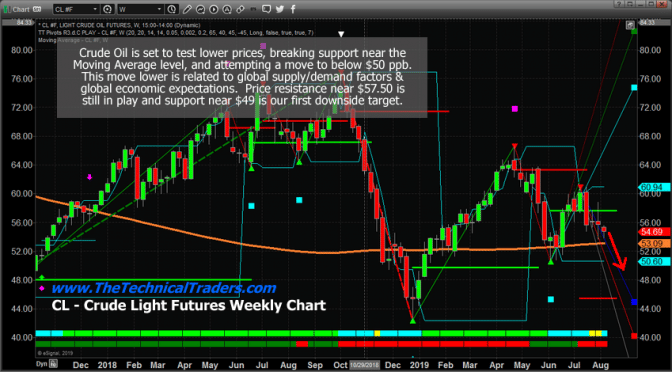

Crude Oil Weekly Chart

The US/China trade issues and global economic turmoil is taking a toll on Crude Oil. Price rotated downward very sharply last week with an incredible -8% downside move in one day. Currently, price is resting just above the Moving Average and should soon breakdown below this level towards the $49 price level. At that point, price should stall, briefly, before attempting to find support below $50.

Our Fibonacci price modeling system suggests true support is found near $45 and $40. Be prepared for a potential downside move of -20% to -25% from current levels.

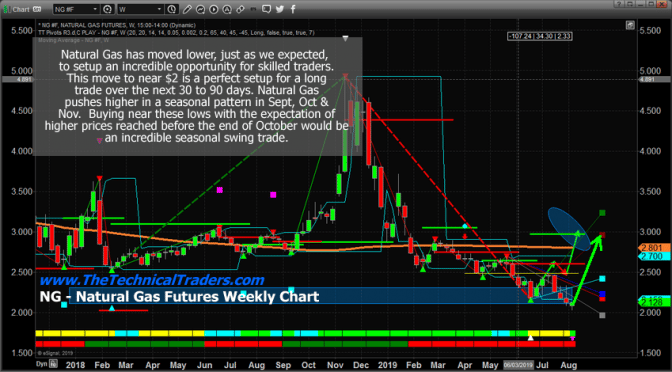

Natural Gas Weekly Chart

Natural Gas has done exactly what we expected. On this Weekly chart, you can see our shaded BLUE support range area and our GREEN and RED arrows from months ago highlighting what we expected to happen in price. Yes, price is lower than we currently expected, but it has aligned with our expected price rotation almost perfectly.

At this point, the sub $2.20 level is a perfect opportunity for skilled technical traders to prepare for the seasonal trend that will push Natural Gas back above the $2.65 to $3.15 level. Allow us to go through our expectations with you so you understand how to plan for and trade this move.

August is typically moderately bearish for NG. So expect to try to pick your entry for this trade in August. The ratio of bearish price activity in August is 1.2x the bullish price activity.

September is STRONGLY BULLISH – with an upside ratio of 10x compared to historical downside price activity. September is where we should see a big upside price move.

October is still STRONGLY BULLISH – with an upside ratio of 3x compared to historical downside price activity.

November is moderately bullish with a 1.3x upside ratio compared to downside price activity.

VIDEO – TODAYS MARKET ANALYSIS

SPX, BONDS, GOLD, OIL, NAT GAS

If you want to get access to my trading indicators and market prediction tools checkout these charts here

CONCLUDING THOUGHTS:

This means two things. First, Crude Oil should continue to breakdown and target the $49 price level over the next few days and weeks while Natural Gas sets up an incredible upside price setup below $2.25 for skilled technical traders. Oil is moving lower because of lower demand related to the global economic slowdown and larger supply issues. Natural Gas is setting up a seasonal pattern that could become a fantastic trading opportunity for traders that time their entries and understand the setup. In late August or early September price should begin to rally well above $2.50 with an ultimate upside target of well above $3.00.

In short, if you want to know what the market is going to nearly every day and get my trade alerts complete with entry, targets and stop prices join my Wealth Building Newsletter – www.TheTechnicalTraders.com

Chris Vermeulen

Technical Traders Ltd.