Mid & Small Cap Indexes May Surge Higher

As the global markets move away from recent concerns of war and Fed rate hikes, I believe both Small and Mid Cap indexes are uniquely positioned to potentially surge 7% to 11%, or more, from recent lows. My analysis suggests both the Small and Mid Cap Indexes may have moved excessively lower over the past 30+ trading days. They may be poised for a unique opportunity and a substantial price rally if the global markets continue to move away from extreme risk events.

As the US Fed and global central banks position to combat inflation while war tensions build near Ukraine, I believe the US Small and Mid Cap Indexes are uniquely undervalued and ready for a potential move higher. The recent recovery in the US major indexes may be evidence of strong bullish price momentum underlying the US Major Indexes. I believe that foreign capital is moving into various US assets to avoid foreign market/currency risks. The US Small and Mid Cap Indexes seem like perfect opportunities for this capital deployment.

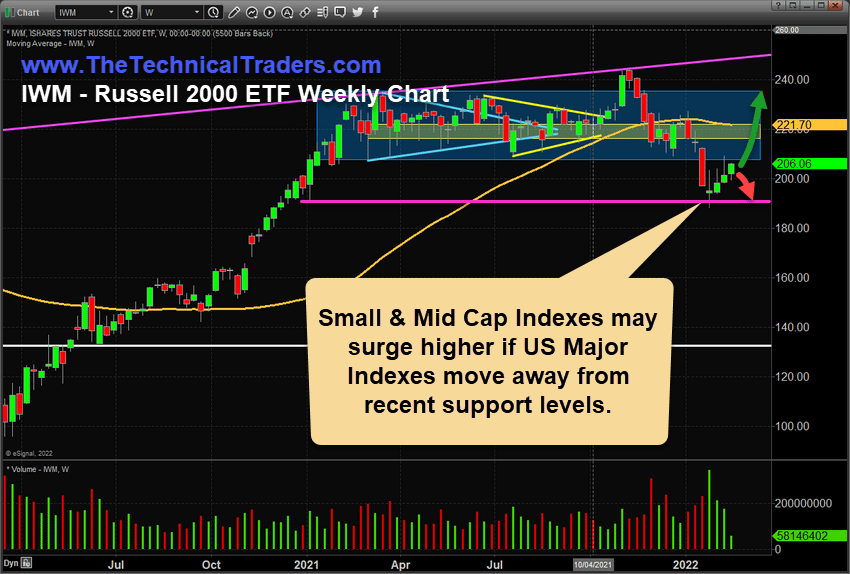

IWM May Rally 12 to 14% – Targeting $238 to $240

This Weekly IWM chart highlights a support level near $191.00 and a recent Three River Morning Star bottom reversal pattern near $194.40. It also highlights the previous range-based trading and dual Pennant/Flag setups using shaded BLUE and YELLOW Rectangles.

I believe IWM has a solid potential to rally back to near the $220 level before finding resistance (+7.25%). If this bullish price momentum continues, IWM may rally to levels above $238 to $240.

The global markets may have recently focused too much on the US Fed and Global Central Banks while missing the underlying strength of the US economy. Consumers are still spending, and the US Fed has yet to make any substantial adjustments to rates or balance sheets.

These recent lows may provide an excellent opportunity for traders to capitalize on a “reversion price move” soon. The only way to navigate and capitalize on these price swings is to stay focused on Technical Analysis and strategic opportunities for trades when they occur.

WHAT TRADING STRATEGIES WILL HELP YOU TO NAVIGATE CURRENT MARKET TRENDS?

Learn how I use specific tools to help me understand price cycles, setups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase. This may start a revaluation phase as global traders identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern drive traders/investors into Metals.

I invite you to learn more about how my three Technical Trading Strategies can help you protect and grow your wealth in any type of market condition by clicking the following link: www.TheTechnicalTraders.com

Chris Vermeulen

Chief Market Strategist

Founder of TheTechnicalTraders.com