Metals & The US Dollar: How It All Relates – Part I

The recent movement in the precious metals markets, an incredible 33% upside price move since August 2018, has reflected an increased level of fear and greed throughout the global markets. Particularly, throughout the foreign markets. Precious metals, specifically Gold, has skyrocketed to some of the highest levels in recent times as foreign currencies devalue against the US Dollar. Still, consumers, institutions and central governments/banks are buying as much as they can right now.

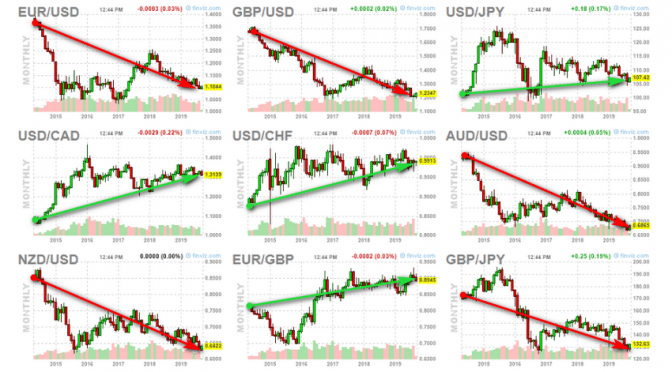

12 Month Capital Shift Seen in Currencies

As we have been suggesting over the past 12+ months, a capital shift continues to play out in the global markets where capital is actively seeking the best, most secure locations for investment and we believe that will result in strength in mature global economies. Take a look at this chart of various foreign currencies to understand how this capital shift process is really playing out across the globe. Be sure to opt-in to our Free Trade Ideas Newsletter.

Japan, Canada, Switzerland are all experiencing moderate price weakness against the US Dollar – yet these mature economies are fairing better than many others. The relationship between the EUR and the GPB appears to be relatively stable as both currencies have dramatically weakened over the past 16+ months – almost in perfect alignment. Comparatively, the other currencies within this display have experienced dramatic price weakness over the past 4+ years in relationship to the US Dollar and their associated PAIR currencies.

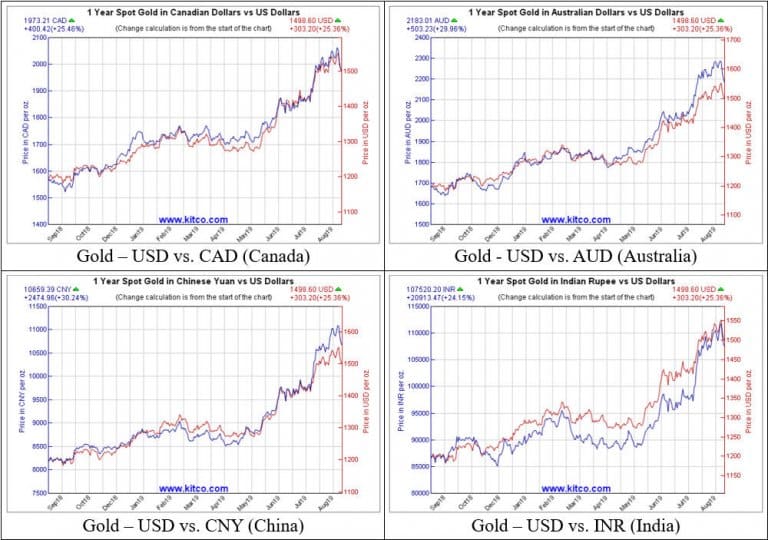

Gold Price Comparison In Other Currencies

The recent upside price move in precious metals exasperates the issue of localized consumption/acquisition of Gold/Silver as pricing pressures continue to push local pricing higher and higher. We are still very early in the bullish price cycle for precious metals. As increased fear and greed enter the markets over the next 15+ months, we believe the scramble to acquire physical metals and market positions will continue to increase even further.

These Gold Price Comparison charts, below, show just how dramatic the upward price move has been for foreign investors in local currencies. In US Dollar terms, Gold has risen just over 33% (approx: $350 USD). In Canadian Dollar terms, it has risen 30% over the past year (approx: $475 CAD). In Australian Dollar terms, it has risen just over 34% (approx: $590 AUD). In Chinese Yuan terms, it has risen just over 36% (approx: $$2,965 CNY). In Indian Rupee terms, it has risen just over 29% (approx: $2,545 INR). The reality is that precious metals have gotten very expensive for foreign investors in local currencies – and this is just starting to the metals rally.

The primary reason for this is the continued capital shift that has been taking place over the past 2 to 4+ years. As the global markets entered a period where commodity prices started collapsing (2014 in Oil), the global markets started shifting away from emerging markets and risky assets/investments. The hunt for more secure investment sources was on.

When Oil bottomed in early 2016, a reprieve in investor sentiment settled into the markets where expansion into more risky assets took place. All of this changed with the top formation in the US stock market in early 2018 and the downside price rotation in Oil in October 2018. Now, as precious metals start to rally and clearly illustrate that fear and greed are entering the markets, the continued hunt for secure, mature economic environments continue at a record pace.

In Part II of this research post, we’ll highlight why we believe the global markets are just starting a dramatic shift that will likely continue to unfold throughout the next 24+ months and why we believe it is important for all skilled technical traders to understand the risks that are present in the current global markets. This is not your simple trending global market any longer (think pre-2014) – this is a BEAST.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I have had a series of great trades this month. In fact, over the past 20 months, my trading newsletter portfolio has generated over 100% return when compounded for members. And we locking in more profits on Tuesday with the Russell 2000 index. So, if you believe in technical analysis, then this is the newsletter and market condition for you to really shine.

Be prepared for these price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

I can tell you that huge moves are about to start unfolding not only in currencies, metals, or stocks but globally and some of these supercycles are going to last years. A gentleman by the name of Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. 2020 Cycles – The Greatest Opportunity Of Your Lifetime

FREE GOLD OR SILVER WITH SUBSCRIPTION!

Chris Vermeulen – www.TheTechnicalTraders.com