If Time Is Precious, Then What You Choose To Spend Your Time On Matters… A Lot

My name is Chris Vermeulen, and I love what I do. I mean, I REALLY LOVE WHAT I GET TO DO EVERY SINGLE DAY!

I’ve worked hard my whole life to be able to say that. I’ve had everything from spectacular successes to gut-wrenching failures, and throughout each, I learned from the lessons that presented themselves along the way. Knowing who I am, what is important to me, and cultivating an open mind are huge parts of how I’ve gotten to where I am today.

And where is that, you might ask?

- I get to spend time with my family and friends, having adventures and experiences that range from our own backyard living on the water to all over the world.

- I get to spend time analyzing the markets and delivering actionable trade alerts for my own investment accounts and to my members. I love developing and refining my different ways of investing and trading that will help us protect and grow our wealth.

- I get to spend time turning my crawl space into a workshop (thank goodness for wheely chairs!), where I get to design and tinker with a new water-based toy that, with help from amazing individuals, I will bring to market.

- I get to spend time with incredible people who are creating a teen adventure movie franchise with my childhood friend John Geddes, The Goldilocks Mission, that will put kids, teens, and adults on the edge of their seats while learning about the climate crisis, clean technology, and how one person can make a difference. More about this at the end of the article.

Why am I telling you about how great my life is?

Because it could be yours too…if you want it. Whatever version of a great life looks like for you, it is within your power to create and attain it. This does not happen overnight, of course. And, honestly, would you really want it to? Without hard work, determination, and dogged effort, an ultimate prize does not have as much meaning or value.

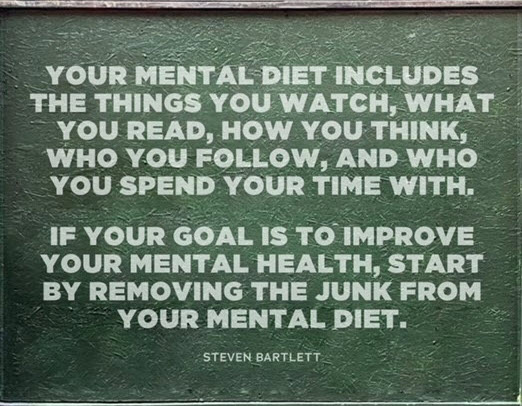

What you choose to spend your time on is what you fill your life with. This quote from Steven Bartlett pretty much says it all:

If your goal is to become a successful trader and/or investor, I have a few tidbits that may be of service. Some of these are out-of-the-box ideas, while others are gaping holes in basic knowledge that I’ve uncovered.

5 Things Every Trader and Investor Needs To Know

# 1 – Know Your Personality Type

It is vital that you embrace knowing who you are and take action to create a plan and rules to follow when trading and investing. For some personality types, it’s much easier to get sucked into news, opinions, stories, and hype and thus be subject to near-constant FOMO because it is just how your brain works. It does not matter how many trading or investing books or courses you have taken in the past; your emotions will override everything you learned, and you will continue to struggle to make strong, consistent gains each year.

To explore this topic more – click here.

#2 – Are You Blinded By Standardized Industry Terms (Stockholm Syndrome)

There is a reason that the following standardized lines are so effective and so difficult to overcome. Buy-and-hold is the best way to grow your money; diversify, diversify, diversify; a 60/40 Portfolio split will protect your money as you get older; 10-12% annual return is normal, etc. We have heard them for so long and from so many ‘experts’ that the average person no longer questions them…or even thinks to dig below the surface. This is a form of financial-based Stockholm Syndrome.

To explore this topic more – click here.

#3 – Do You Know What The Two Types OF Drawdowns Are

I continue to be shocked by how few traders and investors know what a drawdown is. If you are one of them, here is a quick breakdown. There are two types of drawdowns. The first measures how much an investment or trading account is down from its highest point (value drawdown). The second is how long it takes for an account to recover to its previous highs (time drawdown). Not understanding these terms can be detrimental to your wealth and retirement.

To explore this topic more – click here.

#4 – Self-Discipline and Proper Expectations

Understanding the psychology of trading is the distinction between those who win and those who don’t. There is a lot of room for failure when it comes to self-discipline and trade execution, and no trader or trading method is 100 percent bulletproof. All people and all strategies have losing trades and losing years.

To explore this topic more – click here.

#5 – Trading More Does Not Mean You Make More Money

To be very articulate and to the point – there is no such thing as easy money in the stock market. You might hear of or experience an easy (aka lucky) win, but unless you spend hours of time learning and understanding investing, trading, and the market itself, you will give every cent of that money back…and probably more. Active traders, in particular, struggle with trading less and watching the market from the sidelines. They feel more pain by waiting in cash than they do when stimulated with trades and taking losses. As an investor or trader, it is crucial to understand the value of, and put into practice, sitting on your hands, taking small losses to avoid more significant losses, and following a strategy instead of shooting from the hip and swinging for the fences.

To explore this topic more – click here.

Concluding Thoughts

To bring this full circle, I will ask you the questions that I asked myself:

- Do you know who you are and who you want to be?

- What are the most important things in life to you?

- What is your purpose?

- Do you have the open mind needed to become a success at whatever it is you take on?

- Have you defined your financial trading goals and found a mentor who can help you meet them?

Answering these questions is worth every second of your time. For example, when it comes to trading, it can only be of help to know if your personality is more susceptible to getting sucked into the hype and caving into FOMO.

For some people, I am the mentor they find. For others, I am the furthest person from a mentor they can think of. And that’s okay. I’m not for everyone, and my strategy for protecting and building wealth is certainly not mainstream…yet.

I will leave you with a couple of quotes to think about:

“The stock market can stay irrational longer than you can remain solvent”

John Maynard Keynes

“It’s not about how much money you can make,

it’s about how much money you can make safely”

Chris Vermeulen

Making money safely and consistently by avoiding market irrationality has given me the opportunity to become involved with a project I feel deeply connected to, The Goldilocks Mission.

In fact, this weekend, my team and I are headed to London as keynote speakers on entertainment, climate, and clean tech for The Goldilocks Mission movie we are producing. It’s a week of hanging with leading entrepreneurs and CEOs as we help weave their brands, technologies, and products into this new movie franchise. Our movie teaser reel will also be featured at a famous theater, along with our display booth at the Innovation Zero event.

I will be there all week and available for a cold pint or hot coffee!

Chris Vermeulen

Chief Market Analyst

TheTechnicalTraders.com

Disclaimer: This and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and maybe buy sell or hold said security at any time.