How To Use A ‘Collar’ To Protect Your Portfolio Against Losses

How can we protect our portfolio against losses when stocks are in a correction? Or even if stocks are not currently in a correction? There are many schools of thought on that.

One way is to close positions and wait for more bullish times on the sidelines. But that may not be the best choice for any number of reasons.

Perhaps you are bullish on a stock position long-term and don’t want to sell it. Maybe you already have a nice gain on your shares but are worried about a further decline. Or perhaps there’s a dividend that you would like to continue to collect.

Simple Portfolio “Insurance”

One relatively straightforward way to protect open stock positions is to buy Put protection. Puts are option contracts that have an inverse correlation to price. If the shares go down in price, the value of the Put will increase, thereby providing some offset to losses in the underlying stock.

The tradeoff is that Puts come at an out-of-pocket cost, and they expire. There’s a cost to carry to have that “insurance” in place.

Taking it a Step Further with a “Collar”

A Collar can be an effective strategy to ensure against significant losses. A common way to offset the cost of purchasing protective Puts is to implement a Collar strategy using options.

Calls are option contracts that increase in value when the underlying shares go up in value. We can sell Calls against our long stock and collect a premium. That’s a simple Covered Call strategy. But in itself, we get no downside protection on our shares other than the amount of the premium collected for selling the Calls.

We can take that a step further by using the premium collected from selling the Calls to purchase protective Puts. That’s known as a Collar. And depending on the option strike prices and duration, we may be able to do that for a net credit and put a little extra profit in our pocket.

Putting on a Collar

Since options contracts control 100 shares per contract, the number of shares you want to protect determines the number of contracts. Say you have 1,000 shares. In that case, the Collar position would consist of 10 short Calls and 10 long Puts.

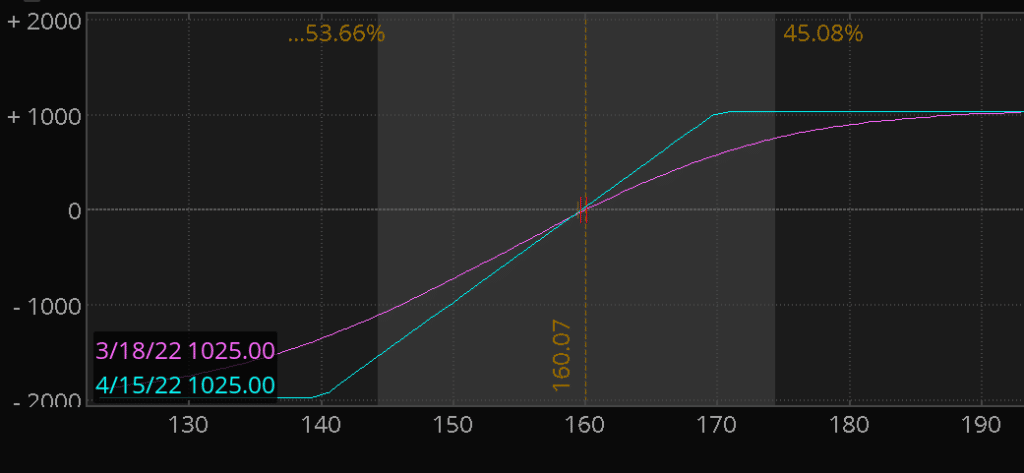

Here’s a P/L graph of a Collar on AAPL. In this example, the stock is at $160. A $170 Call is sold for $1.25, and a $140 Put is purchased at $1.00. A Net credit of $0.25 is collected when the position is put on. Both options are 30 days to expiration (DTE).

The Tradeoffs

While it’s tempting to think of the Collar as a way to get “free” Put protection, there are some tradeoffs. By selling Calls, we are limiting our upside. In the example above, we could have a $10 gain to the upside. We’d also get to keep any net premiums collected, another $0.25 per share. But because we’re obligated to provide shares at $170, we have capped our profit potential.

The Collar also only gives us partial protection to the downside. Options also have a limited life and expire.

What Happens at Expiration?

If the share price is above our Call strike price at expiration, we’re likely to have our shares “called away” – meaning we’ll be obligated to sell our shares at the strike price, $170 in this example.

But we could also extend the duration by rolling that Call out for additional credit. As long as there are more than a few cents of time value in our short Call, we’re less likely to have it exercised even if it is in-the-money (ITM). If our counterparty wanted to close their position, as long as there’s time value left in the option, they would be better off to sell their long Call rather than exercise it against us.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

If the share price is between our Call and Put strike prices at expiration, those options expire worthlessly, and we’re left with our stock as before.

If the share price has dropped below our Put strike, we would want to either sell the Put or exercise it. We could “put” the stock to our counterparty at $140 per share. Alternately, we could sell the Put and continue to hold onto our shares.

The best case is for the options to expire with the share price just below the Call strike price. In that case, both the Puts and the Calls expire worthlessly, and we get to keep our shares. We are then free to sell shares at a profit or keep them and apply another Collar further out in time.

Summary

If you own shares that you don’t want to sell, consider putting on a Collar using options to give you some downside protection. A Collar entails selling calls against your shares and using the premium collected to purchase puts for downside protection. The tradeoff is your upside is limited. But you get to hold onto your shares to continue to collect dividends (if any), all while having long Puts in place for downside protection.

Read On To Learn More About Options Trading

Every day on Options Trading Signals, we do defined risk trades that protect us from black swan events 24/7. Many may think that is what stop losses are for. Well, remember the markets are only open about 1/3 of the hours in a day. Therefore, a stop loss only protects you for 1/3 of each day. Stocks can gap up or down. With options, you are always protected because we do defined risk in a spread. We cover with multiple legs, which are always on once you own.

If you are new to trading or have been trading stock but are interested in options, you can find more information at The Technical Traders – Options Trading Signals Service. The head Options Trading Specialist Brian Benson, who has been trading options for almost 20 years, sends out real live trade alerts on actual trades, such as TSLA and NVDA, with real money. Ready to subscribe, click here: TheTechnicalTraders.com.

Enjoy your day!

Chris Vermeulen

Founder & Chief Market Strategist

TheTechnicalTraders.com