Gold and Silver Rally Back After Fed Emergency Rate Cut

Over the past few weeks and months, our research team has continued to sing the praises of precious metals – particularly Gold and Silver. After last week’s dramatic selloff in precious metals (attributed mostly to margin call sales), both Gold and Silver rallied almost 3% on Tuesday, March 3 – the day the US Fed issued an emergency 0.50% rate cut.

We believe this move by the US Fed solidified a fear in the global markets that the central banks are preparing for a much broader economic contraction and attempting to front-run weakness by moving price rates lower. This will help to ease capital restrictions, liquidity across global markets and spur some global borrowing at a time when the Coronavirus may continue to weigh on global economies. Still, for skilled metals traders, this is likely the rocket fuel we need to see Gold rally above $1800 very quickly and for Silver to rally above $21 quickly as well.

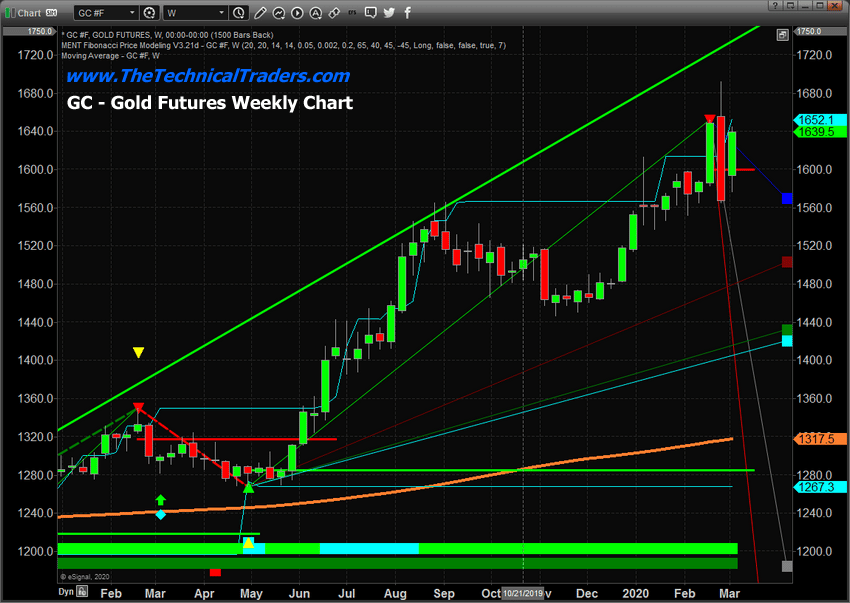

This Weekly Gold chart highlights the early recovery that took place on Tuesday, March 3, 2020. Gold actually closed at $1641.6 for the day – up 2.93%. This move nearly recovered the entire bearish previous Weekly bar – suggesting that traders were not going to be forced away from the metals markets by any shakeout.

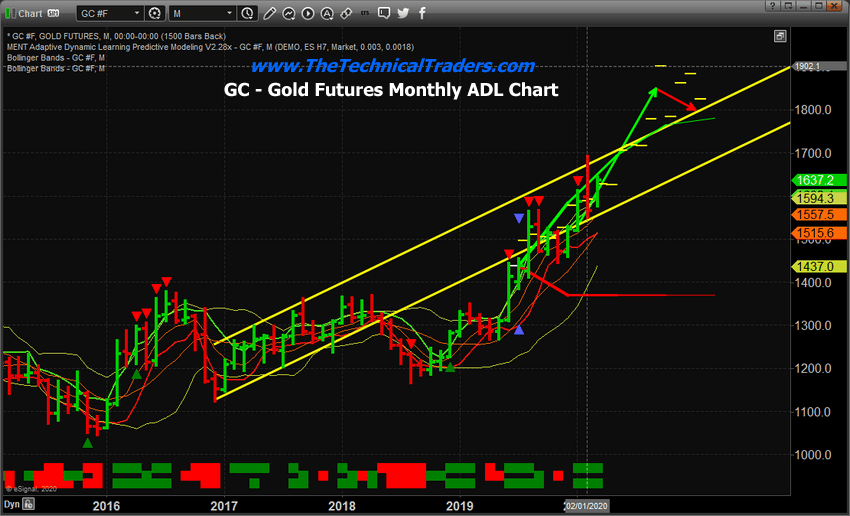

Our ADL predictive modeling system on this Gold Monthly chart suggests Gold will rally above $1700 within 2~3 weeks, then briefly pause before rallying to levels just below $1800. From there, it appears Gold will rally very quickly to near the $1902, a pullback to levels near $1820, then settle into a range near $1875 or higher.

Considering Gold was trading at $1560 just a few days ago, this represents a +21% rally from recent lows.

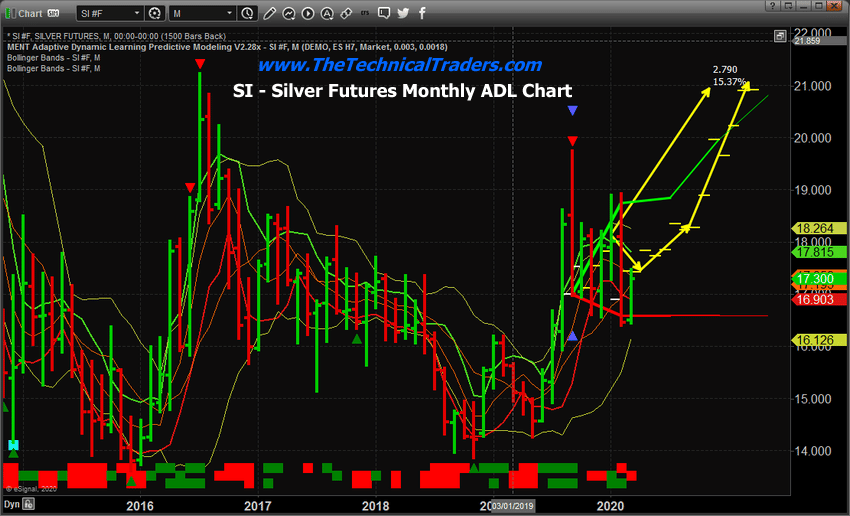

This ADL Monthly Silver chart also highlights the advance in prices in Silver and how the next 3~5+ weeks will likely support a moderate upside price advance to levels near $18.35 before a more aggressive upside move begins where $19, the $20, then $21 will be reached over a very short period of time (roughly 30 days). Remember, the Gold to Silver ratio was sitting near 94 at the end of February. If this ratio reverts back to levels near 75, Silver would likely rally 45% or more from current levels.

Don’t miss these incredible moves in precious metals. The markets are actually gifting these recent low price levels to skilled traders. We issued a research post just last week that suggested any move below $1600 in Gold was an excellent opportunity for skilled traders to load up. Silver prices just above $16 was another gift for skilled traders.

We don’t believe these current levels will be available for much longer. Our modeling systems are suggesting precious metals is just beginning a much bigger upside price move. Now is the time to get in while you can before the +20% to +40% rally begins.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you visit my ETF Wealth Building Newsletter and if you like what I offer, join me with the 1-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Bar!

Chris Vermeulen

www.TheTechnicalTraders.com