Could This Be a “Suckers” Rally?

Everyone I know who is not involved in the stock market or has little knowledge about it is calling me and asking what stocks, indexes, and commodities to buy because everything is so cheap and dividends are juicy again.

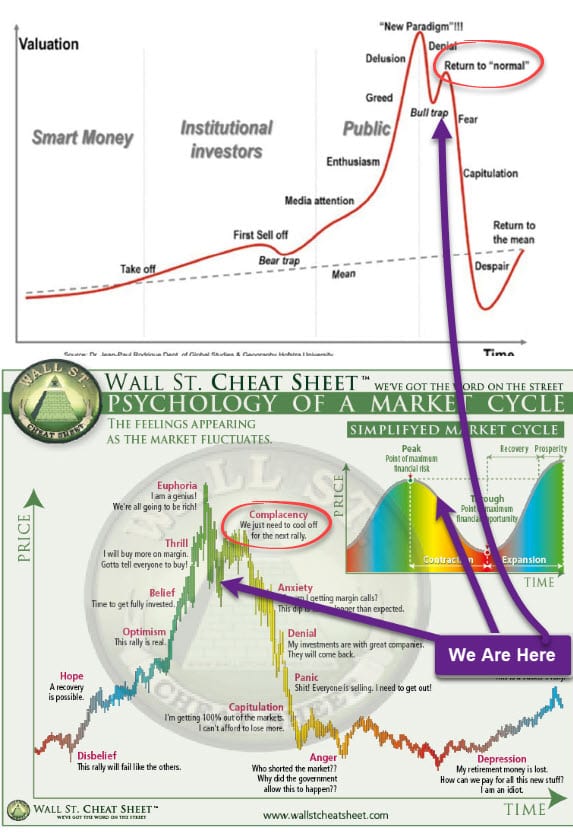

Just look at the market sentiment chart, and price cycles that the stock market goes through, and listen to my talk below while reviewing these to images. It’s not rocket science, but the lack of education on the financial markets coupled with the force of greed to make money and miss out on the next big bull market has everyone getting suckered into this dead-cat bounce, also known as a bear trap, bear market rally.

LISTEN TO MY TALK – CLICK HERE

If you want to see something else really exciting/nerve-wracking/ and real check out this post on the Stock Market Top.

A subscriber to my market video analysis and ETF trading newsletter said it perfectly:

“Always intrigues me how many amateur surfers get to the north shore beaches in Hawaii, take one look at monster waves and conclude it’s way too dangerous. Yet the amateur trader looks at treacherous markets like these and wants to dive right in!!” Richard P.

I have to toot my own horn here a little because subscribers and I had our trading accounts close at a new high watermark for our accounts. We not only exited the equities market as it started to roll over we profited from the sell-off in a very controlled way.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.