CGS – Consistent Growth Strategy

A Tactical Investment Strategy To Reach and Retain Retirement Status Faster, with Less Risk.

We don’t believe in resting on our laurels while strategies that worked in the past drain investment accounts in the present. We follow price trends using technical analysis and control risk through position management. We feel those with significant wealth, nearing retirement, or enjoying retirement should focus on avoiding corrections, bear markets and holding stocks or bonds when they are falling in value.

An asset revesting portfolio can generate superior long-term risk-adjusted returns by rotating capital into trending assets and out of underperforming assets. We deploy capital to the asset with the most significant growth potential and lowest downside risk through our asset class hierarchy, thus providing maximum capital appreciation over time.

Because of our core beliefs and strategy, we are well-equipped to navigate whatever the market throws our way. And because we follow price, we never have to try and predict where the price may go. Our trend and risk-controlled strategy identify “when,” “what,” and “how” to enter and exit top-performing assets.

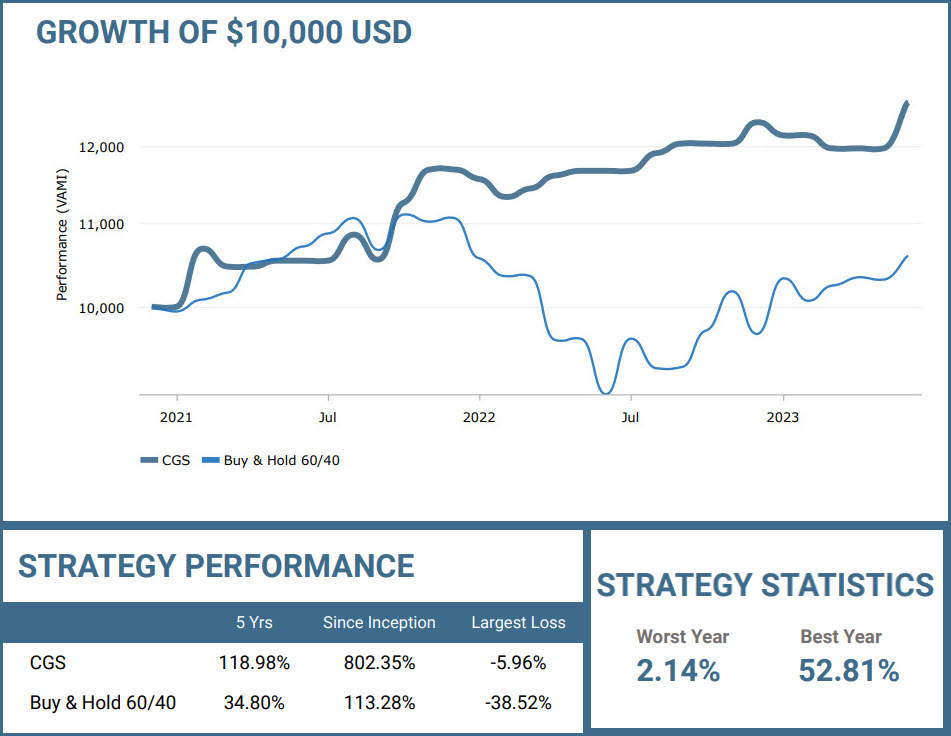

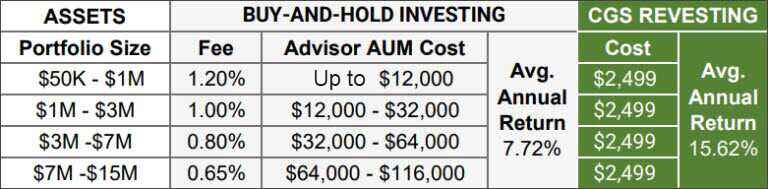

CGS VS. Diversified Buy-And-Hold:

The CGS Asset Revesting approach is radically different from traditional diversified buy-and-hold strategies. Typically, investors are stuck holding positions, left to witness their account values diminish with fluctuating market trends. Conversely, Asset Revesting offers a dynamic and proactive approach investors and the investment industry desperately need.

CGS swiftly reallocates capital towards the strongest asset class trending higher and, with equal agility, exits positions when the asset starts to plateau. As clearly illustrated in the chart below.

The most crucial metric in assessing any investment strategy is its maximum drawdown, otherwise referred to as the largest loss. Prioritizing capital protection above all else is what Asset Revesting does best and has redefined the concept of portfolio management. Then, the strategy shifts its focus to generating high returns.

As illustrated in the table below, the stark contrast in the largest losses between the CGS and the conventional buy-and-hold approach with stocks and bonds is unequivocally significant. CGS ensures that your investment has superior growth potential and unparalleled security against market downturns.”

CGS Signals Newsletter Deliverables:

- Asset revesting signals are posted in the members’ area, mobile app, and emailed.

- Autotrading, have our signals automatically executed in your account at no additional charge from us.

- Receive a weekly written report with charts on the key indexes, bonds, and commodities explaining their current trend.

- Receive video reports covering assets in greater detail and Intermarket relationships about how one may affect the other.

- Access to our exclusive stock market gauge. Know where the stock market is within its trading and investment cycle.

- Live mentoring Q&A webinars twice a month.

- Our mobile app gives you everything in the palm of your hand, so you always have a pulse on the market and positions.

You’ve spent a lifetime building your wealth. It’s time to let an asset revesting strategy help remove the stress and risk from the buy-and-hold rollercoaster ride and allow you to enjoy more time with the ones you love.

Learn How CGS Can:

– Grow Your Wealth

– Protect Your Wealth

– Save You Time & Money

Let’s talk.

We’re here to help you thrive!

We are here to help you achieve your financial and lifestyle goals. The opportunity is yours to let us show you how we can help protect and grow your wealth with our investment strategy signals.