Adaptive Fibonacci Suggests Much Lower Prices Yet To Come – Part I

Our Adaptive Fibonacci Price Modeling system suggests a much deeper price move is in the works and the current price rally will likely end near resistance levels identified by the Adaptive Fibonacci Price Modeling system. We are posting this research post for friends and followers to help them understand the true structure of price and to allow them to prepare for what we believe will become a much deeper downside price move in the future.

Fibonacci Price Theory teaches us that price moves in waves within up and down price cycles. The recent peak in price, near February 25, 2020, has resulted in a very deep -36% price collapse in the S&P 500 (ES) recently. This downside move has been mostly straight down, excluding a brief retracement in early March. The strength of this downside price move suggests a moderate upside price recovery will take place before the next downside leg sets up.

Before we

continue, be sure to opt-in to our free market trend signals

before closing this page,

so you don’t miss our next special report!

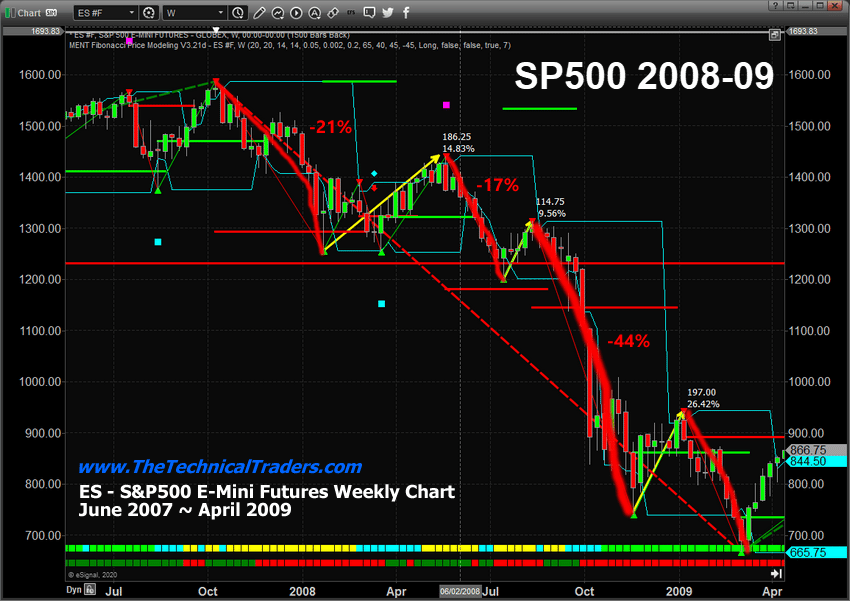

S&P 500 Weekly Chart of 2008-09 Credit Crisis Market Collapse

Throughout the 2008-09 Credit Crisis market collapse, prices staged multiple recovery attempts within the downward price trend. The first, after the initial -20.88% selloff in late 2007, resulted in a +14.83% price recovery that lasted for over 15+ weeks. The second recovery, near the end of July 2008, resulted in a +9.56% recovery after a nearly -17% price decline. After this brief recovery in July 2008, the price collapsed by a massive -44% from August to November 2008.

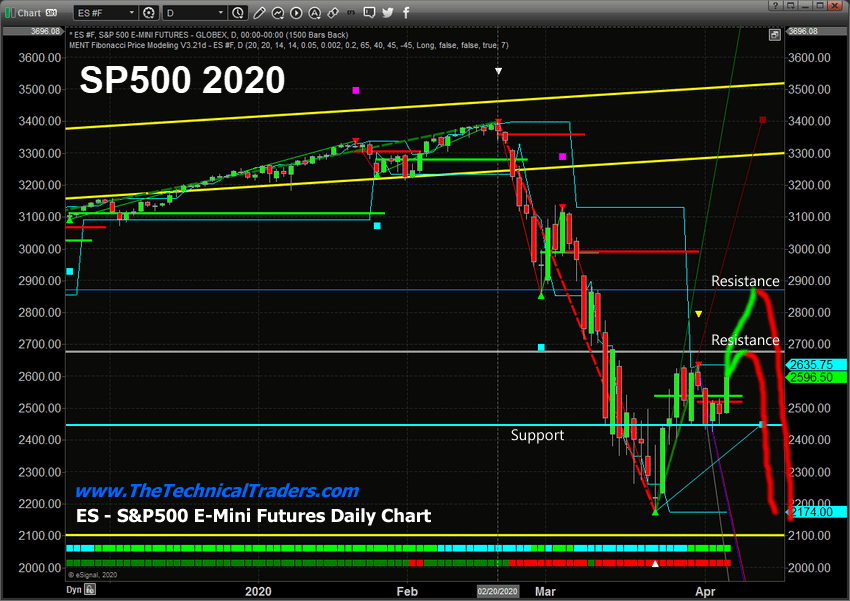

Daily S&P 500 Chart

This Daily ES chart highlights the first two levels of resistance at 2700 & 2870 that could stall the rally and prompt a downside price move in the future. Support is currently at 2450. We believe the 2700 level will act as a soft ceiling in the ES where price may attempt to rally, briefly, above this level, which it did yesterday, then pull back and pause as selling pressure re-enters the market. The 2870 level may act as a hard ceiling where price may attempt to reach this level, but immediately reverse back to the downside.

Overall, we believe continued selling as a result of forward global economic expectations is the most obvious outcome where a deeper price bottom will setup sometime later this spring or early summer.

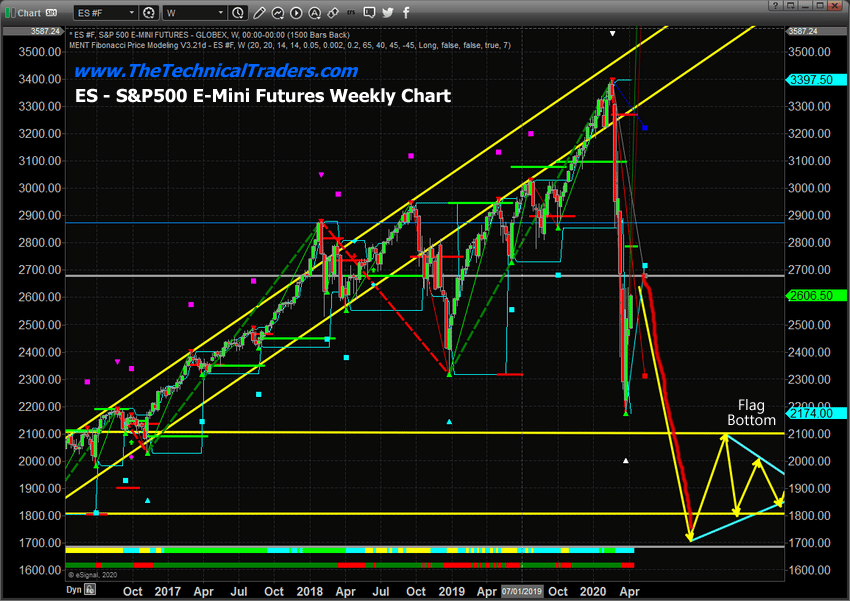

Weekly S&P 500 Chart

This Weekly S&P 500 chart (ES) shows a possible outcome for price going forward if another downside move starts. A new downside price move to levels near to, or just below, the 2015~16 low price range is not unreasonable. From this level, we believe a “Flag” formation will setup creating an extended price bottom pattern down at those extreme lows. We believe this “Flag” formation will end near August~October 2020, just before the 2020 elections and prompt the beginning of a new upside price recovery in the US and global markets.

This is a large forward-looking projection and you may be rolling your eyes, but they are very possible. In fact, last year we predicted the months and price levels in which gold and oil would start new major trends, and we did this 8 months before they took place, similar to what we are proposing here.

Concluding Thoughts:

The rotation in price setup by this brief upside price move will set up a new Fibonacci downside and upside price target range. We believe it is essential for price to continue this type of rotation as the eventual bottom sets up in the US and global markets. We believe the true price bottom will happen only after the virus event has subsided and global economies begin to start functioning like normal again.

Currently, there is simply too much of a world-wide disruption to expect that the bottom has already set up near last year’s (2019) brief price lows. The scale and scope of the current downside price collapse do not properly reflect the total scope of this global virus event yet – it is still a reactionary move in price that has yet to properly digest the total scope of the global economic disruptions. There is a chance for stronger bounce/rally in the next few weeks/months if the virus can start to be contained, and that will continue to mimic that of the 2000 tech bubble. Believe it or not, there is a big similarity to what happened then, to what is happening now in terms of price action and market sentiment. Read article and see these charts.

In other words, we believe more selling will be seen in the global markets and more economic contraction will take place until we are safely beyond this virus event. The longer the global economic shutdown continues, the more likely we are to see a deeper price bottom in the future and the more likely we are to see more extensive economic collateral damage across the world. No matter which way the markets move we will follow and trade the price action and profit. That is the benefit of following price vs trying to trade prediction, fundamental data etc..

In Part II of this research article, we’ll dig deeper into the underlying components that support our research.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.