Important Market Update: Stocks/Bitcoin

My take on today’s price action. Today was a broad market sell-off, meaning most stocks fell. Volume was strong, indicating some distribution selling from large firms, as well as fear-based selling, based on our panic selling indicator, which closed at our threshold of 3.

Out of the 11 main sectors, only one was positive, and that was technology, specifically NVDA. Overall, small-cap stocks and the large blue-chip dividend stocks are down the most.

Bitcoin’s price action appears bearish, given the recent surge and subsequent decline on high volume. It’s now back below where we sold it for a 20% gain last week with the BAN strategy.

On a currency front, the dollar index gained some ground, while gold and silver moved lower. While the dollar is still in a short-term downtrend, from a longer-term perspective, and more so, the USD:CAD appears to be trying to find a bottom. That means if you are Canadian, holding USD currency in your account could become favorable here soon. Fingers crossed!

In the video posted below, I shared how, when the QQQ reaches a 15% target from our trend signal, the market historically becomes volatile and enters a correction. Not every time, but 60% of the time, it Works Every Time – see funny clip!

Today, we hit our third target with the ACS ETF Signals Newsletter QQQ position at 15%. This position should now be closed if you are copying exactly what I do.

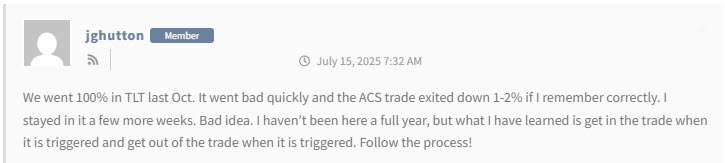

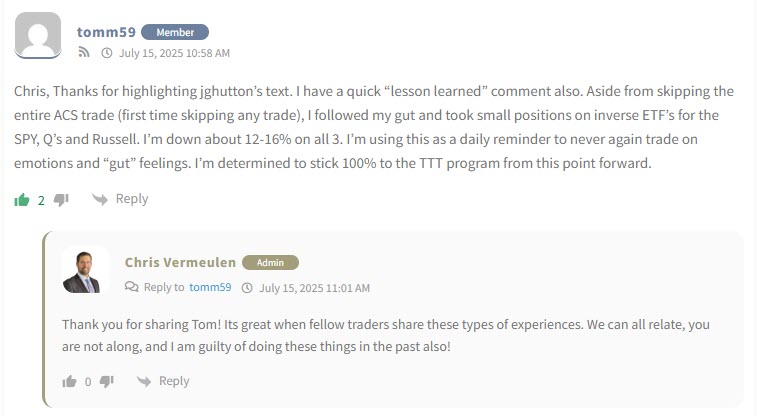

If you decide to stay in the trade and deviate, just read the members’ comments below as your warning.

MEMBERS COMMENTS:

Last but not least, my focus and goal is to help as many retirees grow and protect their lifestyles for market crashes. See what other investors like you are saying about what I do here

Chris Vermeulen

Chief Investment Officer

TheTechnicalTraders.com

Disclaimer: This email and any information contained herein should not be considered investment advice. Technical Traders Ltd. and its staff are not registered investment advisors. Under no circumstances should any content from websites, articles, videos, seminars, books, or emails from Technical Traders Ltd. or its affiliates be used or interpreted as a recommendation to buy or sell any security or commodity contract. Our advice is not tailored to the needs of any subscriber, so talk with your investment advisor before making trading decisions. Invest at your own risk. I may or may not have positions in any security mentioned at any time and may buy, sell, or hold said security at any time.