Is The Technology Sector about to break lower?

We believe the current capital shift in the US stock market may be settling into the Technology sector as investors move away from growth and into value. Technology has recently recovered very nicely from the late December 2018 lows and is currently setting up a very eerily similar pattern across multiple charts.

If our analysis is correct, we believe the Technology sector may be setting up for a downside price breakdown near the APEX of these Pennant/Flag formations that appear in our charts. Near recent, all-time highs, this downside breakdown could be rather large in size, possibly as much as -20% to -35% or more, and could result in a global stock market decline that could shock most investors/traders.

The economic data that has recently been announced in the US continues to show moderate strength overall. The jobs numbers are decent. The consumer is still moderately active and we are getting into the Christmas Rally season. Yet we are also in the midst of a Presidential Election cycle that continues to heat up and drive almost daily new headlines. Our opinion is that the US consumer will become fixated on the political theater while we get closer to the November 2020 elections and may curb Christmas/holiday spending if news/perspective suddenly darken.

One of the first sectors we believe could break is the Technology sector – where foreign investors have poured billions into this sector while chasing price gains and to protect against foreign currency devaluation. Once investors determine Technology is no longer “safe”, then a downside price event (true price exploration) will likely happen and we are concerned the downside risks could be much greater than 20~25%.

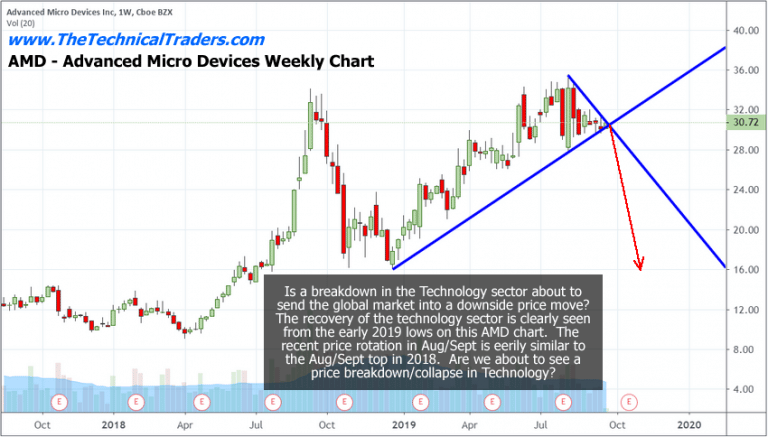

This AMD weekly chart provides one of the clearest pictures of the tight Pennant/Flag formation setting up in price. After a Double-Top type of formation near $35, any further price advance was rejected near $36. The current tight price rotation after the August 2019 peak suggests a very tight Pennant/Flag formation is setting up. If our analysis is correct, the APEX/breakout/breakdown event is only a few days away. Our count of the Pennant rotation suggests the breakdown move (lower) is the most likely outcome.

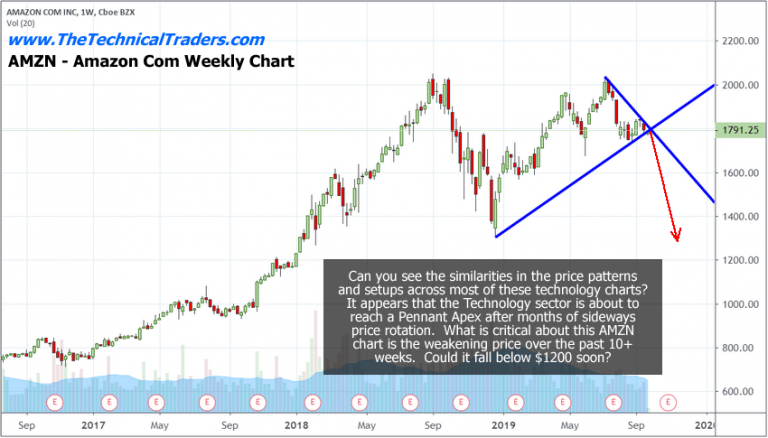

This AMZN chart highlights a similar pattern to the AMD chart. Although the current Pennant/Flag formation is a little more defined, the structure is still the same. An August 2019 high after a Double-Top formation, downward price rotation after the August 2019 peak and a clear APEX setting up RIGHT NOW. The downside risk in AMZN is clearly a drop to near previous support (near $1310) – -20% or more.

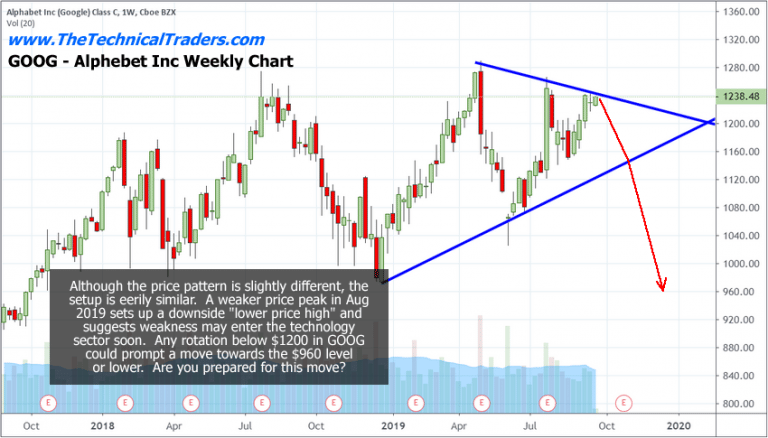

GOOG provides a very clear example of the price volatility that is setting up a major Pennant/Flag formation.. Although the current setup is broader than the previous two examples, the potential for a breakdown event in GOOG is still strong. The Double-Top pattern near $1280 provides clear resistance. The recent narrowing price channel sets up a very clear Pennant/Flag formation. We believe the downside price move in GOOG will initially target the lower price channel, then break that channel and continue lower.

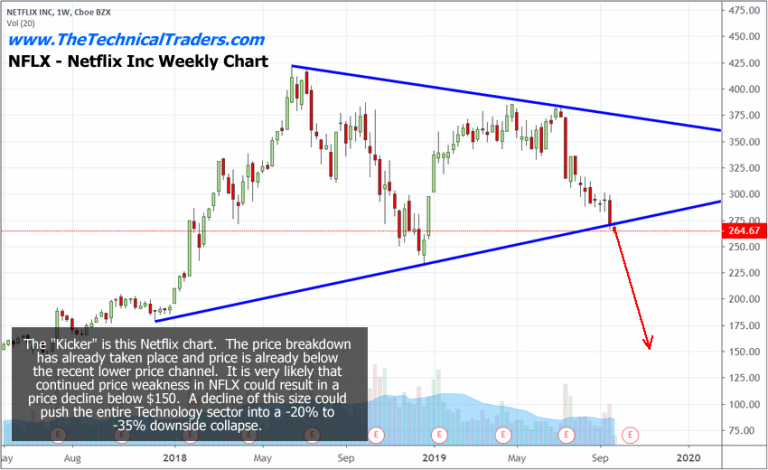

Netflix has already broken below the lower price channel. This is what brought this entire sector to our attention recently. If Netflix continues lower, it could draw the entire Technology sector and US major indexes much lower over the next few days/weeks. The downside price risk in Netflix is easily -25% to -45% – or more.

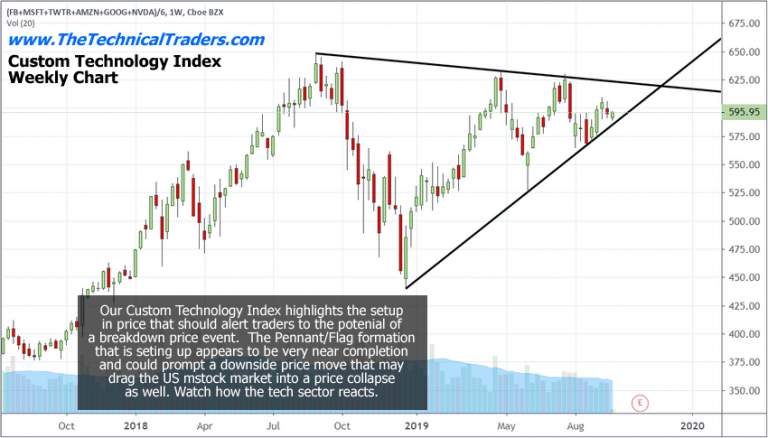

Our Custom Technology Index chart shows how the overall Technology sector is struggling to stay above the lower price channel. Our concern is that one or more of the major technology firms may break the lower Pennant channel and attempt to start a breakdown in the US stock market. If this is the case, then a panic may setup in the markets where investors dump technology very quickly.

Concluding Thoughts:

Skilled technical traders are adept at finding ways to profit from nearly any price trends. A quick

Also, take a look at all my precious metals trade signals this year (2019) with a total gain for subscribers of my Wealth Building Newsletter of 41.74% profit. More than double the return than if you bought and held GDXJ gold miners ETF.

My point here is that no matter how much you love metals or technology stocks (and I LOVE them both), you do not need to always be in a position

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are life-changing events in a good way if traded correctly.

Chris Vermeulen

www.TheTechnicalTraders.com

NOTICE : Our free research does not constitute a trade recommendation, or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed. Visit our web site (www.thetechnicaltraders.com) to learn how to take advantage of our members-only research and trading signals.