How to Trade Index Price Spikes

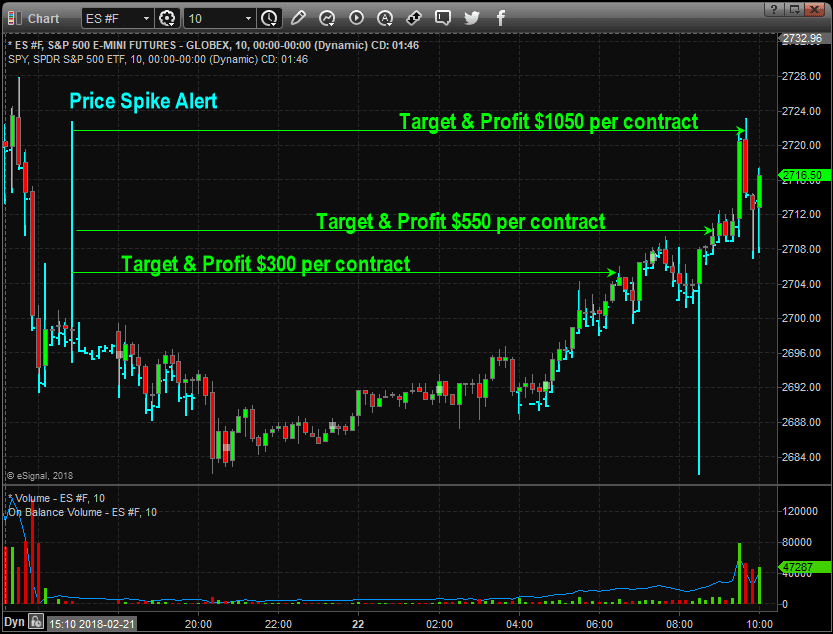

Last night the stock market flashed us a quick price spike on the SP500 index and we sent this out to our members as soon as we saw it. Price spikes are the markets way to tipping its hand for us to see where the big player’s should move in the next 1-3 trading sessions. Most spikes trade targets are hit within 12 hours. Last night spike provided trades with a $300. $550, or $1050 profit per ES mini contract they traded. But with that said, spikes can be traded with SP500 index ETF’s as well as long as your broker allows you to trade Pre/Post market hours, which most brokers do allow.

Below is a chart showing the spike and move to the upside:

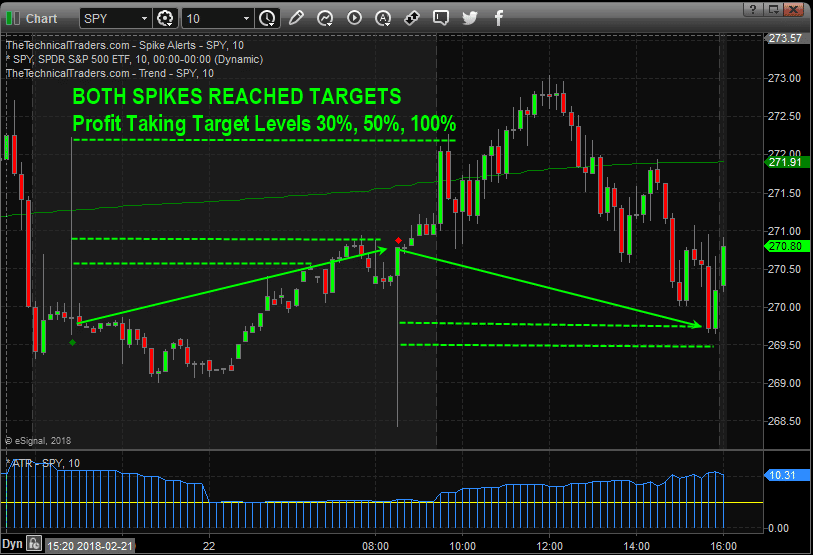

Updated Chart Showing Continued Price Movement With Spikes

These spikes are something will be providing on a regular base as they show up on the charts in our pre-market video analysis or a quick email and chart image during post market hours. These spikes take place ONLY in pre/post market hours which is why the average Joe does not know about this hidden gem.

To learn more click on the post below to see more charts and our explainer video on trading price spikes.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Become A Member Today and Experience

Our Proven Technical Trading Strategies

Chris Vermeulen