US Fed Set To Rattle Global Markets – Part I

With less than 24 hours to go before the US Fed rate decision announcement, all eyes are watching how the US stock market is reacting to the possibility of a rate cut (25 basis point) that has been telegraphed by the US fed many weeks in advance. Almost as if the US stock market is moving against all odds, the S&P and NASDAQ have pushed higher into new all-time high territory while the Dow Jones index currently trades just below recent highs. What should traders expect with the Fed announcement and beyond?

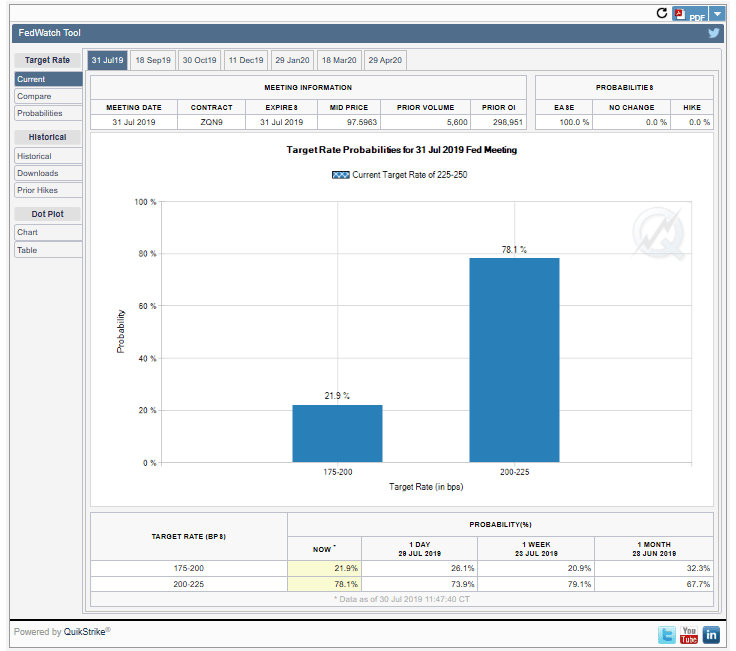

Probability of Rate Cut Percent

First, we need to understand the global markets have already priced a 25 basis point rate decrease into the markets based on expectations. The CME Fed expectations data suggests the market is 78.1% confident that a 25 basis point rate decrease will happen.

Source (CME)

This suggests that global traders are already prepared for this move and we may not see much volatility if the US Fed does not surprise anyone with their language/future expectations.

We believe the US Fed is taking this rate decrease to ease the supply of US Dollars throughout the world. Over the past 18+ months, the strength of the US Dollar has prompted a shift away from weaker global economies and into the US equities market, US Treasuries and the US Dollar. We believe this shift is reaching a critical moment in time where the fragility of the foreign markets has reached a tipping point.

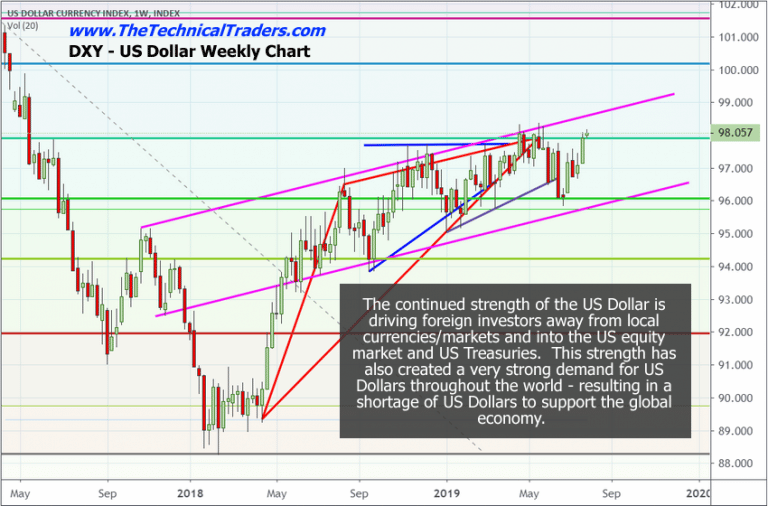

Weekly US Dollar chart

You can see from this Weekly US Dollar chart that the rally from the bottom in early 2018 has been tremendous – +11.25% and climbing. While this US Dollar rally has taken place, many foreign currencies have continued to weaken while the global economy has recently slowed to a crawl. As long as the US Dollar stays within the magenta price channel moving forward, we expect this trend to continue.

The shift in how capital is being deployed and the stress that continues throughout the globe with regards to economic activity and output is related to something that we believe took place back in 2007 through 2016 – the global effort to support a very weak global economy.

We highlighted some of our thoughts in this recent research post about the black hold in global banking.

Overall, we believe the actions by the global central banks and the US Fed from 2007 till 2016 created a “setup” in the global markets that very few people foresaw or understood. This shift happened at a pace and fever that few people could comprehend and came to a head in November 2016 when President Trump was elected. We believe it happened somewhat like this…

2004~2006: Greenspan raises rates on an unprecedented scale (over 450%) pushing the US/global banking/credit sector into crisis in 2007-08

2008~2010: As the biggest global banking/credit crisis unfolds, the US Fed and global central banks do everything possible to save the world from decades of economic malaise and destruction. US Fed lowers interest rates to near ZERO creating a run on US dollar debt/credit.

The Current Market Setup

2011~2015: As foreign market engages in debt/credit expansion, infrastructure projects and an “easy money” rally mode, something begins to change in 2014~2015. China realizes the nation’s wealth is being exported to the US and other markets as well as a US stock market rotation that shocked the global investors.

2016~2017: The US Elections (2016) took the focus away from the global markets for a period of 15+ months and allowed the easy US Dollar trading activities to continue into hyperspace. This is when many foreign nations/companies took huge risks leveraging debt and success into future debt/risks based on a belief that “this success will never end”.

Then This Happened…

January 2017: President Trump is sworn in and the US Fed begins raising rates aggressively. The disruption that resulted from this 2017 combination event resulting in one of the largest “global unwinding” processes we’ve seen in quite a while and it has really only just begun.

The downward rotation in the US Dollar in early 2017 as a result of uncertainty in US policy and perceived strength in foreign markets as US interest rates were still relatively low – under 1.4% most of that time. After US FFR rates crossed above the 1.75% level, the easy US Dollar carry trade became much more difficult to maintain and foreign investors had already setup trillions in debts expecting the US Fed to maintain easy money policies for decades.

Source: https://fred.stlouisfed.org/series/EFFR

What is the US Fed expected to do at this time? Either they lower the FFR so that the global markets can continue to run their credit/debt functions and attempt to deleverage the “setup” over the next 5+ years or the US Fed risks creating a run-away train type of scenario where foreign central banks lack the ammo to support their own economies and the US Fed risks creating hyper-inflation by not acting accordingly. In short, the US Fed to the global bankers rescues again.

Well, here we go with the US Fed setting the policy and expectations for the future as this incredible 1800% FFR rate increase has pushed the global markets into potential turmoil. We’ll complete our research in the second half of this research post in a few hours stay tuned!

CRUCIAL WARNING SIGNS ABOUT GOLD, SILVER, MINERS, And S&P 500

In early June I posted a detailed video explaining in showing the bottoming formation and gold and where to spot the breakout level, I also talked about crude oil reaching it upside target after a double bottom, and I called short term top in the SP 500 index. This was one of my premarket videos for members it gives you a good taste of what you can expect each and every morning before the Opening Bell. Watch Video Here.

I then posted a detailed report talking about where the next bull and bear markets are and how to identify them. This report focused mainly on the SP 500 index and the gold miners index. My charts compared the 2008 market top and bear market along with the 2019 market prices today. See Comparison Charts Here.

On June 26th I posted that silver was likely to pause for a week or two before it took another run up on June 26. This played out perfectly as well and silver is now head up to our first key price target of $17. See Silver Price Cycle and Analysis.

More recently on July 16th, I warned that the next financial crisis (bear market) was scary close, possibly just a couple weeks away. The charts I posted will make you really start to worry. See Scary Bear Market Setup Charts.

CONCLUDING THOUGHTS:

In short, you should be starting to get a feel of where each commodity and asset class is headed for the next 8+ months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities starting to present themselves will be life-changing if handled properly.

FREE GOLD OR SILVER WITH MEMBERSHIP!

Kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen – www.TheTechnicalTraders.com