Four Key Questions To This Crisis Everyone is Asking

Recently, I was asked to participate in a live radio talk with Arnold Gay and Yasmin Wonkers at Money 89.3 Asia First and was sent the following questions to prepare for the show. I thought this would be a great way to share my thoughts and expectations related to the Covid-19 virus, global economics and what the Central Banks are doing to combat this virus economic event.

The reality is that the bottom in the markets won’t set up until fear subsides and the unknowns related to this virus event are behind us. Until then, the global markets will attempt to seek out the true valuation levels based on this fear and the unknowns. This means true valuation could be much further away from current price levels as the virus event is still very fluid in nature.

I’ve included a few of our custom index charts to highlight exactly where the markets are currently situated and have attempted to explain my thinking related to these charts. Please continue reading.

First, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

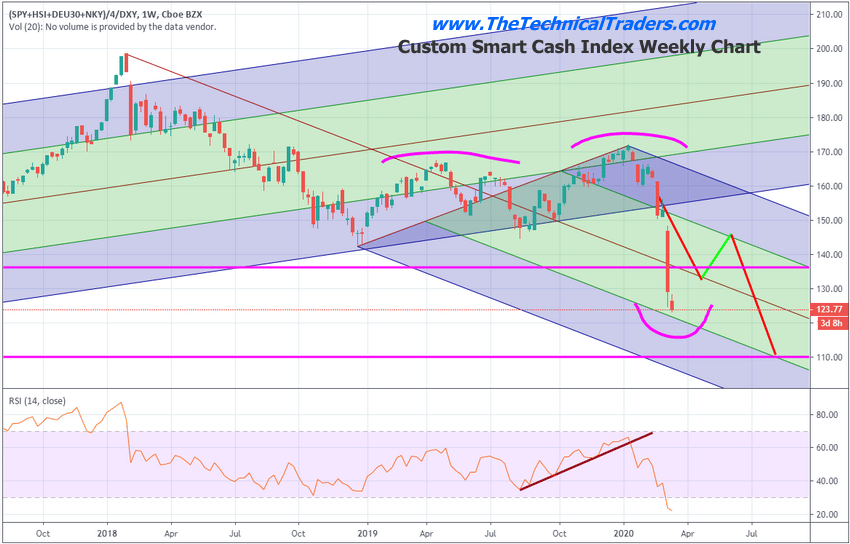

Custom Smart Cash Index Weekly Chart

This first chart is our Custom Smart Cash Index Weekly Chart. We had been expecting a breakdown in the US stock market last August/September 2019 (near the origination point of the line on the RSI pane) as our Super-Cycle system indicated a major breakdown was likely near the end of 2019 and into early 2020.

As the US Fed started pumping credit into the Repo market and the US/China trade deal settled over many months, a zombie-like price rally pushed prices higher through December 2019 and into early 2020. We alerted our members that this was likely a blow-off rally and to prepare for greater risks.

You can see how dramatic the change in trend actually is on this chart. We have broken the upward sloping price channel and moved all the way to the lower range of the GREEN downward sloping price channel. This is HUGE. Near these levels, we believe the US stock market will attempt to find support while continuing to rotate and setup additional “waterfall downside price events”. These custom indexes help us to understand the “hidden side” of the market price action.

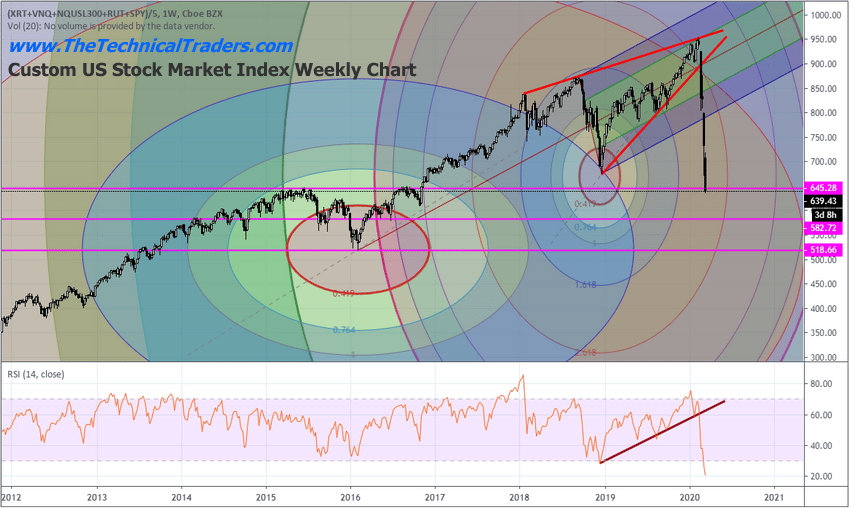

Weekly Custom US Stock Market Index

This next Weekly chart is the Custom US Stock Market Index and we want you to pay very close attention to the fact that the recent lows have come all the way down to reach the upper range of the 2016 trading range. Once the 2018 lows were breached, we knew the markets were setting up for a deeper downside price move.

We do believe this current level is likely to prompt some type of “Dead Cat Bounce” or moderate support though. The entire range of 2016 (low, midpoint and high) are very much in play right now as these represent the current support levels for the US stock market. We do believe some moderate support will be found near these levels – yet we have to wait for the price to confirm this bottom setup.

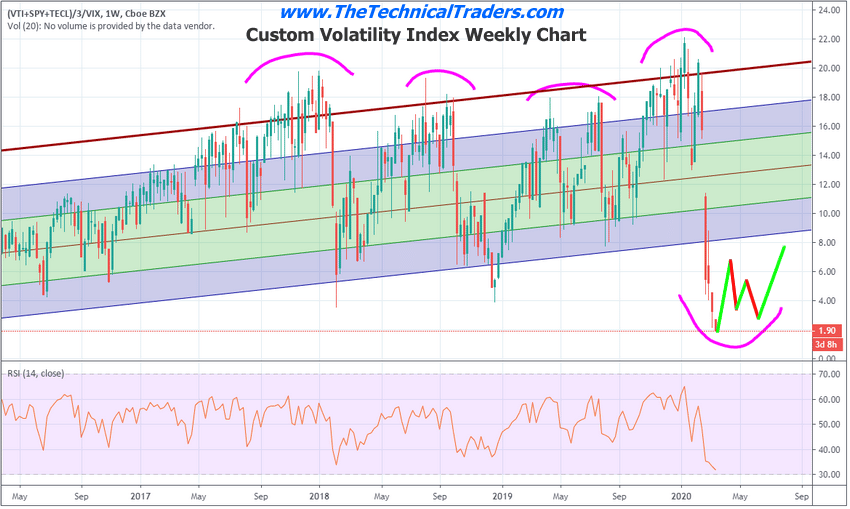

Weekly Custom Volatility Index

This is our Weekly Custom Volatility Index and the extremely low price level on this chart suggests the US stock market may attempt to try to find moderate support soon. We have not seen levels this low since 2009. If the markets continue to push lower, this Custom Index will continue to stay below 6.0 as the price continues to decline. Yet, we believe this extremely low price level may set up a bit of support near recent lows (within the 2016 range) and may set up a sideways FLAG formation before the next downside price leg.

Please continue reading the questions (below) and answers/thoughts to those questions (below the questions). We certainly hope this information helps you to understand and prepare for the next 6 to 12+ months as we believe the volatility and unknowns will persist for at least another 4 to 6+ months. But keep in mind the market dynamics change on a daily and weekly basis and if you want to safely navigate them and have a profitable year follow my analysis and ETF trades here

Questions:

1. Rates at zero, massive injections and coordinated central bank action… why isn’t the market convinced the situation is under control?

2. What are investors looking for now – A peak in coronavirus infection rates? A sense that a proper healthcare response is in place and won’t be overwhelmed?

3. The main issue seems to be that this is not a slowdown, but the sudden closure of economic activity, do you see massive fiscal support coming, including bailouts for sectors like airlines?

4. Do you get a sense that the White House finally gets it, and is now moving to reassure markets and ordinary Americans?

Answers/Thoughts:

The markets are not reacting to what the global central banks are doing right now and probably won’t react positively until two things happen: fear of the unknown subsides across the globe and the total scope of the global economic destruction is assessed (think of this as TRUE PRICE VALUATION). Right now, we are in the midst of a self-actuating supply and demand-side economic contraction that will result in a renewed valuation level as markets digest the ongoing efforts to contain/stop this virus. Where is the bottom, I have an idea of where the bottom might setup – but the price will be what dictates if that becomes true.

If 2018 lows fail to hold as a support level, then we are very likely going to attempt to reach the 2016 trading range and I believe the midpoint and low price range of 2016 are excellent support levels for the market. I show the SP500, Nasdaq and Dow Jones index analysis and prediction in this video below.

What we are looking for in terms of closure of this event (or at least a pathway out of it) is some type of established containment of the event, the spread of the infections and the ability for governments and economies to begin to advance forward again. As long as we are stuck in reverse and do not have any real control of the forward objective (meaning consumers, corporations and governments are reacting to this event), then we will have no opportunity to properly estimate forward expectations and advancement in local and global economies – and that is the real problem.

The White House and most governments get it and are not missing any data with regards to this virus event. I truly believe that once this virus event ends and the general population gets back to “business as normal”, the world’s economy will, fairly quickly, return to some form of normal – with advancing expectations, new technology and continued global economic and banking functions. Until that happens, which is the effective containment and control of this virus event, then no amount of money or speech writing is going to change anything.

Far too many people are acting emotionally and afraid right now. The facts are simple; until we get a proper handle on this virus event, there will continue to be extended threats to our economy, people, families and almost every aspect of our infrastructure, banking, society and more. Once the virus event is mostly contained and settled, then we can get back to business cleaning up this mess and finding our way forward.

I’m not worried too much, my research team and I advised our clients to move into bonds and cash before the drop in equities and have been warning our members of a “zombie-rally) for the past 5+ months which took place as expected. We called for a “volatile 2020 with a very strong potential for a breakdown in global markets” near August 2019. This is playing out almost exactly like we expected (except we had no idea a virus event would be the cause).

I firmly believe the global leaders and dozens of technology firms will have a vaccine and new medical advancements to address the Covid-19 virus. I believe this event will be mostly behind us in about 90+ days. What happens at that point is still unknown, but I believe we will be able to see a pathway forward and I believe all nations will work together to strengthen our future.

In closing, I urge everyone to try to relax a bit and understand this is a broad (global) market event with a bunch of unknowns. It is not like the Fed can just throw money at this problem and make it go away. This is going to be a process where multiple nations and various industries and groups of people will have to work together to reduce and eliminate this threat. Because of that, there are no real clear answers right now – other than to be prepared for a few months of quarantine to be safe.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com